The U.S. economy has now shrunk for the second straight quarter, the Bureau of Economic Analysis announced Thursday. The 0.9 percent annualized drop in the second quarter comes on top of a 1.6 percent drop in the first quarter, further raising fears of a recession.

What two negative GDP quarters means for ‘recession’ — and our politics

Naturally, this has led to plenty of consternation for a Democratic Party already staring down the barrel of an arduous 2022 midterm election. Imagine that race also taking place in an officially declared recession. Hence the preemptive pushback from the Biden administration, which has assured we aren’t in a recession and has downplayed the significance of the two-straight-quarters shorthand that now looms so large.

We might not know for some time whether we’re in or entering a recession, given such designations come retroactively, and this situation poses some difficult questions.

But just how closely correlated are two straight quarters of negative GDP to actual, declared recessions? What impact has that had on when recessions are actually declared? And what is the political significance if a recession is declared?

The first two questions are easier to answer.

Despite the shorthand, two straight quarters of negative GDP have not been determinative of an impending recession resignation. As the NBER itself has stated, “Most of the recessions identified by our procedures do consist of two or more consecutive quarters of declining real GDP, but not all of them.”

In the 2020 pandemic-induced recession, the NBER announced the recession in June 2020 — even before the announcement of a second-straight (very) negative quarter the following month.

The recession before that — the “Great Recession” between late 2007 and 2009 — was also declared without two straight negative quarters registering yet. The designation came in December 2008, after data showed the first and third quarters of 2008 were negative, but not the second. The following month, the fourth quarter report gave us a second straight negative quarter.

And the recession before that — in 2001 — didn’t satisfy the shorthand at any point. The third quarter of that year was initially reported as being negative, but it would be the only one. The NBER still declared a recession in November of that year.

All of these, of course, are examples of two straight negative quarters being unnecessary to declare a recession rather than insufficient. But it’s also conceivable — though rare — to actually have two straight negative quarters without a recession designation at all. It apparently happened in 1947 when, as the New York Times’s Ben Casselman noted, some of the stronger indicators for the economy echo what we see today.

So: In 1947, we had two consecutive quarters of negative GDP, but positive jobs, positive industrial production and positive consumer spending and NBER doesn’t consider it a recession.

Could it happen again? Stay tuned.— Ben Casselman (@bencasselman) July 27, 2022

Any such designation might take some time, if it ever arrives, in large part because of the unusually mixed signals Casselman highlighted.

As a 2008 Congressional Research Service report recapped, both declarations of the beginnings and ends of recessions are often delayed:

The longest delay between the beginning of a new phase of the business cycle and its announcement was when a recession was found to have ended in March 1991 but was not announced until 21 months had passed. The shortest delay was five months after the expansion ended in January 1980. Of the eight examples shown here, four were not announced until at least a year had elapsed.

Beyond that, there’s the more complicated question of the political impact. The unhappy reality for Democrats is that we’re entering this debate at a particularly inopportune time, with voters deciding control of two very narrowly Democratic-controlled chambers of Congress in the 2022 midterms and with the race looking competitive, if leaning toward Republicans.

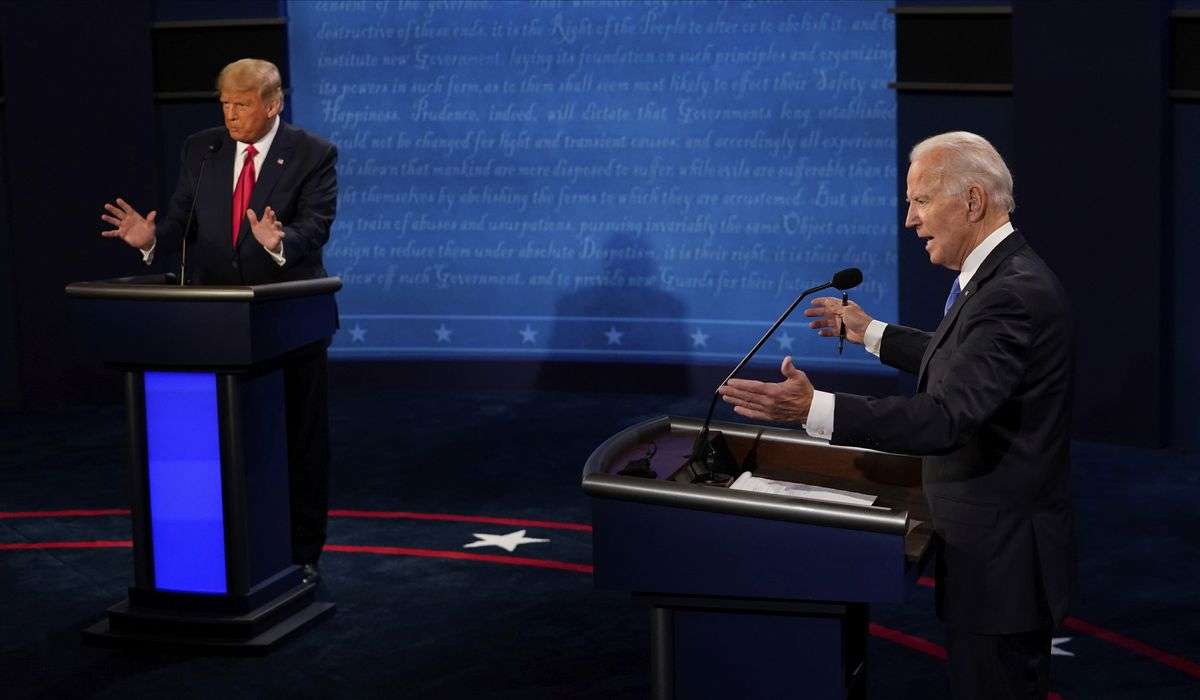

It’s a setup with little precedent. Both the 2001 and 2020 recessions came amid other issues that severely mitigated any political judgments being made about the recession — the 9/11 terrorist attacks and the coronavirus pandemic, respectively. Voters judged President Donald Trump poorly for his response to the pandemic, but him losing reelection later that year wasn’t really about the recession, per se, nor was that a major Democratic talking point. Pretty much everyone worldwide was experiencing a recession.

The recession of the late 2000s, meanwhile, was declared shortly after Republicans had already lost the White House at the tail end of George W. Bush’s presidency. The negative impact of the financial crash was very much baked-in to that result, but it wasn’t formally a recession until afterward.

Recessions further back are a little more comparable to today.

When the NBER declared a recession in April 1991, George H.W. Bush was still riding very high at that point. And he would do so for months afterward, with an approval rating that remained in the 70s. But his response — or lack thereof — wound up costing him, on top of other problems including on foreign policy, as the New York Times wrote in the summer of 1992:

Whoever’s fault the recession was, Mr. Bush appeared slow to recognize the agony the sour economy was causing many Americans. And whatever lies ahead, the public has been unwilling to excuse him and believes he has been indecisive and insensitive.

The latest New York Times/CBS News poll last week showed that only 34 percent of adults approved of the way Mr. Bush was handling his job, and that only 16 percent liked how he was dealing with the economy — a lower rating than even President [Jimmy] Carter got at his worst moment.

Ronald Reagan also struggled with his economic approval ratings in 1982 after the NBER declared a recession in January of that year, with Democrats running on the “Reagan recession” in the midterms and winning.

In these last two examples, though, it’s fair to ask how much the technical designation actually mattered, compared to the indicators people were already seeing in their everyday lives. Americans already judge President Biden very poorly on the economy — only about 3 in 10 approve of him on that issue, and even Democrats are quite lukewarm on it — because of inflation and high gas prices.

But certainly, the prospect of a recession won’t help. Republicans will use that word regardless of the NBER’s ultimate call — citing the shorthand and instances in which Democrats and members of the media have employed it — but having it become official at any point (and particularly in the next three months) would take things to a different level.