In the lead-up to this NFL season, Amazon released promotional videos for its Thursday Night Football package about a new “Prime ball.” Star quarterbacks Justin Herbert and Matthew Stafford raved about a new football Amazon was set to roll out, more oblong and aerodynamic than the traditional ball. Stafford casually tossed it 100 yards in one ad.

With ‘Thursday Night Football’ on Amazon Prime, the NFL bets on streaming

The spots were convincing enough that several reporters inquired to the NFL: Was Amazon really introducing a new football?

Alas, no. But Amazon will air its first exclusive Thursday night football game this week, a marquee matchup between the Los Angeles Chargers and Kansas City Chiefs, officially launching the NFL into the streaming era. The footballs will be regulation size, but fans outside of Kansas City and Los Angeles will need an Amazon Prime subscription to watch the game. That means that, for the first time, most NFL fans on Thursday night can’t pick up their remote and flip to the game on TV.

Amazon, one of the country’s largest tech companies and commerce giants, is paying more than $1 billion this season for a package of exclusive Thursday night games to broadcast the NFL, America’s most popular TV show. The rationale: to boost its Prime membership, which was first introduced for free shipping and now has some 200 million subscribers worldwide. Amazon says 80 million households in the United States have watched at least one piece of its video content in the last year. (Jeff Bezos, Amazon’s founder, owns The Washington Post.)

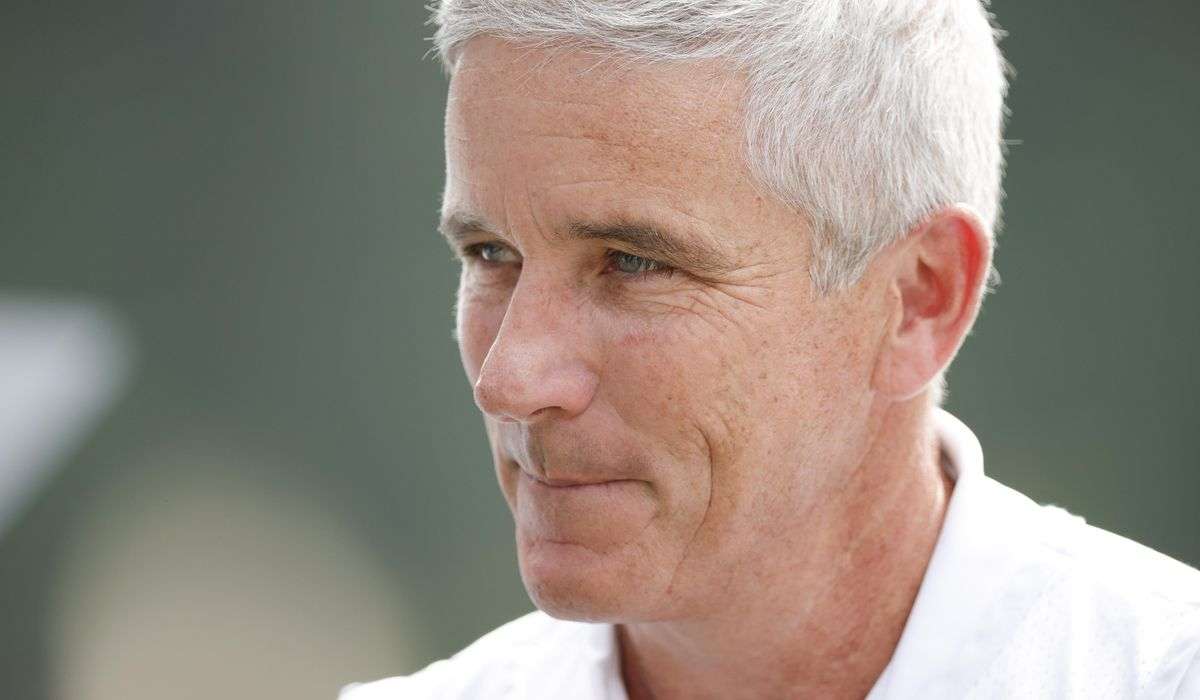

“Everything we do here starts with the customer and works backward, and we’re trying to ask ourselves how do we make Prime better for our customers,” said Jay Marine, global head of Amazon’s sports division.

The NFL’s business model has long relied on simplicity to reach the most fans: It’s Sunday afternoon? Flip on Fox or CBS. To facilitate the Thursday transition, Amazon has set up a customer-service call center filled with thousands of representatives to field troubleshooting calls in case fans can’t find the game. The company has blanketed its ubiquitous delivery trucks and millions of packages that it sends around the country with special advertising wrapping to alert fans. And Amazon Fire TVs and voice-activated Alexa devices have been programmed to help find the games.

Once fans find the game (they also can view it if they have an Amazon Video subscription), Amazon has promised a few new bells and whistles. There will be one alternate feed that has an overlay of statistics and game information; on some smart TVs, viewers will be able to control their own replays and some camera angles; and another feed for several games will feature Dude Perfect, a sports and comedy group popular on YouTube with young fans.

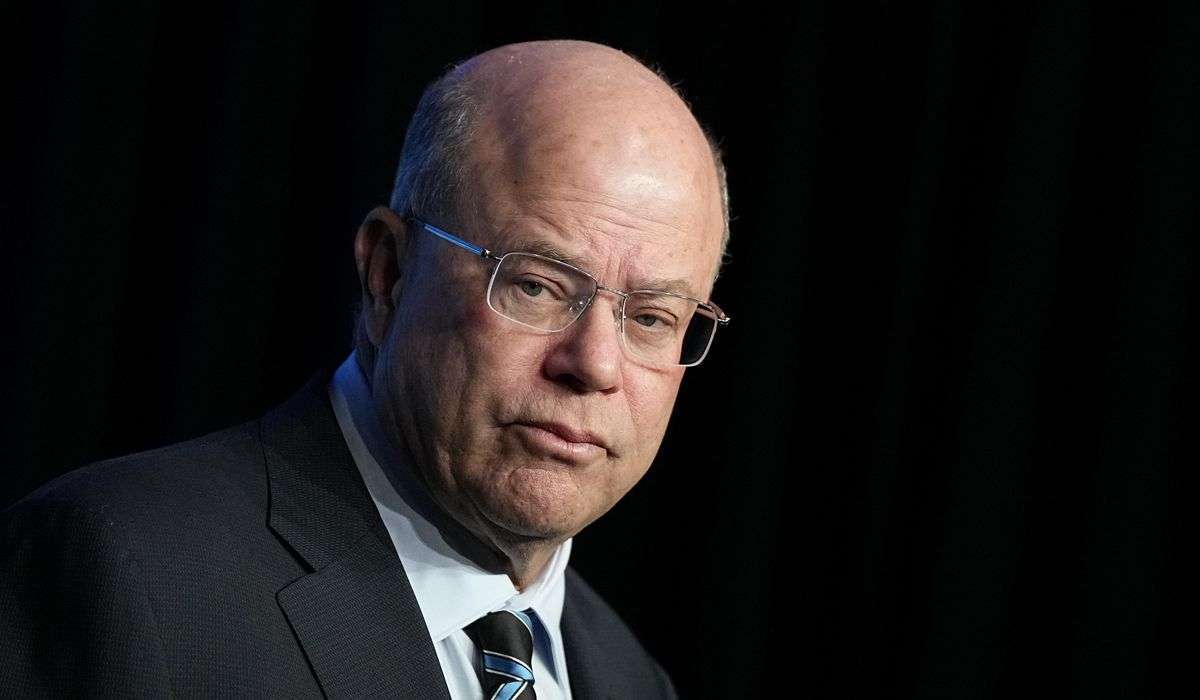

Still, Amazon wants the broadcasts to feel familiar. So it turned to veteran broadcasters Al Michaels and Kirk Herbstreit to call the games and Fred Gaudelli, the longtime producer of “Sunday Night Football” on NBC, to produce them. (Amazon has leased its own trucks and cameras for the broadcast but has partnered with NBC’s production crew to produce the telecasts.)

“We want to respect sports fans,” said Marie Donoghue, the vice president of global sports video at Amazon and a former ESPN executive. “It’s not meant to be gimmicky.”

“I say to people: ‘Do you have Netflix? It’s the same thing,’ ” Michaels said. “ ‘You find the app, you bring it up, and it should be right there. No problems.’ ”

The signings of the venerable (and seemingly ageless) Michaels and Herbstreit, ESPN’s well-known lead college football analyst, were part of a wild offseason of NFL-announcer musical chairs. With the names it did land but also those it didn’t, Amazon signaled its intention to be taken seriously as a sports broadcaster. The company approached Rams Coach Sean McVay, though he decided to stay with the Rams, and it spent six months courting Troy Aikman before he ended up at ESPN with longtime partner Joe Buck.

Sports, Amazon executives like to note, are effective in driving people toward Prime, which already has a package of exclusive Premier League games in the United Kingdom. The two largest Prime sign-up days in the United Kingdom coincided with televising soccer games, the company said.

Here in the United States, Amazon has a stake in the YES Network and carries a handful of New York Yankees games exclusively; with the NFL, Amazon has signaled a belief in the biggest brands in sports. But those types of packages are also hard to come by; ESPN and other traditional broadcasters have ponied up enormous amounts of cash to maintain most of the top sports rights.

Amazon had recent talks with Formula One, the Champions League and the Big Ten before those properties signed elsewhere, opting for the reach of traditional TV. (According to a person with knowledge of the F1 negotiations, Amazon was interested in a longer deal with F1, but the circuit chose a shorter extension with ESPN.) Amazon is also among the media companies that have talked to the NFL about its Sunday Ticket package for out-of-market NFL games.

While there are viewing trends in Amazon’s favor — in July, for the first time, more minutes were streamed than consumed on cable TV — far more sports viewers are reached on TV. During the preseason for the NFL, games on the broadcast networks, Fox, NBC and CBS, brought in around 5 million viewers. Amazon’s pre-season stream drew around 500,000 on Prime Video.

Asked what Amazon sports might look like in 10 years, Marine said, “If I told you, I’d have to kill you.”

He added: “Just kidding. What I can tell you is that I fully expect Prime sports to be a major, major top broadcaster in the world in major markets.”

Amazon certainly has size on its side compared with traditional media companies. Its market capitalization is $1.4 trillion; that of CBS and parent company Paramount is $16 billion. Entertainment behemoth Disney’s is $213 billion.

In one other first for the NFL season, Amazon partnered with Nielsen to provide advertisers with third-party data on viewership numbers, which will help better compare streaming with TV. Amazon promised its advertisers 12.5 million viewers, which was first noted by Adage, but that includes fans in local markets who will be able to watch games on broadcast TV. (Amazon also reached a distribution deal with DirecTV to show games at bars and restaurants.) Amazon believes it has a unique proposition for advertisers, including data about how many people see an ad and immediately turn to Amazon to search or buy the product.

Production-wise, Amazon’s first preseason game went smoothly. Afterward, Michaels regaled the broadcast team late into the night telling stories about, among others, O.J. Simpson.

In an interview, Michaels, 77, mused about the changes to the business he has seen over his career — cable and streaming but also the demand for live sports. The most famous call of his career, the 1980 U.S. Olympic hockey team’s upset of the Soviet Union, was seen mostly on tape delay. Even after TV executives lobbied to push the start time back, the game was played in the early evening and then broadcast in prime time a few hours later. “It was so bizarre because most people did not know the score,” Michael said. “They watched a game at 8 that was already played.”

He added, “From such a low level like that to this, I’ve seen the whole tapestry of the business play out.”