Mortgage rates fall below 3 percent again

Freddie Mac, the federally chartered mortgage investor, aggregates rates from around 80 lenders across the country to come up with weekly national average mortgage rates. It uses rates for high-quality borrowers who tend to have strong credit scores and large down payments. These rates are not available to every borrower.

The 15-year fixed-rate average slid to 2.51 percent with an average 0.7 point. It was 2.54 percent a week ago and 3.20 percent a year ago. The five-year adjustable rate average fell to 2.94 percent with an average 0.4 point. It was 3.09 percent a week ago and 3.46 percent a year ago.

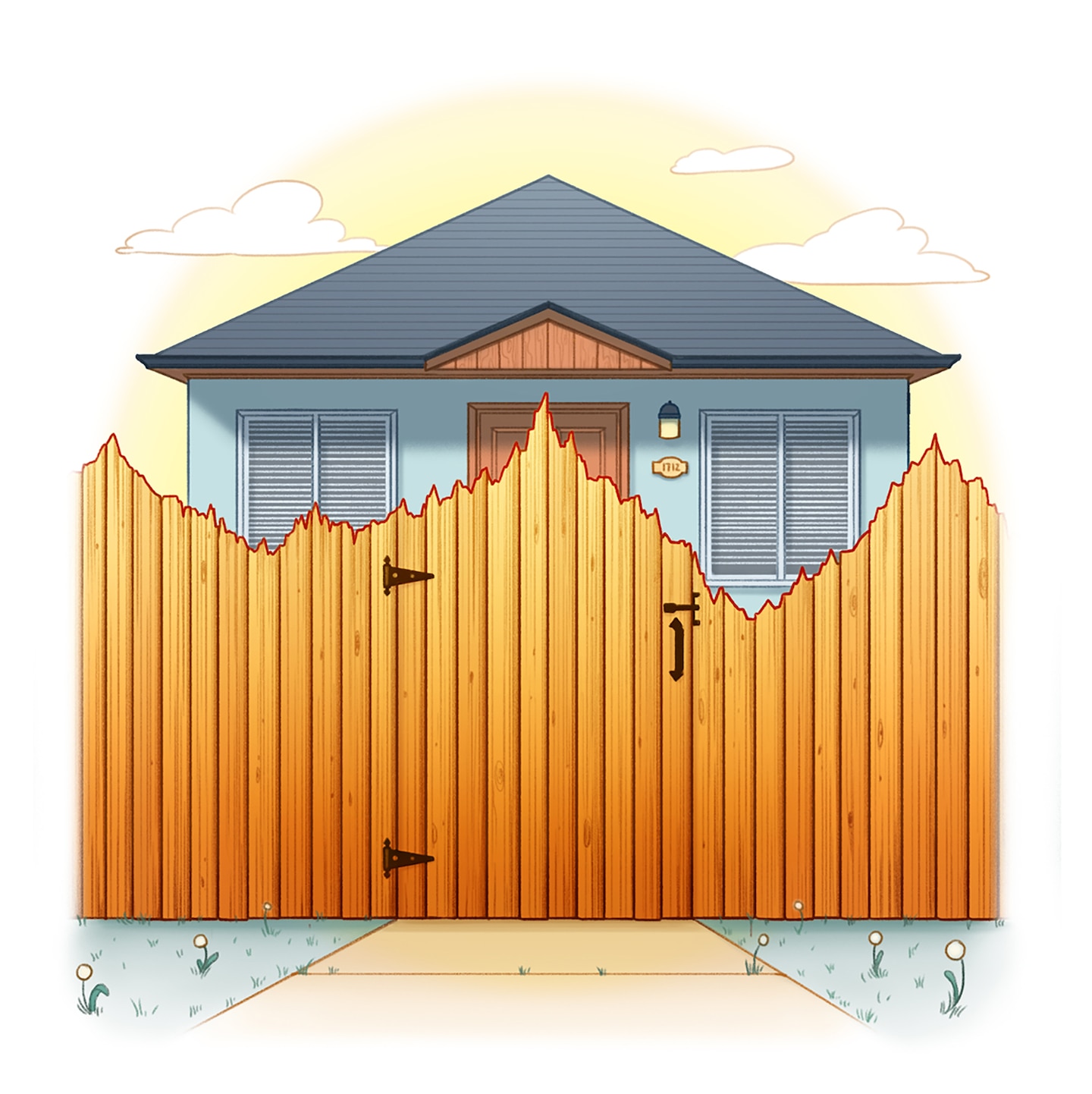

Low rates fueled the revival of the housing market after the Great Recession. But lately they are a source of frustration. Homeowners want to refinance but struggle to reach banks and lenders because of how busy they are. Home buyers want to take advantage of the low rates but the few number of homes on the market are driving up housing prices and making selections scarce.

And as attractive as these rates are to borrowers, few can obtain them. Many lenders are putting restrictions on loans, particularly if a borrower wants a cash-out refinance or jumbo loan or has a poor credit score.

“Because of financial uncertainty brought about by the pandemic, many lenders have tightened their restrictions on jumbo loans,” said Glenn Brunker, mortgage executive with Ally Home. “Some lenders have gone as far as not offering jumbo loans or only making them available to existing customers. … It’s important to know jumbo mortgages aren’t just for the super-rich. Borrowers in areas where real estate prices tend to be higher, such as California, New York, Boston, Miami and Washington, D.C., may need jumbo loans to even achieve homeownership.”

At its meeting this week, the Federal Reserve held firm on interest rates and its bond-buying program. Even though the Fed didn’t change its benchmark rate, mortgage rates still fell. That’s because the central bank doesn’t set home loan rates. But its decisions influence them.

“The Fed will continue to purchase residential and commercial mortgage-backed securities to keep the market liquid, which we have learned is a must for the entire economy,” said Mitch Ohlbaum, president of Macoy Capital in Los Angeles. “It is no surprise they are not moving on the Fed funds rate at this point in time as they need to keep any tools they have handy when/if things do get worse. As far as banks/lenders are concerned, they are still unwilling to lower rates any further and you might see some lenders increase rates to keep volume manageable.”

“What we have at present in the U.S. is a deflationary gap,” said Dick Lepre, senior loan officer at RPM Mortgage in Alamo, Calif. “A deflationary gap is the difference between potential and actual GDP. The economy is akin to an overstocked store with too few customers. The appropriate correction is lower prices. This downward pressure on inflation should drive Treasury yields and mortgage rates lower.”

Treasury yields have fallen the past couple of days. The yield on the 10-year Treasury sank to a near record-low 0.58 percent Wednesday. Yields run counter to price. When prices rise because demand is great, yields fall.

“While [the] media emphasizes how bad things are in the U.S., the fact is that things are worse elsewhere,” Lepre said. “We will continue to see flight-to-quality buying of U.S. Treasury debt and GSE debt. This is likely to persist through most of 2021.”

Meanwhile, mortgage applications were flat last week. According to the latest data from the Mortgage Bankers Association, the market composite index — a measure of total loan application volume — decreased 0.8 percent from a week earlier. The purchase index fell 2 percent from the previous week but was up 21 percent year-over-year. The refinance index slipped 0.4 percent but was 121 percent higher than a year ago. The refinance share of mortgage activity accounted for 65.1 percent of applications.

“Mortgage rates remained near record lows for conventional loans last week, and refinances in the conventional sector continued to slightly increase,” Mike Fratantoni, MBA’s chief economist, said in a statement. “However, rates on FHA loans rose, leading to an almost 18 percent drop in FHA refinances. Home buyers stepped back slightly, and there was a larger drop in purchase application volume for FHA, VA and USDA loans. This trend, along with the fact that average loan sizes are increasing, indicate that prospective first-time buyers are being impacted more by the rising economic stress caused by the resurgence in covid-19 cases, as well as the uncertainty on how the next round of government support will take shape.”

More Real Estate: