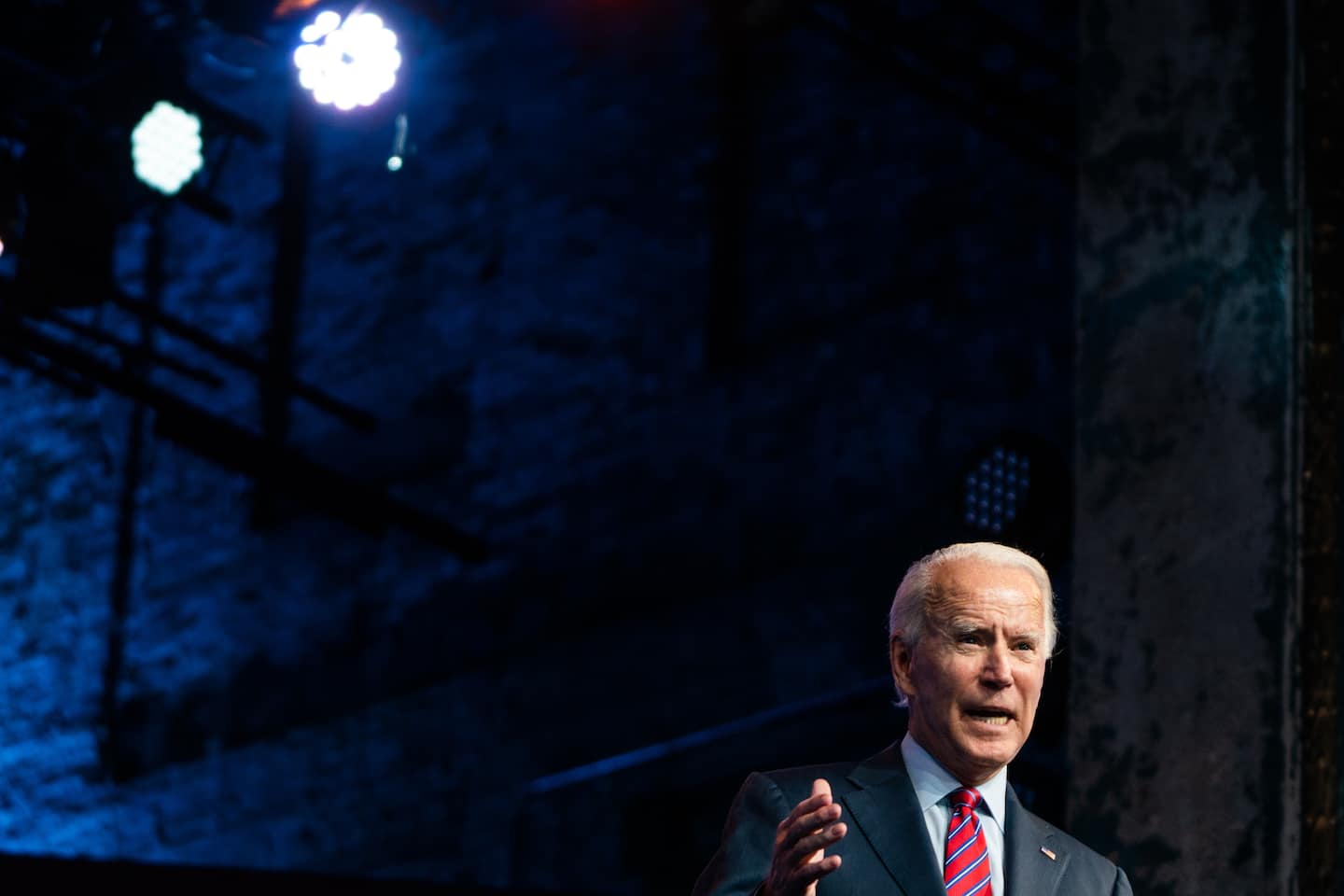

Democratic Senate control will give Biden freer hand in pursuing tax agenda

Biden wants to use the extra money to pay for a far-reaching domestic agenda, with new spending on health care, infrastructure, low-income schools and climate initiatives. His approach would be a sharp turn from the past four years, during which the Trump administration pursued an agenda that cut taxes for corporations and the super-rich.

Democratic control of the Senate, after a pair of wins in a runoff election in Georgia this month, will give Biden more flexibility in pursuing his tax agenda, analysts said, although they cautioned that the narrow 50-50 margin — with Vice President-elect Kamala D. Harris casting tie-breaking votes — will limit the Biden administration’s ability to pursue its most ambitious goals, particularly raising the tax rate for corporations.

First and foremost, experts said, Biden will have a relatively easy time pushing through tax cuts he has proposed for modest earners and the middle class, such as expanding the child tax credit for the duration of the economic crisis, and permanent tax cuts to ease the burden of paying for health insurance, child care and a first home.

Those kinds of moves are popular with moderate Democrats and some Republicans. In 2019, Sens. Mitt Romney (R-Utah) and Michael F. Bennet (D-Colo.) put forth a bipartisan plan for expanding the child tax credit, a sign that the Biden administration may be able to find Republican allies on the issue.

“That is one potential area where the Biden administration might like to explore,” said Garrett Watson, a senior policy analyst at the conservative-leaning Tax Foundation. Watson said he views “any tax relief or tax changes that are more generous to taxpayers as part of any stimulus that may happen” as particularly likely this year.

Given their thin margins, Democrats will have to pursue policies that unite progressives who want the wealthy to contribute more and moderates who are skittish about increasing taxes during the worst economic crisis in decades. For instance, moderate Democrats may oppose raising the corporate tax rate from 21 percent to 28 percent, as well as Biden’s wish to raise taxes on capital gains, experts said.

“People need to be careful about overstating what they think Biden can get done,” said Howard Gleckman, a senior fellow at the Urban Institute’s Tax Policy Center. “A lot of what happens in the Senate will depend on the support of moderate to conservative Democrats” such as Sens. Joe Manchin III (W.Va.) and Jon Tester (Mont.), he said.

Biden’s best chance of getting corporate tax increases through would be to make technical changes to existing tax laws, such as the tax treatment of corporate deductions, Gleckman said. That could include raising taxes on the foreign income of U.S.-based multinational companies, which could draw on bipartisan support for boosting domestic manufacturing; eliminating or lowering the tax deduction for corporate interest payments; and reducing firms’ ability to use their business losses to receive refunds for past taxes.

Democrats may try to add some of their tax priorities to the next stimulus bill meant to address economic distress resulting from the coronavirus pandemic. Sen. Charles E. Schumer (D-N.Y.) has said that $2,000 stimulus checks will be a priority for Democrats in Congress.

The Biden administration will also probably look closely at what tax policy changes it can make through a bureaucratic legislative tool called the reconciliation process, an expedited form of lawmaking on budget issues that was used in the Trump era to pass tax cuts for the wealthy and corporations. Reconciliation bills are not subject to filibusters, which means they need only a simple majority to pass, although those measures generally can contain only provisions related to the federal budget.

Biden has a plethora of priorities to choose from as he tries to craft a strategy for how to get his policies through Congress — including on taxes, health care and infrastructure.

“This is really the single most important question Biden has to answer, is how much stuff does he try to jam into that reconciliation bill?” Gleckman said. “He’s going to have to pick and choose.”