Wealthy retirees got a tax break from the coronavirus relief bill

Let’s hope the legislation that emerges this time around is more careful with our tax money and makes sure that help is going to people who need it. And not to people who don’t.

Let me explain the Cares Act giveaway, which involves the rules that govern “defined contribution” retirement accounts.

If you’re 72 or older and have a 401(k), 403(b) or any other kind of defined contribution account, you have to take “required minimum distributions” from your accounts each year. These distributions, determined by your age and your accounts’ year-end balances, are federally taxable and are taxable in some states as well. (People who inherit accounts are required to take RMDs, regardless of their age.)

The Cares Act eliminated the distribution requirements for this year. That’s a nice break for older people like me — I’m 75 — who are fortunate enough to not need distributions from their retirement accounts to pay their bills.

This tax break became part of the Cares Act because Congress didn’t want to penalize people of retirement age by forcing them to sell stock during a market crash. Such a crash seemed to be well underway in late March, when the Cares Act was being discussed.

For instance, if someone age 75, who has a 4.37 percent required distribution for this year, had all her money in an Standard & Poor’s 500 index fund, she would have had to withdraw 8.74 percent of her fund’s balance to meet that requirement if the market were down 50 percent.

Someone age 80, with a 5.35 percent required distribution, would have had to withdraw 10.7 percent.

Considering that the S&P was down 30.8 percent on March 23 and was seemingly headed lower, fear of a 50 percent drop was rational.

But rather than doing something intelligent and reasonably fair — such as allowing people to take, say, $15,000 less than their normal required minimum distributions — Congress and President Trump agreed to eliminate RMDs entirely this year.

Obviously, that was worth a lot more to people with big account balances and significant RMDs than to people with smaller balances and smaller RMDs. And it was worth nothing to people who need to take their full minimum distributions to pay their bills.

And guess what? When last I looked, the S&P 500, thanks in part to the Cares Act, was almost 45 percent above its March low — and was actually up slightly for the year.

So if your retirement account consists of S&P 500 index funds, getting to skip your required distributions this year is a terrific deal. Not only do you avoid having to pay federal (and possibly state and local) income tax on your distributions, but if current prices hold, you’ll also end up with growth in the RMD money that you got to leave in your account.

Sweet for financially fortunate older people. Pretty sour for everyone else.

Follow-up: I’ve been criticized for not saying in my recent column that President Trump’s yet-to-be-released proposal to lower payroll taxes would undermine Social Security’s already-rickety finances.

The reason I didn’t say that is that we don’t know any details about what Trump wanted to propose. If it was like the payroll tax cuts that were enacted in 2011 and 2012 during President Barack Obama’s administration, or that were in effect for parts of the 1980s, Treasury will reimburse the Social Security and Medicare trust funds for the lost payroll tax money.

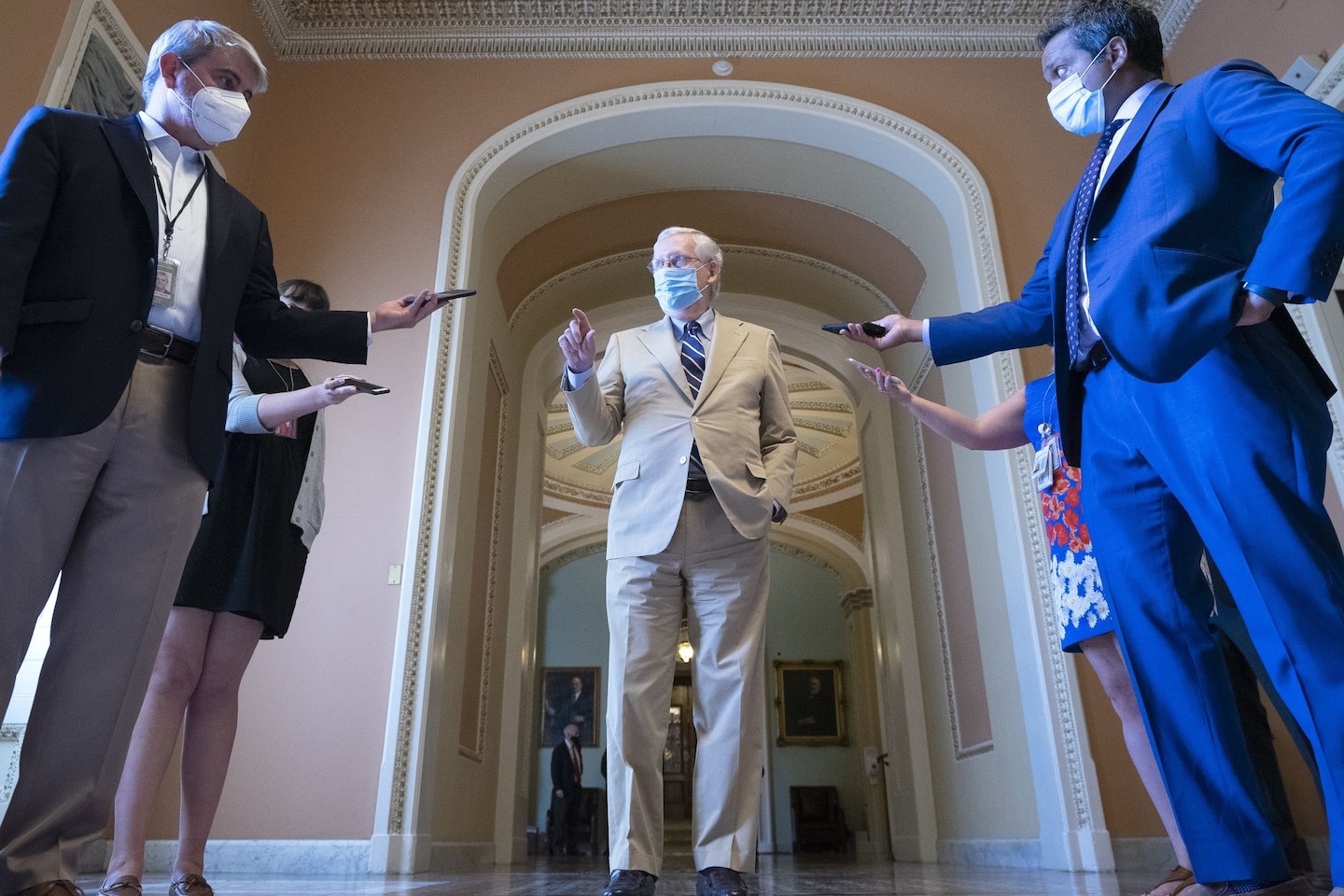

It seems to be a moot question for now, given that Republican senators aren’t proposing a payroll tax cut as part of the stimulus package. But should Trump propose such a cut in the future, which I think is likely, rest assured I will be checking to see if his proposal would hurt the Social Security and Medicare trust funds.