Wealth gaps between Black and White families persisted even at the height of the economic expansion

Last year, the median wealth for Black families was less than 15 percent that of White families, according to the 2019 Survey of Consumer Finances, released by the Federal Reserve on Monday. White families had median family wealth of $188,200, compared to that of Black families, which was $24,100.

The extensive survey is a detailed look at 2019 American household finances right before the recession began and millions of jobs were wiped away, offering yet another snapshot of an economy that worked best for White Americans and those at the top.

Those disparities laid the foundation for a recession that has been painfully unequal, with the worst of the crisis over for the wealthiest Americans while others scramble to make rent or pay for groceries. Last year, for example, the typical White family had $50,600 in equities they could tap into in an emergency, compared to just $14,400 for the typical Black family and $14,900 for the typical Hispanic family.

“These gaps in emergency savings are particularly relevant in light of the covid-19 pandemic and associated job losses. Because the 2019 [Survey of Consumer Finances] data were collected just before the onset of the pandemic, these gaps in savings suggest large disparities in families’ ability to weather the pandemic,” according to a Federal Reserve staff research note attached to the survey.

At the same time, families near the bottom of the income and wealth spectra saw substantial gains in their median and mean net worth between 2016 and 2019. As the unemployment rate ticked down to 3.5 percent by the end of 2019, the benefits of a tight labor market were finally reaching communities still climbing back from the Great Recession. (The last time the Fed conducted this extensive survey was 2016.)

The current recession has put sharp focus on how the Fed can narrow persistent racial and economic gaps and rebuild an economy that doesn’t leave marginalized communities behind. But it’s unclear how exactly the Fed can use its broad-based tools — be it setting interest rates or hitting an inflation target — to mitigate the country’s racial inequality.

Low interest rates, for example, can reduce unemployment and often boost the stock market and asset prices. But those benefits can disproportionately accrue to White Americans who are more likely to hold investments.

Last year, about 53 percent of families owned stocks, a slight uptick from 2016, the survey showed. But only about 31 percent of families in the bottom half of the income distribution held stocks last year. For comparison, about 70 percent of families in the upper-middle-income group held stock, and more than 90 percent of families in the top decile held stock.

White families are also almost three times as likely as Black families, and more than four times as likely as Hispanic families, to have received an inheritance, strengthening the transfer of wealth from generation to generation.

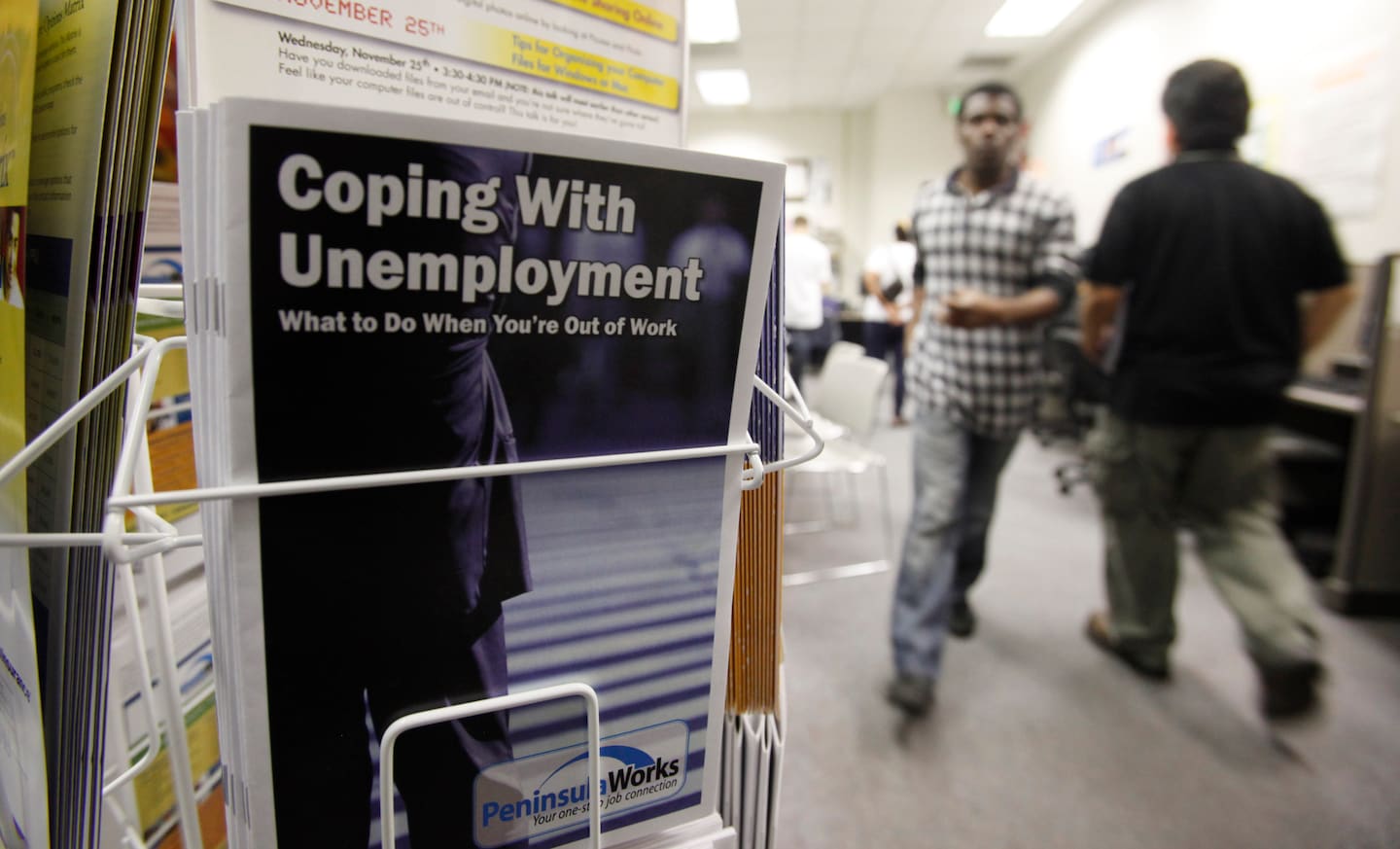

Federal Reserve Chair Jerome H. Powell and his colleagues often note that job losses since February have disproportionately affected low-income workers, women and workers of color, many of whom work in service-sector jobs that have been slow to return in the middle of the public health crisis. And even as the recovery moves at a quicker pace than some expected, economic gaps persist in the labor force. Last month, the overall unemployment rate fell to 8.4 percent — but the rate for Black Americans was 13 percent, and 10.5 percent for Hispanics.

Throughout a listening tour last year, Fed leaders were repeatedly told that the economic gains of the most recent expansion were lifting low-income communities. Then, the message to Fed leaders was, “Keep this going. This is the best labor market we’ve seen,” Powell said at a June news conference.

“We had every expectation, every reason to expect that this would continue, and then [the pandemic] comes,” Powell said this summer. “So it’s — it’s heartbreaking, and, you know, we want to get it back.”