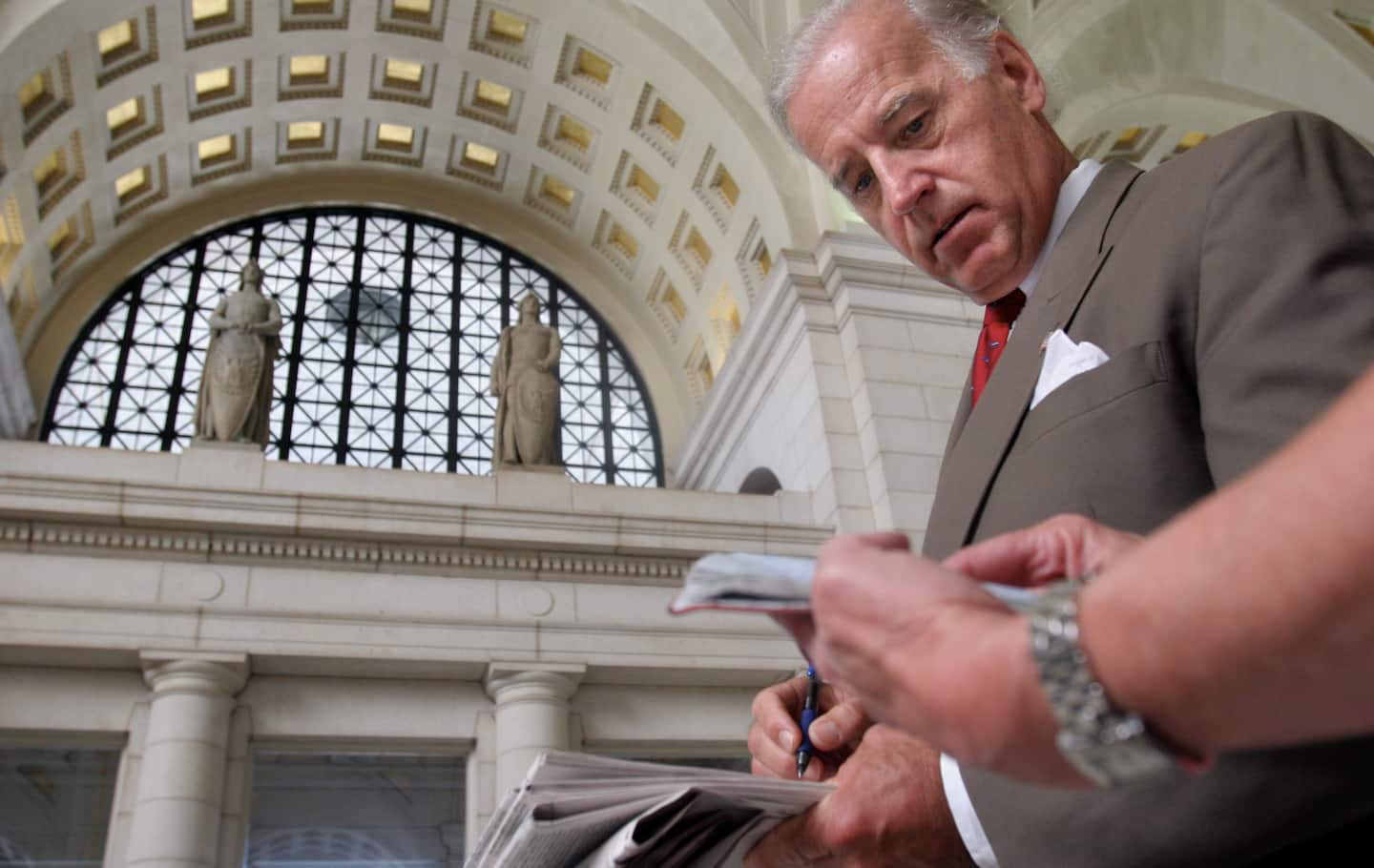

Americans’ debts are mounting, putting new focus on Biden’s role opposing bankruptcy protections

As president, Biden says, he will push for letting people who enter bankruptcy discharge their student debts and protect the equity they have built in cars and homes. He embraced a plan put forth by Sen. Elizabeth Warren (D-Mass.) that would also make more people eligible to file for bankruptcy and allow them to file without paying exorbitant legal fees.

Those commitments may carry greater significance as experts are predicting a wave of bankruptcy filings from individuals and business owners who are burning through their savings and federal stimulus benefits, leaving them unable to pay their bills and make loan payments.

During the country’s last recession, beginning in 2007, bankruptcy filings steadily increased as millions of Americans lost their jobs and savings. That pattern has not yet repeated itself during the pandemic, as personal bankruptcies from March to September were actually down 27 percent compared with last year. But bankruptcy attorneys expect that trend to reverse as federal aid runs out and lending moratoriums expire.

“Once these programs start to drop off, we’re going to start seeing people popping up,” said Rick Abelmann, a bankruptcy attorney in Hawaii, where the pandemic has wiped out the past eight years of economic growth. The sudden loss of tourism has sidelined restaurant staff, tour guides and bed-and-breakfast owners. In just five months, the state went from having the second-lowest unemployment rate in the country to the third-highest.

Abelmann said he expects a surge of bankruptcy filings rivaling the peak of the Great Recession and has hired two new employees to handle the expected volume of requests. A half-dozen experts interviewed for this story, including law professors, academic researchers, consumer advocates and other bankruptcy attorneys, agree that a wave of personal bankruptcies is unavoidable. Bankruptcies for large businesses have already ticked up this year.

“It’s out there and it’s waiting and it’s got this tape holding it together, but as soon as the tape busts, it’s all going to come spilling out,” Abelmann said.

Federal and state efforts to combat the economic effects of the pandemic included myriad efforts to prevent immediate catastrophes for Americans, such as increased unemployment insurance and temporary bans on evictions. Some landlords and creditors have voluntarily held off on squeezing debtors, but they may run out of patience. Litigation, one of the main drivers of bankruptcy filings, has been held up in many places by court closures, leaving a backup of claims.

“The county courthouse here in San Diego was shut down,” said John Colwell, a California bankruptcy attorney and president of the National Association of Consumer Bankruptcy Attorneys. “They were getting 1,000 pieces of mail a day.”

The 2005 bill was designed to keep people who could afford to pay their debts from abusing the bankruptcy system. But after the law was implemented, it had the opposite effect: Poor people were discouraged from seeking bankruptcy protection because it became more expensive and complex without giving them a way out of college debts or letting them protect their homes.

Personal bankruptcy filings climbed steadily through the 1990s and first half of the 2000s, spiking in 2005 when uncertainty about the new law prompted a surge in filings. Then they dropped: There were 27 percent fewer filings in the first 10 years after the law took effect than the decade before it, even despite a wave of bankruptcies triggered by the Great Recession.

Researchers attribute the decline to a drop in filings from low-income households and worry they will not seek protections now because of the difficulty of filing.

“Too few people file for bankruptcy compared with the number of people who are in debt or [facing] collection or struggling with debt,” said Jialan Wang, assistant professor of finance at the University of Illinois at Urbana-Champaign, who co-authored a recent paper looking at the decrease in bankruptcy filings so far during the pandemic.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 mandated a mountain of new paperwork, including a means test and a credit counseling course. As a result, attorney fees shot up. The cost of an average Chapter 7 bankruptcy rose from about $600 in 2004 to about $1,000 in 2008, researchers at the University of Maine found. Now, bankruptcy experts say, the cost approaches $2,000.

Without the ability to rid themselves of debt that bankruptcy affords, low-income debtors suffer larger drops in credit and become more vulnerable to litigation. A 2015 study by the Federal Reserve Bank of New York found that people who file for bankruptcy achieve credit scores 40 to 80 points higher than those in a similar financial position who don’t seek bankruptcy.

Todd J. Zywicki, a law professor at George Mason University who advocated for the 2005 bill, said the decline in filings after the legislation suggests it succeeded in stopping people from taking advantage of the system.

“Prior to the reform, bankruptcy filings went up and up regardless of the business cycle,” Zywicki said. “After bankruptcy reform, bankruptcy filings followed the business cycle.”

However, University of Pittsburgh economics professor Stefania Albanesi estimates that a large number of indebted Americans who should have filed for bankruptcy during the Great Recession didn’t because the law created new barriers to doing so, exacerbating the financial distress facing some of the country’s poorest households. Albanesi, who co-authored the New York Fed study, expects another wave of “missing bankruptcies” over the coming months and years.

Beginning in the 1990s, business sectors including banks, credit card issuers, department stores and mortgage lenders had been pushing for changes to bankruptcy laws, arguing that the rules allowed individuals to recklessly run up debt and escape serious penalties. The issue came to a head in 2005, when Republicans — generally amenable to the industries’ requests — controlled both houses of Congress and President George W. Bush was in his second term.

Biden, whose home state of Delaware is headquarters of many of the country’s largest credit card issuers, joined the effort along with 17 other Democrats in the Senate. The banking industry, including Delaware-based credit card giant MBNA (since acquired by Bank of America) spent more than $100 million in support of the campaign to change bankruptcy laws.

MBNA also hired Biden’s son, Hunter Biden, as a consultant from 2001 to 2005, something Barack Obama’s presidential campaign acknowledged after Obama chose Biden to be his running mate.

Biden, by then a powerful senator and longtime member of the Senate Judiciary Committee, pushed a theory that bankruptcy protections were letting too many people off the hook for debts and putting too much of the burden of unpaid bills on creditors. “An awful lot of people are discharging debt who shouldn’t,” he said at a 2001 Senate hearing. “I am so sick of this self-righteous sheen put on anybody who wants to tighten up bankruptcy is really anti-debtor.”

Warren, then a Harvard University professor, led an assembly of advocates resisting the legislation and arguing that it would badly hurt middle-class and low-income Americans.

“It treats every family — it assumes that they are all in bankruptcy for the same reason: that they have overspent,” Warren said of the bankruptcy bill in her 2005 Senate testimony. “This means that a family driven into bankruptcy by the increased costs of caring for an elderly parent with Alzheimer’s is treated the same as someone who maxed out his credit cards at a casino.”

Biden teamed with Republicans in blocking some of the amendments supported by the advocates and proposed by more left-leaning Democrats, including measures to exempt senior citizens at risk of losing their homes, members of the military or people who couldn’t afford their medical bills. Biden supported exempting low-income filers from the means test and making alimony and child support payments a higher priority over other debts in bankruptcy court, two measures that made it into the final bill.

Advocates and Democratic congressional staffers who fought the legislation generally agreed that given Republican control, Biden may not have been able to stop it from passing had he wanted to, but that he could have done more to make sure it protected people.

“I don’t think it’s fair to say that everything in that bill was his fault,” said Robert F. Schiff, a former staffer for Russell Feingold, then a Democratic senator from Wisconsin. “There was a gigantic financial industry behind it and the Republicans were pressing for it. He pushed for it and he voted for it, but he wasn’t behind all of it.”

After being elected to the Senate herself, Warren introduced a plan to largely undo the 2005 law by making it easier for individuals to file, ease the process of discharging student debt and protect people’s homes and cars. When both Warren and Biden ran for president last year, she revived their earlier dispute.

“At a time when the biggest financial institutions in this country were trying to put the squeeze on millions of hard-working families who are in bankruptcy because of medical problems, job losses, divorce and death in the family, there was nobody to stand up for them,” Warren told a crowd in Iowa.

“I got in that fight because they just didn’t have anyone, and Joe Biden was on the side of the credit card companies,” she added.

Biden co-sponsored an early version of the 2005 bill and was thanked on the Senate floor by Republican Sen. Orrin G. Hatch (Utah) for working “tirelessly for years” on the legislation. But during his presidential run, he reversed himself on the issue, similar to how said he regrets his past support for parts of a 1990s crime bill and apologized to Anita Hill for his role in Supreme Court Justice Clarence Thomas’s confirmation hearings.

Warren dropped out of the presidential race in March, and Biden endorsed her plan a week later. Speaking at a town hall event in March while campaigning against the more liberal Bernie Sanders, Biden embraced Warren’s bankruptcy plan, saying it “allows for student debt to be relieved in bankruptcy, provides for a whole range of other issues that allows us to in fact impact on how people are dealing with their circumstances.”

Warren now says through a spokeswoman that together they “have a plan to make bankruptcy laws work better for families instead of the creditors who cheat them.”

“The economy won’t be able to recover unless working families are getting the relief they need, and that’s what Vice President Biden and Senator Warren are committed to doing,” said spokeswoman Ashley Woolheater. A Warren aide said the senator is working to turn the plan into legislation.

Biden’s campaign website links directly to Warren’s plan. Campaign spokesman TJ Ducklo issued a statement saying, “Joe Biden has fought for working families over corporations his entire career, and is running for president to rebuild the middle class so that everyone can come along.

“He believes that we need to fundamentally reshape our bankruptcy system so that middle-class families being crushed by debt — made worse by a once-in-a-generation economic crisis caused by Donald Trump’s failed leadership — can get the relief they desperately need.”

With millions of Americans struggling to meet basic needs, advocates say changes are badly needed and that bankruptcy reform has not been a priority of President Trump, who has boasted of how his companies repeatedly used bankruptcy law in the past to protect his wealth and “make deals better.”

More than 6 million households missed either rent or mortgage payments in September, according to a Mortgage Bankers Association report, and 26 million people missed student loan payments.

“Absent pretty dramatic relief legislation, there’s going to be a big wave of bankruptcy cases,” said Henry Sommer, president of the National Consumer Bankruptcy Rights Center.

Despite Biden’s about-face on the campaign trail, Warren supporters are skeptical that the Democratic nominee will rush to undo the bill he helped pass years earlier if he becomes president.

“This is not going to be the focus of a Biden administration,” said Georgetown University law professor Adam J. Levitin, who assisted Warren with her bankruptcy plan.

On the other hand, he said, “the world may look different when you are a senator from Delaware versus the president of the United States.”