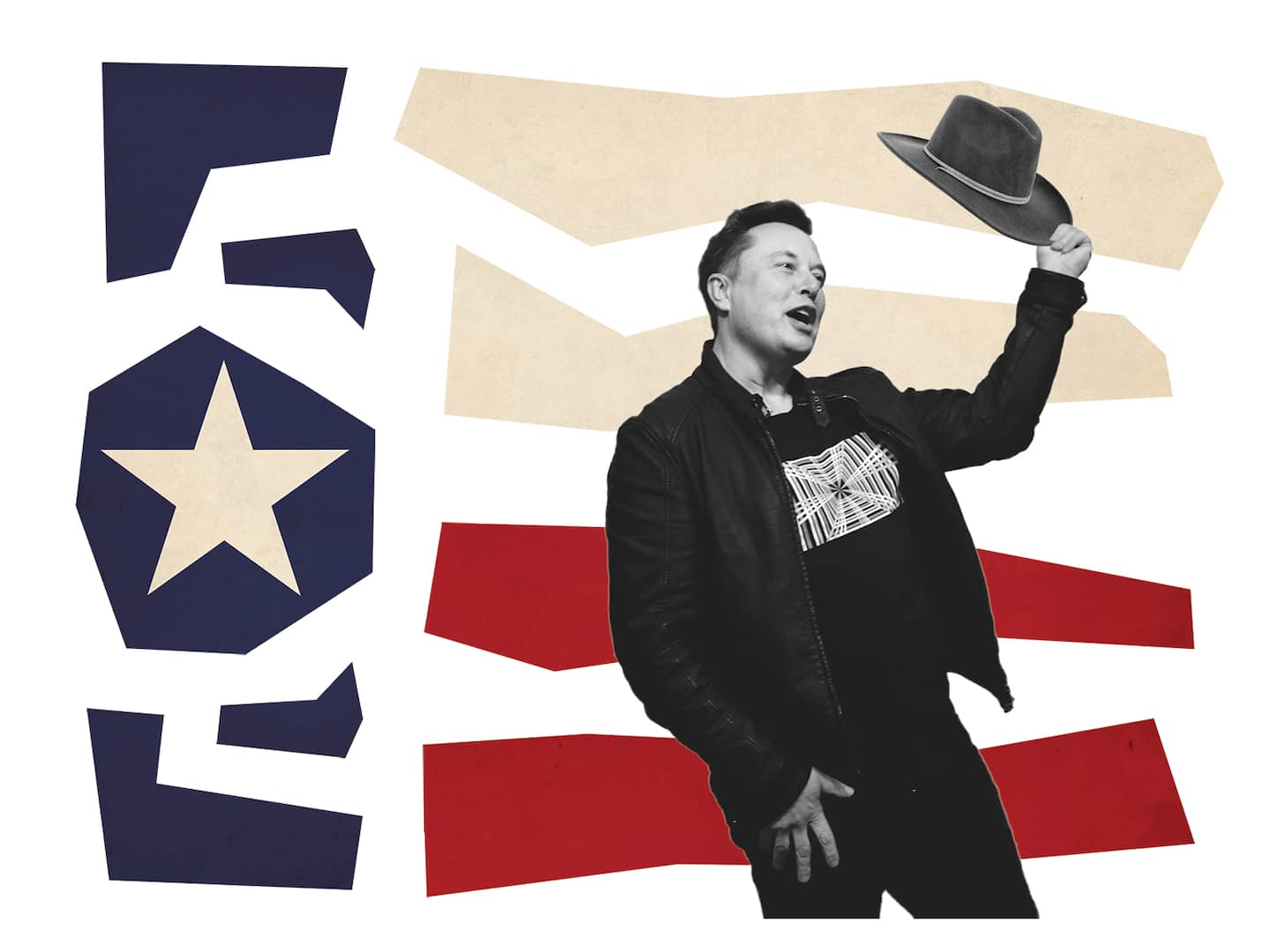

Elon Musk moved to Texas and embraced celebrity. Can Tesla run on Autopilot?

Twice in a matter of days recently, the 49-year old complained of what he called an “insane” work schedule, juggling responsibilities with his car company and aerospace firm and taking in “torrents of information” in wall-to-wall meetings.

But critics say the rigors of Musk’s personal schedule, and the seeming cult of personality that has developed around him, are beginning to show in the car company he runs — the one that he took from an upstart pioneer in electric vehicles to the world’s most valuable automaker. Musk, they say, is drowning in outside commitments like his aerospace company and other endeavors while letting quality — and strategy — at Tesla fall victim. And there are familiar concerns.

“There have been years past where some of his behavior was horrifying and had cost huge costs especially from his little tussle with the SEC,” said Ross Gerber, a Tesla investor and supporter of Musk who is close to the company. “And he’s come a long way. What I’m worried about is his success makes him a little bit loose again.”

Musk spent much of the past year focused on trying to demonstrate his aerospace firm’s viability to shuttle people into space on reusable rockets, all while Tesla worked to construct multiple factories and launched a new SUV. Musk also juggled the birth of a newborn son and his own personal move to Texas. He sprinkled in spontaneous public appearances in venues such as social media app Clubhouse in between his barrages of tweets. Musk became the world’s richest person in January, thanks to skyrocketing Tesla stock.

In interviews with a dozen current and former Tesla employees, investors and analysts, critics pointed to a series of questionable business moves, and even outright missteps by Tesla, as a potential symptom of the outside demands on Musk. They described a company where Musk is less present and increasingly isolated, where subordinates are reluctant to question the CEO’s vision, and where the de facto position entails eschewing market research. It’s a top-down, shoot-by-the-hip ethos directed by Musk.

Tesla did not respond to repeated requests for comment. In response to emails seeking comment, Musk replied only: “Give my regards to your puppet master.”

In a regulatory filing in February, the company highlighted the risk it faces by relying so much on Musk.

“We are highly dependent on the services of Elon Musk, our Chief Executive Officer and largest stockholder,” Tesla said in the filing, in language unusual for the way it cited a corporate CEO’s numerous outside commitments. “Although Mr. Musk spends significant time with Tesla and is highly active in our management, he does not devote his full time and attention to Tesla.”

The filing cited Musk’s helm over SpaceX and “other technology ventures.” Along with Tesla and SpaceX, Musk leads an outfit focused on merging the human brain with computers, Neuralink, along with a tunnel building firm, The Boring Company.

Musk’s impulsive leadership has worked to Tesla’s benefit so far. His bets have resulted in huge successes, vaulting Tesla from an upstart electric vehicle pioneer to the world’s most valuable automaker. The company delivered a record of nearly 500,000 vehicles in 2020 and has cannibalized prospective U.S. electric vehicle sales from practically every other automaker.

But cracks have also started to appear as Tesla has stumbled on some vehicle releases and its vehicles grow older, prompting some recalls. Regulators are scrutinizing the company for fires and some of its more innovative features.

“There isn’t a culture at Tesla really other than ‘let’s do what Elon wants to do,’” said Ed Niedermeyer, who wrote the book “Ludicrous: The Unvarnished Story of Tesla Motors.” He said the eyebrow-raising Cybertruck debut — in which a supposedly unbreakable window shattered onstage — showed the state of play better than any other recent company event.

“It clearly reflected Elon’s increasing isolation inside the company,” he said. “He becomes more powerful and that power sort of isolates him more and more.”

Current and former Tesla employees described Musk as less present on the factory floor in recent months, involving himself primarily in higher-profile decisions and events, like end-of-quarter delivery crunches and matters related to the company’s earnings calls and investor presentations. That’s a contrast from around three years ago, when the chief executive was known to sleep at the factory as the Model 3 faced production issues.

“I think the stress is definitely less now that the company’s more established,” said one former employee on an automation team paid close attention by Musk, who spoke on the condition of anonymity because he was not authorized to speak publicly on company matters. “His pressure on certain things has certainly dropped.”

Musk grew up in South Africa and went on to study in Canada and then the University of Pennsylvania. He emerged as a tech titan with the sale of the site he co-founded, PayPal, to eBay in 2002. Musk, the payments platform’s onetime CEO, pocketed $165 million. He founded SpaceX in 2002, with the ambition to take humans to Mars in a private venture.

The enigmatic entrepreneur invested in Tesla in 2004, a year after its founding, and holds more than a 20 percent stake in the company, according to a regulatory filing this month. He was named chairman of the company in 2004, though he would lose that title in the wake of a 2018 spat with the Securities and Exchange Commission.

Musk became Tesla CEO in 2008 and proceeded to revolutionize the car industry. He helped mastermind the launch of a series of electric cars that were simultaneously sporty and aspirational, yet carried enough range to make them practical. That combination helped bring electrification to the masses, as Tesla went from niche luxury automaker to an electric vehicle powerhouse, selling nearly half a million vehicles per year.

Musk has more than 47 million followers on Twitter, thanks in part to a bombastic personality there that has landed him in trouble.

He’s cut in the mold of many tech company CEOs, who are under constant pressure to keep their companies fresh and innovative. But as Tesla reaches middle age, it faces similar risks as other personality-driven Silicon Valley start-ups turned giants.

Apple CEO Steve Jobs was known for his vision before his death in 2011 prompted what some view as a loss of innovation at the tech giant. Amazon will soon face the transition of founder and chief executive Jeff Bezos to executive chairman, testing the culture he’s instilled. (Bezos owns The Washington Post.)

“The biggest asset within Tesla is Elon,” said Dan Ives, an analyst with Wedbush Securities who has followed Musk’s moves closely over the years. He adds that some have worried what happens if “Musk feels like he’s had massive success with Tesla, he’s built an unparalleled brand and now he could go from fifth gear to third gear.”

Even Musk recently questioned how long he can keep it up, suggesting he’ll write a book.

“Nobody is or should be CEO forever,” he observed during a Tesla earnings call late last month, launching a wave of speculation — almost certainly premature — about a potential looming departure. “It would be nice to have a bit more free time.”

It’s a far cry from just two years ago, when the company’s stock hit a recent low amid production and demand concerns. Musk had faced an SEC investigation costing him and Tesla $20 million each, and he lost his chair on the company’s board in 2018.

Musk has come out of the pandemic more famous and respected than ever. He is, depending on the day, the world’s richest or second-richest person. Fortune named him its 2020 Businessperson of the Year. He made Gallup’s poll of the world’s most admired men, sandwiched between Pope Francis and U.S. Sen. Bernie Sanders (I-VT) in the top 10.

After hitting a near-term low of $177 per share in mid-2019, Tesla’s stock soared to a new high of more than $2,000 just over a year later, before the company implemented a 5-for-1 split late last summer. Tesla’s cash flow woes had abated and the company was posting consecutive quarters of profitability.

Tesla faced an unusual stumble in late 2019, when the company released a polarizing pickup, dubbed the Cybertruck, as it aimed to capture a new market for its electric vehicles. While its sci-fi-derived design won over the company’s most ardent fans, the angular proportions and stainless steel exoskeleton were off-putting to many who would have otherwise been interested in a Tesla pickup, and it remains unclear if the truck can be legally built with its current specifications.

As the coronavirus took hold, Musk started tweeting the panic over it was “dumb.” And he wrote that there would be “close to zero new cases” by the end of April a year ago. He was on a call with Trump where he pushed reopening and praised the president. He had a public meltdown during an earnings call in late April, raging against California officials’ shutdown orders in an expletive-laden rant.

“To say that they cannot leave their house and they will be arrested if they do, this is fascist,” he said on the call. “This is not democratic — this is not freedom.”

Jennifer Chatman, a management professor at the University of California at Berkeley’s Haas School of Business, pointed to Tesla’s firing of workers who’d opted to stay home during the pandemic, a broken promise to workers first reported by The Post.

“Every time you reduce the quality of Tesla as a workplace then by definition you’re going to reduce the quality of the employees who are willing to work there,” she said.

In May, he sent his company’s stock plunging with an eyebrow-raising tweet questioning its value. He also used Twitter to announce the birth of a newborn son, X Æ A-Xii (initially spelled X Æ A-12 but changed to comply with California regulations).

“I am selling almost all physical possessions,” Musk wrote during that whirlwind period in May. “Will own no house.”

That same month, Musk oversaw the most important mission in SpaceX’s history at Cape Canaveral. SpaceX reached a milestone feat with the successful launch to space — and safe return — of a pair of NASA astronauts, becoming the first private company to fly humans into orbit.

And like so many Californians who have become fed up with the state’s politics and frequent natural disasters, Musk last year relocated to Texas, acknowledging in December he had moved.

As Musk moved and focused more energy on SpaceX, Tesla employees said he didn’t have the same presence he once did. Special requests from Musk dwindled.

Tesla’s hotly anticipated Model Y crossover, released in 2020, has surprisingly struggled, prompting the company to yank some variations from the lineup and cut the price by up to $3,000 at a time. Its refreshed Model S includes a controversial half-moon “Yoke” style steering wheel which aims to automate turn signals and gear selections, something likely to be scrutinized by regulators.

The Model Y faced quality control concerns after its launch early last year, including reports that the roof of a brand new vehicle blew off, and a back seat was not attached. Some analysts attributed poor build quality to the strain of producing cars during the pandemic.

Meanwhile, Tesla in October debuted the feature suite it dubs “Full Self-Driving” amid regulatory and industry concerns it was not ready. The company is not using the most advanced hardware available and is instead opting for a cheaper approach that relies on a series of interconnected cameras to stitch together live images of what the car sees.

Some of Tesla’s current fleet of passenger vehicles are nearing a decade old — with the flagship Model S and the Model X SUV facing a recall over faulty high-tech screens that failed to meet automotive standards.

And observers balked at Tesla’s response to the screen recall ordered by federal regulators in January. The company’s Vice President of legal argued Tesla’s giant center screens should not be expected to last the life span of the vehicle, raising concerns about the longevity of the cars overall.

Musk now finds himself with the chance to expand Tesla’s global reach in Europe and Asia, and stretch its appeal beyond the blue state that is America’s biggest electric car market, to the middle of the country where Tesla plans to build its sci-fi pickup, the Cybertruck.

Tesla has started construction on a factory in Austin, hailed as the future of the company, and another near Berlin that is expected to supply its vehicles in Europe. Meanwhile it is continuing an aggressive expansion into Asia, after the company built a facility in Shanghai where it is manufacturing a local-made variant of its Model 3 and Model Y.

Musk has staked his bets on the Model Y crossover, which he has said will outsell its models S, X and 3 combined. He says he ultimately wants Tesla to build 20 million cars per year.

Such claims might normally strike investors as pie-in-the-sky predictions.

“Even a Jobs comparison is unfair at times because [Musk is] even one step even more extreme in terms of what he’s done publicly,” said Gene Munster, an investor and managing partner of Loup Ventures, who follows Tesla and Musk closely. “There is a group of founders and CEOs that are controversial but do a great job for shareholders and that’s Steve Jobs and that’s Elon.”

Investors and analysts point to more recent concerning signs. Just this month, Tesla said in a business filing it had invested $1.5 billion in bitcoin and would begin accepting the cryptocurrency as a payment. While a potentially savvy move to benefit from the volatile cryptocurrency, analysts also said it entails serious financial risk that could wipe out the company’s profits.

Musk in the days before the announcement promoted the joke cryptocurrency Dogecoin, driving up the price of the meme-based offering. “Who let the Doge out,” one of the tweets read.

Musk over the weekend opined on Twitter that the value of cryptocurrencies such as bitcoin seemed too high. Bitcoin values have subsequently fallen by around $10,000 and price variations have plunged the cryptocurrency into uncertainty. Tesla stock dipped sharply Tuesday morning, trading down nearly 4 percent at $688 per share.

“We’re seeing this with Elon Musk: a lack of impulse control,” said Chatman, the UC-Berkeley professor.

One employee, who spoke on the condition of anonymity because he was not authorized to speak publicly about company matters, said he winced as he learned a fellow factory employee had poured $70,000 derived from company-issued Tesla stock into bitcoin, following Musk’s lead.

“He knows whatever he says, people do and he’s taking advantage of it,” the worker said. He recalled warning his co-worker that Musk “doesn’t care about you; he’ll ruin you.”