Unemployment statistics during the pandemic have been inflated by backlogs, according to GAO report

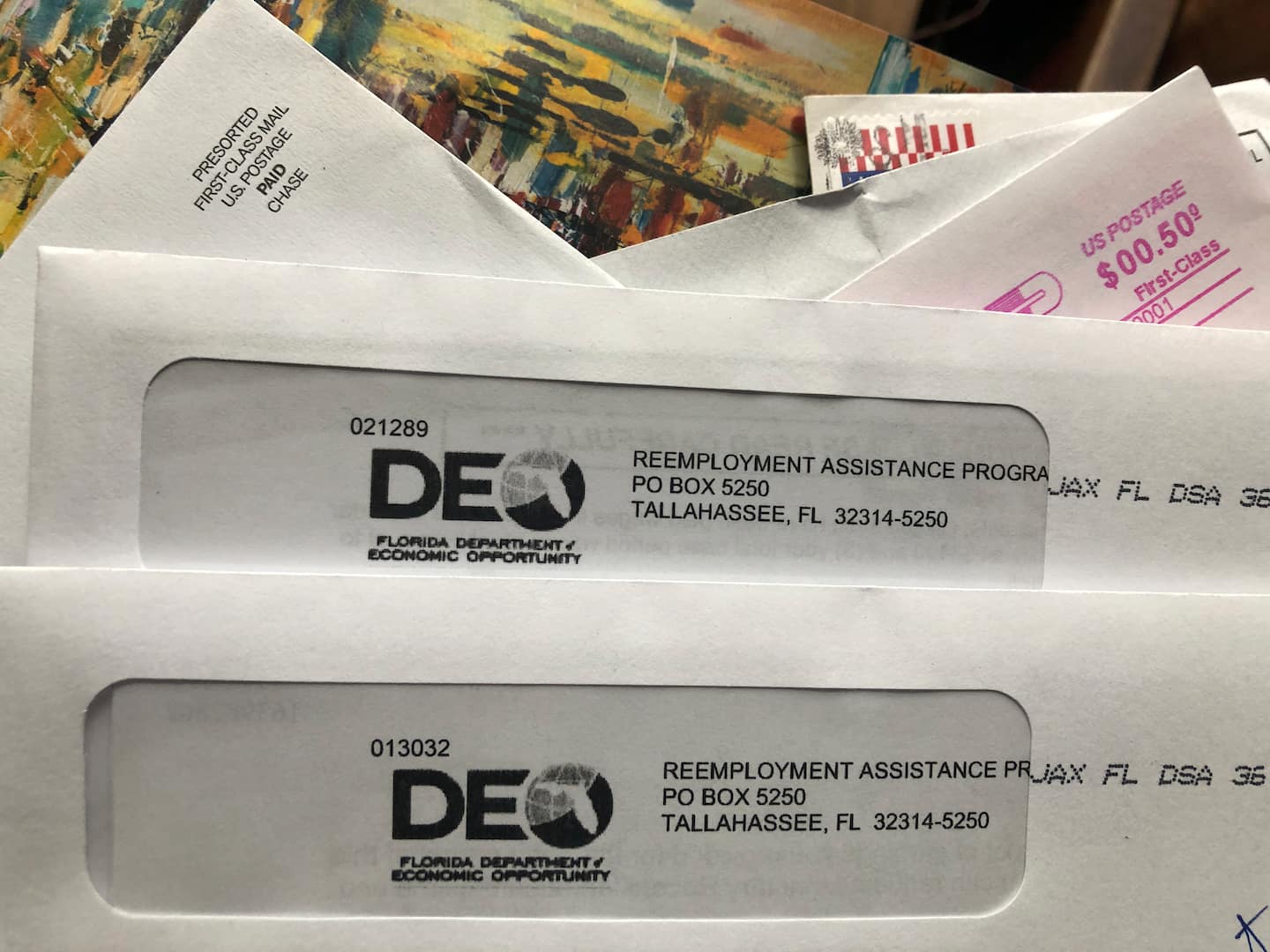

In particular, unemployment numbers have likely been inflated due to issues with backlogs in many state unemployment systems, according to the GAO report.

The Labor Department doesn’t actually count each person who is claiming jobless benefits every week. Instead, the agency uses a tally of ongoing state claims as a stand-in for the total number of people receiving unemployment benefits at any given time across the country, which it calls continuing claims.

Last week, the Labor Department reported 20.4 million continuing claims.

But the GAO said that this statistic is misleading, noting that each week of unemployment is counted as a separate claim when certified, even if it is just one person with multiple weeks of claims processed.

Before the pandemic, this was an acceptable approximation. But due to the massive level of backlogs, as well as the ability for some workers to file claims retroactively, this has resulted in a significant number of extra claims during the pandemic, the GAO said.

And they are not without consequences, as unemployment claims have served as a weekly indicator for analysts and policymakers about the health of the labor market and broader economy as a whole.

“We need to know what happened so we can shore up these systems and this doesn’t ever happen again,” said the Economic Policy Institute’s Heidi Shierholz, a former chief economist for the Labor Department. “We have chosen to disinvest in these programs for decades and this is what you get from that.”

The weekly report on unemployment insurance has also relied on inconsistent reporting of data from states in the Pandemic Unemployment Assistance program — the jobless benefit program Congress created for gig and self-employed workers, which has further complicated week-to-week comparisons.

For example, in a sample of 20 states, the number of continued claims submitted in the PUA program through June 27 was nearly 20 million more than the total number of people who had submitted an initial claim, the GAO found.

Other quirks have complicated the process.

In California, due to the way the state’s unemployment system works in two week increments, the number of continued claims may be more than twice the number of actual people submitting claims, the GAO said, citing an analysis by the California Policy Lab.

“To understand the supportive role UI and PUA benefits are playing in the economy during the pandemic, reliable data are needed on both the number of new claimants each week and the number of continuing claimants who are relying on program benefits,” the GAO report said. “Without an accurate accounting of the number of individuals who are relying on these benefits in as close to real time as possible, policymakers may be challenged to respond to the crisis at hand.”

The GAO also found problems with the PUA program that went beyond statistics.

A majority of states paid PUA claimants the minimum allowable benefit instead of the full amount they were eligible for, meaning that many households fell below the poverty line after the supplemental $600 a week in unemployment insurance expired over the summer.

The GAO also noted that fraud, particularly in the PUA program, may also be inflating some states’ counts.

In a response to the GAO included in the report, the Labor Department said it planned to clarify its future unemployment releases to note that the number of continual claims does not accurately estimate the number of people claiming benefits.