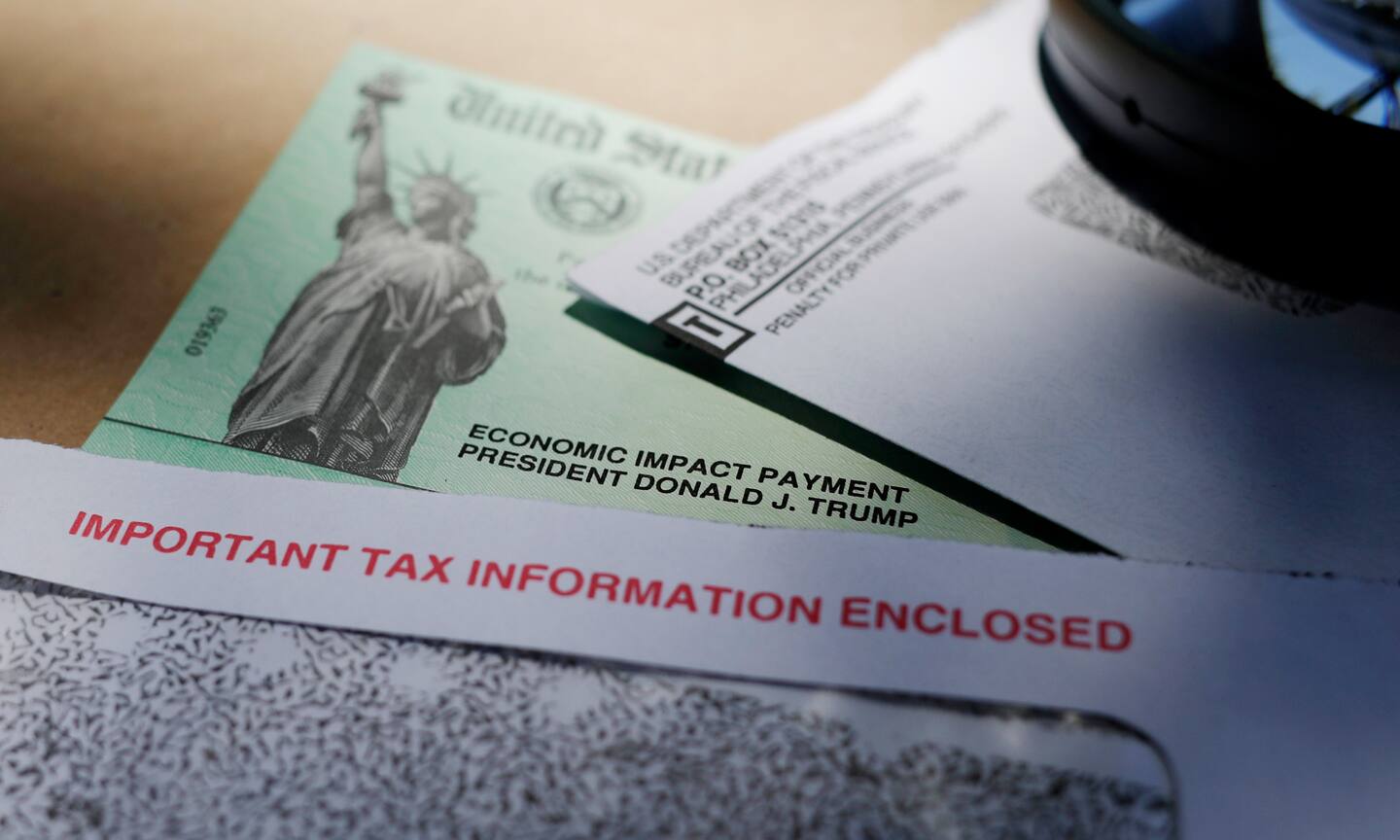

Federal judge rules against Treasury and IRS again: The incarcerated are entitled to stimulus checks

The Coronavirus Aid, Relief, and Economic Security (Cares) Act provides economic impact payments or stimulus payments of up to $1,200 for individuals and $2,400 for taxpayers filing a joint tax return. There was nothing in the law prohibiting prisoners from receiving stimulus payments.

A class-action lawsuit was filed on behalf of incarcerated individuals in local, state and federal facilities arguing that the IRS actions were unlawful. Judge Phyllis Hamilton of the U.S. District Court for the Northern District of California agreed, saying the decision to withhold the stimulus payments was “arbitrary and capricious.” Hamilton ordered the Treasury Department and the IRS to send the relief money and to do so within certain deadlines.

Still not chastened, the Trump administration appealed. Last week, Hamilton again smacked away efforts by the government to stop the distribution of the payments, entering a final summary judgment. And the judge is making the IRS give incarcerated individuals additional time to claim their stimulus money, moving an initial Oct. 30 deadline to Nov. 4.

The judge also ordered that the IRS send out a notice that correctional facilities officials should give to incarcerated individuals about the court’s decision. The agency would also need to mail blank 1040 forms for inmates and instructions on how to fill out the paper return to ensure that every eligible person in each facility has a packet in time to file a claim, said Kelly Dermody, a partner with San Francisco-based Lieff Cabraser Heimann & Bernstein, one of the law firms representing the plaintiffs and class-action members.

The plaintiffs are also represented by the nonprofit Equal Justice Society, which advocates against inequities in the criminal justice system.

“Hopefully this is the last of it,” Dermody said. “They have already wasted a lot of taxpayer money chasing after checks that were previously properly issued, misleading correctional authorities about eligibility, and filing brief after brief in court trying to stop our fellow Americans from getting stimulus money.”

Incarcerated individuals who filed a 2018 or 2019 tax return, received Social Security benefits or Railroad Retirement benefits in 2019, or previously registered with the IRS through the non-filers portal should get an automatic payment in the mail or by direct deposit.

Because incarcerated individuals are generally not allowed access to a computer, they will have to fill out and postmark a simplified Form 1040 federal return by Nov. 4.

For those capable of going online, there’s more time to claim a stimulus payment. The deadline to use the agency’s online non-filers tool at irs.gov is Nov. 21.

The economic impact payment is an advance credit for 2020. Under the Cares Act, payments must be made by Dec. 31. If people don’t receive a payment by then, they won’t receive their stimulus funds until they file a 2020 federal return next year.

By Nov. 9, the government has to confirm the number and amount of stimulus payments distributed as a result of the court order.

“The covid relief funds will mean that incarcerated people, who are among those in our society most endangered and harmed by covid, can purchase hygiene products and can pay for the services needed to communicate with their families at a time when fulfilling these most basic of human needs is most critical,” Mona Tawatao, legal director for the Equal Justice Society, said in a statement following the latest court ruling.

If you have questions about the recent order, the most helpful information can be found in an FAQ at caresactprisoncase.org. Particularly useful is a link to a sample Form 1040 with highlighted instructions on how to fill out a 2019 return, including writing “EIP 2020” on the top of the form and where, if the person is still in a correctional facility, to add the personal corrections number to make sure the stimulus check is sent to the right location and person.

If you still have questions — and you should read the entire FAQ — there’s a contact form to get additional assistance from attorneys working on the class-action case.

Reader Question of the Week

If you have a personal finance or retirement question, send it to colorofmoney@washpost.com. In the subject line, put “Question of the Week.”

This week’s question is about the class-action lawsuit against Treasury and the IRS.

Q: I used the IRS non-filers tool in August and was told I was not eligible for a stimulus payment because I was incarcerated during 2020. I was released in July. What is the next step I should take?

A: As a result of the class-action lawsuit, the IRS is required to reconsider any claim for a stimulus payment that was previously denied. The court order directs the IRS to automatically reprocess stimulus claims by Oct. 24. If you’ve already used the non-filers tool, you should automatically get a stimulus payment.

If you are in the group whose payment is being reprocessed, that doesn’t mean the check will arrive by Oct. 24; it may be delivered many weeks later, Dermody said. Keep in mind, the IRS is still experiencing delays in processing stimulus payments and tax refunds because of the pandemic.

Retirement Rants and Raves

I’m interested in your experiences or concerns about retirement or aging. You can rant or rave. Send your comments to colorofmoney@washpost.com. Please include your name, city and state. In the subject line, put “Retirement Rants and Raves.”

I’m still receiving a lot of distress emails from seniors about Social Security scams.

“A social security scam has tried twice this week to scare my husband,” one reader wrote. “The caller threatens jail time if he does not comply. He thought it was real until I told him it was a scam, but they are so convincing.”

Another reader wrote: “I received an automated call saying that there was an issue with my Social Security number and there were serious violations. I, of course, knew it was a scam but called anyway. When I asked what the issue is, the woman asked what my recording said. I told her something to do with my Social Security number. She hung up on me. I called back again and this time got a man. I told him I received a call and that it was shameful that they are trying to scam people. He, of course, hung up on me.”

I know it’s tempting to give scammers a verbal tongue-lashing, but it’s better you don’t. Here are some columns on this scam that just won’t go away.