As part of their effort to hook tens of millions of Americans on gambling, sportsbooks have spent billions of dollars on splashy bait. They flooded last season’s NFL broadcasts with commercials. Caesars transformed a fleet of Ubers in Arizona to look like chariots. BetMGM claimed to have received the first bet placed from space — relayed from a SpaceX shuttle to a proxy in Las Vegas.

Sportsbooks are sweating their billion-dollar marketing bet

In the fight for sports bettors, astronomical spending — from those incessant broadcast ads to enticing sign-up deals — is part of a considered gamble, based on projections indicating that sportsbooks will clear several thousand dollars over the lifetime of their average customer. It’s a heady proposition, but not all shareholders and top executives have the stomach to endure years of losses. For some sportsbook operators, a new directive is emerging: The house needs to start coming out ahead.

It’s not that Americans haven’t been gambling; they have placed around $150 billion in regulated bets in the four-plus years since the Supreme Court ruled that states other than Nevada were free to establish their own sports gambling laws.

Yet among this booming industry’s publicly traded companies — which includes most of the major enterprises — only FanDuel has turned a quarterly profit. The company controls a leading 47 percent market share, per research firm Eilers & Krejcik, after spending $1 billion on advertising and promotions last year. DraftKings and BetMGM control another 35 percent between them. Many of the other nearly 60 operators are under pressure to become more cost-conscious. The top tier of sportsbooks is expected to keep spending lavishly on marketing, but this fall, would-be gamblers can expect to see skimpier promotions and fewer sportsbooks advertising on national TV.

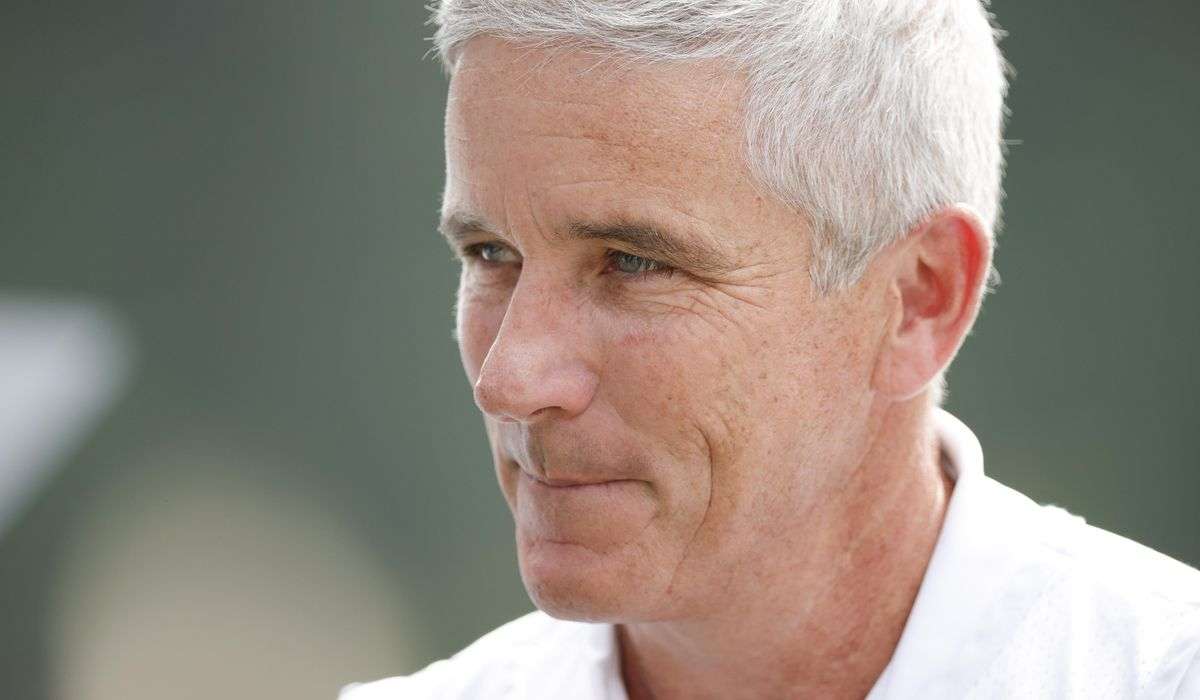

“You’ve seen the industry pull back and say, ‘Wow, fighting for market share got pretty ugly in terms of losses,’ ” said David VanEgmond, a former executive at FanDuel and Barstool Sportsbook who now leads the investing group Bettor Capital.

Caesars, once among the industry’s most hard-charging spenders, is leading a marketing retreat intended to curb steep losses. Less than a year after announcing a billion-dollar, two-year plan to promote its mobile app, Caesars has canceled more than a quarter-billion dollars in planned marketing.

The shift in focus from acquiring customers to making money is a natural evolution for emerging markets, says McKinsey analyst Dan Singer. Signing up for a sportsbook is somewhat cumbersome, and many American bettors only join two or three. “When a market opens up, you’ve got to get out there and start acquiring,” Singer said, “because being the first book that someone downloads gives you roughly twice as much action as being the second or the third.”

After that initial race for customers, advertising can become more targeted, though spending never stops. In Europe, where sports gambling has been legal for decades, operators consistently spend 15 to 20 percent of revenue on marketing, Singer said. Despite legalization in additional states and a growing customer base, national TV advertising for Week 1 of the NFL season was flat this year vs. 2021, when sports betting operators spent a combined $26 million on commercials, according to Nielsen.

U.S. sportsbooks are shifting their marketing focus from acquisition to retention, VanEgmond said, after watching Caesars have “a bunch of people come in, then losing them to other places and now having nothing really to show for it.”

Caesars wasn’t just blitzing the airwaves; the company was also driving the promotional market. Eye-popping promotions are an easy method of luring new bettors choosing among products that can seem more or less interchangeable — and last fall Caesars escalated the race, offering customers up to a $5,000 “risk-free” first bet.

When legal sports gambling went live in New York at the start of this year, Caesars ran an even more generous promotion: a deposit match up to $3,000, plus a $300 bonus. The company claimed to have quickly achieved 40 percent market share in what has become the highest-betting state (at least before Californians vote in November on whether to legalize sports gambling). But Caesars needed to rein in its promotion within weeks, and its market share in New York has fallen to about 21 percent, per Eilers & Krejcik.

Monetary inducements are one of the main lures that sportsbooks use to entice prospective customers. But lately, instead of offering so many lucrative “risk-free” bets, some sportsbooks have favored sure-thing promos that pay less, such as $100 in free bets as a reward for placing a $5 bet. “It’s basically bribing the customer,” said “Captain” Jack Andrews, a professional sports gambler who runs the advice website Unabated. “That drops the customer acquisition costs, and they can shake the customer upside down over the years and get out more than $100.”

Rather than simply competing to offer the most generous giveaways or blanketing the airwaves, sportsbooks are focusing on low-cost engagement. PointsBet offers new customers five consecutive days of $100 second-chance bets. “You have five straight opportunities to get to know the product,” said Rick Martira, the company’s executive vice president of marketing and strategy.

Entering football season, Raymond Doyle, BetMGM’s vice president of digital media and brand, said the company would use predictive modeling to help “get the right mix of customers and avoid recruiting the bonus hunters” — savvy players who take advantage of favorable promos to pocket risk-free money.

In addition to buying exposure through advertisements or promotions, sportsbook marketers increasingly are opting to simply pay media companies for sending them customers.

The Action Network helped popularize this model in the United States. Although the media company bills itself as providing gambling advice that helps bettors win money, the company also earns referral fees from sportsbooks. In 2018, then-CEO Noah Szubski told Slate that the company’s goal was to earn referral fees, plus a cut of customers’ lifetime gaming losses. “It’s like happy f—ing birthday,” Szubski said. “That’s the billion-dollar business.” In May 2021, Danish betting company Better Collective acquired the Action Network for $240 million.

Ahead of this football season, the Action Network signed deals to provide online betting content for media companies such as the Philadelphia Inquirer, the New York Post and the Boston Herald. Newspaper conglomerate Gannett has its own referral deal with a sportsbook.

To see the results in action, Jonathan Lerner, an industry veteran who now works at EV Analytics, suggested searching “Javonte Williams rushing yards prop,” referring to a starting running back in the opening “Monday Night Football” matchup.

On the first page of search results, seven of the eight websites linked to betting offers.

Still, for the average sports fan, that’s a less aggressive form of promotion — even if it does mean sports betting marketing has spread beyond television to search engines, news reports, podcasts and radio shows. The books are still trying to reel in new customers; only the nature of the bait has changed.

Last year, Caesars’ omnipresent national TV ads — featuring actors J.B. Smoove and Halle Berry along with Archie Manning and sons Peyton, Eli and Cooper — helped the sportsbook increase its brand awareness from 1 percent to the 20s, according to Spence Kramer, CEO of Ten6, which produced the campaign. This NFL season, Caesars ads will appear only on ESPN and NFL Network.

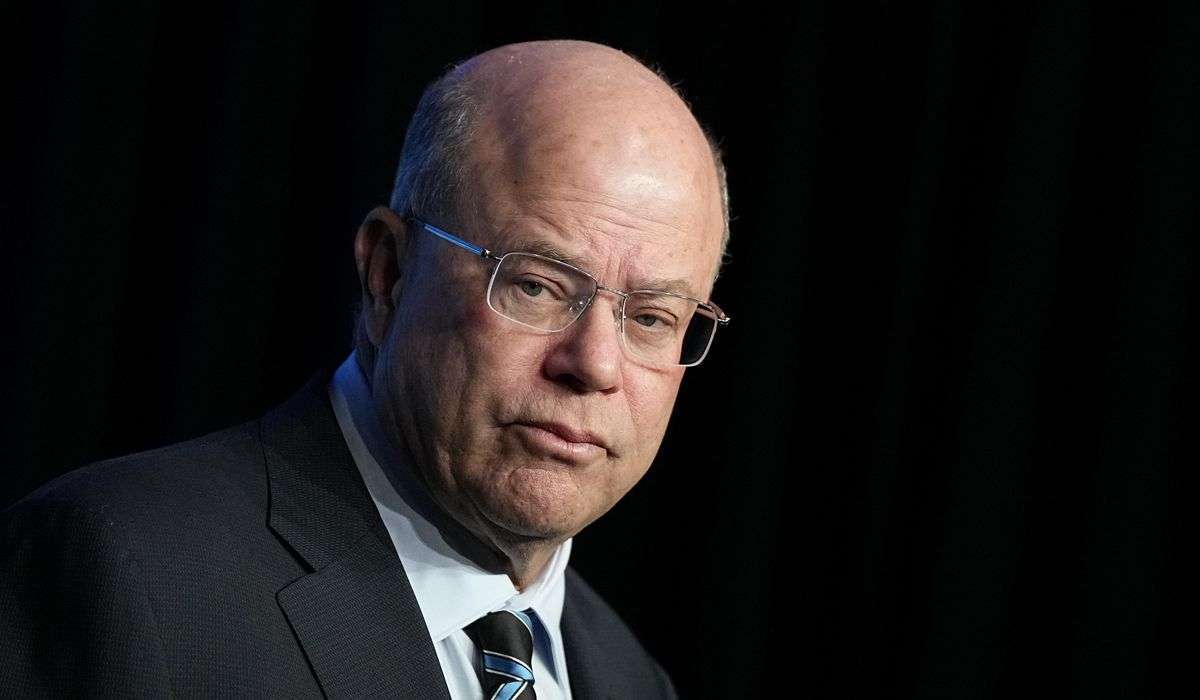

“We’ve proved we could carve out a significant piece of the business,” Caesars CEO Tom Reeg told investors last month, calling the strategic shift a “dramatic pivot.” “Now we want to prove we can make a profit.”