Bonuses before bankruptcy: Companies doled out millions to executives before filing for Chapter 11

Five days before seeking Chapter 11 protection, J.C. Penney awarded $7.5 million in bonuses to its top four executives. The retailer, which hasn’t turned a profit since 2010, entered bankruptcy with more than $8 billion in debt. (Charles Krupa/AP)

The coronavirus recession tipped dozens of troubled companies into bankruptcy, setting off a rush of store closures, furloughs and layoffs. But several major brands, including Hertz Global, J.C. Penney and Neiman Marcus, doled out millions in executive bonuses just before filing for Chapter 11 protection, according to a Washington Post analysis of regulatory filings and court documents.

Since the pandemic took hold in March, at least 18 large companies have rewarded executives with six- and seven-figure payouts before asking bankruptcy courts to shield them from landlords, suppliers and other creditors while they restructured, the Post review found. They collectively meted out more than $135 million, documents show, while listing $79 billion in debts.

Labor experts and bankruptcy attorneys say the payouts are particularly egregious — and unjustifiable — during an economic crisis, and were timed to bypass a 2005 law passed specifically to prevent executives from prospering while their companies flailed.

“These are bonuses that unfairly enrich the very same corporate managers that led the company into bankruptcy,” said Brandon Rees, a deputy director at the AFL-CIO, the nation’s largest coalition of labor unions. “That unfairness is compounded by the fact that we’ve just experienced the worst unemployment rate since the Great Depression.”

[A running list of retailers that have filed for Chapter 11]

The retention bonuses, which range from $600,000 at the parent company of retailer New York & Co. to the $25 million awarded to executives at Chesapeake Energy, illustrate how the pandemic recession is exacerbating economic inequality in the starkest terms: Those same companies laid off tens of thousands of workers, the majority earning less than $29,000 a year.

Utobia Hornbuckle, 49, lost her job at Chuck E. Cheese’s corporate office near Dallas just as the nation was preparing to shut down. The part-time position booking birthday parties had been just enough to lift her out of homelessness, she said, allowing her to afford a motel room. She’d hoped it would eventually help her into a one-bedroom apartment that she could share with her daughter and three grandchildren.

But on March 17, she was furloughed from her $12.50-an-hour job. Six months later, she was among dozens of corporate employees laid off from the family-friendly restaurant chain.

During that time, Chuck E. Cheese’s parent company filed for bankruptcy, citing $2 billion in debt. But first it awarded nearly $3 million in bonuses to top executives, including $1.3 million to chief executive David McKillips, who had been with the company less than five months.

[Bankrupt retailers face a new hurdle: Getting rid of inventory]

“Of course it makes me mad,” Hornbuckle said. “But that’s kind of the way of the world now: Big corporations do what they want to, and the rest of us — the peons, the small people — fall off our feet.”

CEC Entertainment, which owns Chuck E. Cheese and Peter Piper Pizza, did not respond to multiple requests for comment. But in a regulatory filing, it said the bonuses were designed to retain employees “while providing them with financial stability.”

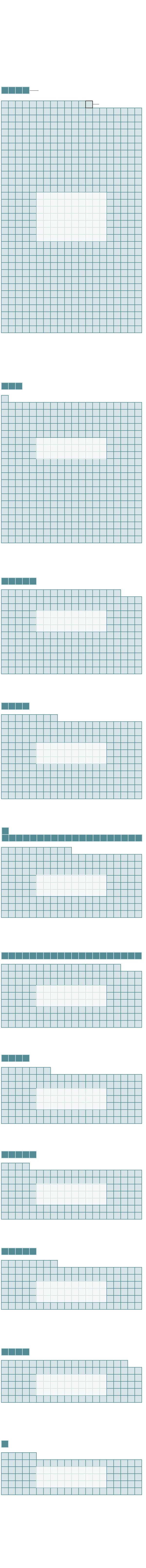

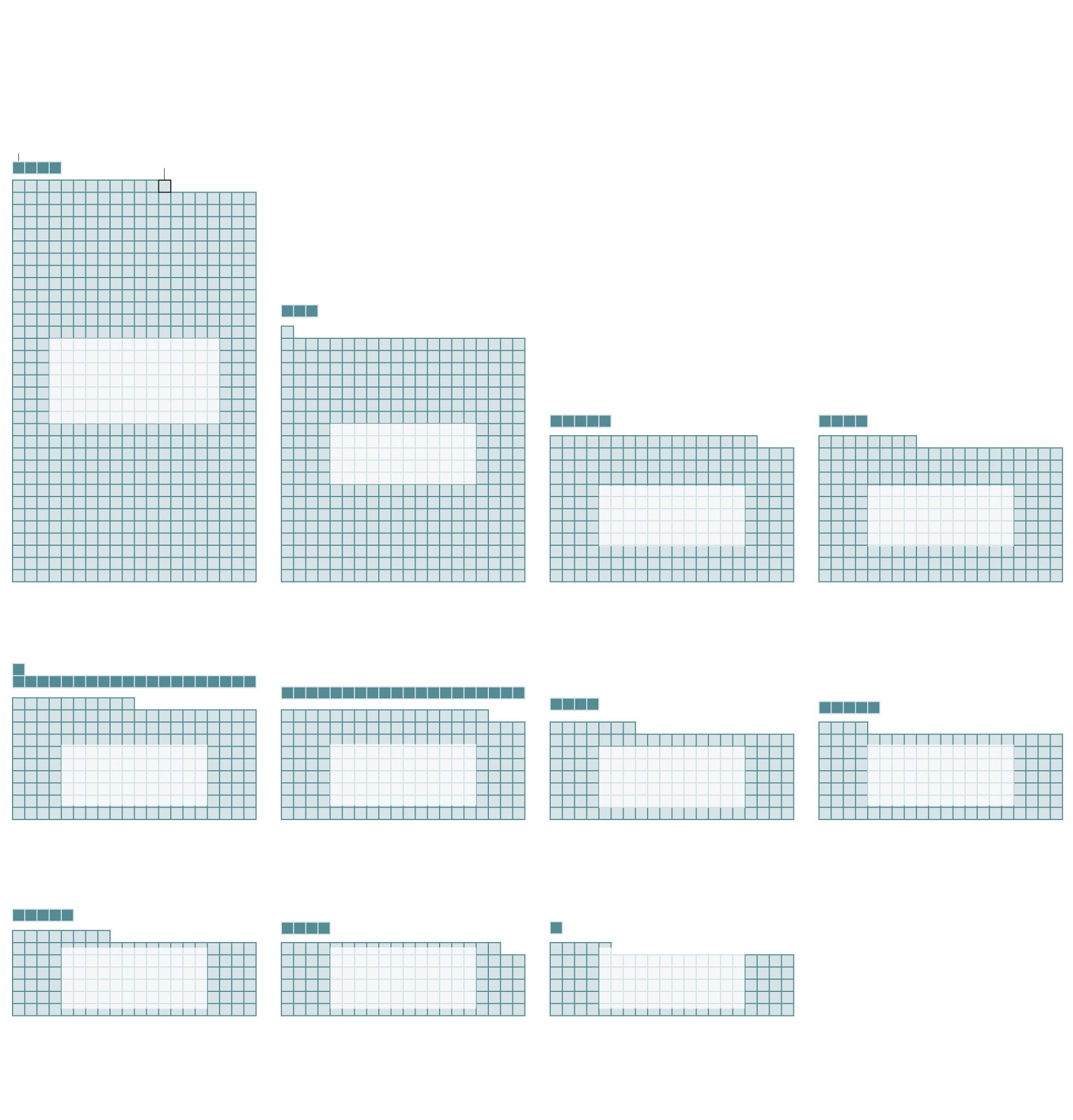

Several large companies paid millions in executive bonuses before filing for bankruptcy this year; here’s how those sums compare with median salaries

J.C. Penney

$7.5M bonus to 4 executives

One worker

earning

the company’s

median salary

Executives who

split the bonus

Bonuses equivalent to the salaries of

653 employees

Ascena Retail Group

Brands include: Ann Taylor, Loft,

Lane Bryant, Justice

$2.7M bonus to 3 executives

Salaries of

401 employees

$3.9M bonus to 5 executives

Salaries of

237 employees

$3.1M bonus to at least 4 executives

Salaries of

228 employees

Chesapeake Energy

$25M bonus to 21 executives

Salaries of

190 employees

Neiman Marcus

$4.5M bonus to more than 20 executives

Salaries of

177 employees

$7.7M bonus to 4 top executives

Salaries of

147 employees

Tuesday Morning

$1.5M bonus to 5 executives

Salaries of

144 employees

Up to $17.3M bonus to 5 executives

Salaries of

128 employees

Tailored Brands

Men’s Warehouse, Jos A Bank, K&>

$3.3M bonus to 4 executives

Salaries of

118 employees

RTW Retailwinds

New York & Co.

$600K bonus to 1 executive

Salaries of

105 employees

Sources: Neiman Marcus estimate based

on median retail industry salary data from

the U.S. Bureau of Labor Statistics. For all

other companies, median employee salary

data as reported in annual filings with the

U.S. Securities and Exchange Commission.

Several large companies paid millions in executive bonuses before filing for bankruptcy this year; here’s how those sums compare with median salaries

J.C. Penney

$7.5M bonus to 4 executives

One worker

earning

the company’s

median salary

Executives who

split the bonus

Bonuses equivalent to the salaries of

653 employees

Ascena Retail Group

Brands include: Ann Taylor, Loft,

Lane Bryant, Justice

$2.7M bonus to 3 executives

Salaries of

401 employees

$3.9M bonus to 5 executives

Salaries of

237 employees

$3.1M bonus to at least 4 executives

Salaries of

228 employees

Chesapeake Energy

$25M bonus to 21 executives

Salaries of

190 employees

Neiman Marcus

$4.5M bonus to more than 20 executives

Salaries of

177 employees

$7.7M bonus to 4 top executives

Salaries of

147 employees

Tuesday Morning

$1.5M bonus to 5 executives

Salaries of

144 employees

Up to $17.3M bonus to 5 executives

Salaries of

128 employees

Tailored Brands

Men’s Warehouse, Jos A Bank, K&>

$3.3M bonus to 4 executives

Salaries of

118 employees

RTW Retailwinds

New York & Co.

$600K bonus to 1 executive

Salaries of

105 employees

Sources: Neiman Marcus estimate based on median

retail industry salary data from the U.S. Bureau of Labor

Statistics. For all other companies, median employee

salary data as reported in annual filings with the U.S.

Securities and Exchange Commission.

Several large companies paid millions in executive bonuses before filing for bankruptcy this year; here’s how those sums compare with median salaries

J.C. Penney

$7.5M bonus to 4 executives

Executives who

split the bonus

One worker earning the

company’s median salary

Ascena Retail Group

Brands include: Ann Taylor, Loft,

Lane Bryant, Justice

$2.7M bonus to 3 executives

Bonuses equivalent to the salaries of

653 employees

Salaries of

401 employees

$3.9M bonus to 5 executives

$3.1M bonus to at least 4 executives

Salaries of

237 employees

Salaries of

228 employees

Chesapeake Energy

$25M bonus to 21 executives

Neiman Marcus

$4.5M bonus to more than 20 executives

Salaries of

190 employees

Salaries of

177 employees

Tuesday Morning

$7.7M bonus to 4 top executives

$1.5M bonus to 5 executives

Salaries of

147 employees

Salaries of

144 employees

Tailored Brands

Men’s Warehouse, Jos A Bank, K&>

Up to $17.3M bonus to 5 executives

$3.3M bonus to 4 executives

Salaries of

128 employees

Salaries of

118 employees

RTW Retailwinds

New York & Co.

$600K bonus to 1 executive

Salaries of

105 employees

Sources: Neiman Marcus estimate based on median retail industry salary data from the U.S.

Bureau of Labor Statistics. For all other companies, median employee salary data as reported

in annual filings with the U.S. Securities and Exchange Commission.

Several large companies paid millions in executive bonuses before filing for bankruptcy this year; here’s how those sums compare with median salaries

J.C. Penney

$7.5M bonus to 4 executives

Executives who

split the bonus

One worker earning

the company’s

median salary

Ascena Retail Group

Brands include: Ann Taylor,

Loft, Lane Bryant, Justice

$2.7M bonus to 3 executives

Bonuses equivalent to the salaries of

653 employees

$3.9M bonus to 5 executives

Salaries of

401 employees

Salaries of

237 employees

Chesapeake Energy

$3.1M bonus to at least 4 executives

Neiman Marcus

$25M bonus to 21 executives

$4.5M bonus to more than 20 executives

Salaries of

177 employees

Salaries of

190 employees

Salaries of

228 employees

Tuesday Morning

$1.5M bonus to 5 executives

$7.7M bonus to 4 top executives

Up to $17.3M bonus to 5 executives

Salaries of

144 employees

Salaries of

128 employees

Salaries of

147 employees

Tailored Brands

RTW Retailwinds

Men’s Warehouse, Jos A Bank, K&>

New York & Co.

$600K bonus to 1 executive

$3.3M bonus to 4 executives

Salaries of

105 employees

Salaries of

118 employees

Sources: Neiman Marcus estimate based on median retail industry salary data from the U.S. Bureau

of Labor Statistics. For all other companies, median employee salary data as reported in annual

filings with the U.S. Securities and Exchange Commission.

Several large companies paid millions in executive bonuses before filing for bankruptcy this year; here’s how those sums compare with median salaries

J.C. Penney

$7.5M to 4 executives

Executives who

split the bonus

One worker earning

the company’s

median salary

Ascena Retail Group

BRANDS INCLUDE: Ann Taylor, Loft,

Lane Bryant, Justice

$2.7M bonus to 3 executives

Bonuses equivalent to the salaries of 653 employees

$3.9M bonus to 5 executives

$3.1M bonus to at least 4 executives

Salaries of

401 employees

Salaries of

237 employees

Salaries of

228 employees

Chesapeake Energy

Neiman Marcus

$25M bonus to 21 executives

Tuesday Morning

$4.5M bonus to more than 20 executives

$7.7M bonus to 4 top executives

$1.5M bonus to 5 executives

Salaries of

144 employees

Salaries of

177 employees

Salaries of

190 employees

Salaries of

147 employees

Tailored Brands

RTW Retailwinds

Men’s Warehouse, Jos A Bank, K&>

New York & Co.

Up to $17.3M bonus to 5 executives

$600K bonus to 1 executive

$3.3M bonus to 4 executives

Salaries of

128 employees

Salaries of

105 employees

Salaries of

118 employees

Sources: Neiman Marcus estimate based on median retail industry salary data from the U.S. Bureau of Labor Statistics. For all other

companies, median employee salary data as reported in annual filings with the U.S. Securities and Exchange Commission.

Many companies have homed in on retention to justify bonuses because they cannot be attached to traditional motivators such as sales targets or stock valuations during bankruptcy. Experts said retaining executives — even those who may have overseen a company’s decline — is often seen as a way to maintain consistency and raise the chances that the company will successfully emerge from bankruptcy.

“Somebody has to run the company, and the thinking is that it’s better to have someone who knows the organization,” said Dayna Harris, a partner at executive compensation consulting firm Farient Advisors. “If the company is able to go through reorganization, then investors still get something at the end and some employees still have a job left. If you go to liquidation, then everybody’s done.”

[Where Joe Biden stands of bankruptcy protections]

Denver-based Extraction Oil & Gas awarded $6.7 million in retention bonuses a week before its June bankruptcy filing because its “historic compensation structure and performance metrics were ineffective in motivating and incentivizing the company’s workforce in our current environment,” spokesman Brian Cain said. The company has laid off more than 120 employees, or roughly 40 percent of its workforce, this year, according to reports.

Of the 17 other companies contacted by The Post besides Extraction Oil & Gas, 11 did not respond to requests for comment. Ascena Retail Group, Chesapeake Energy, Hertz, Intelsat, Neiman Marcus and Tuesday Morning declined to comment.

[The iconic brands that could disappear because of coronavirus]

The issue of executive compensation has been contentious for years, emblematic of America’s widening income gap. In 2019, the CEOs of the nation’s largest companies made more than 320 times the salary of their average employee, data shows. Thirty years earlier, the ratio was 61 to 1.

The rise of pre-bankruptcy bonuses corresponds with the passage of 2005 legislation meant to stamp out such payouts during reorganization, attorneys say. The Post’s review found that companies typically awarded bonuses within weeks — or days in several cases — of filing for Chapter 11 protection.

“It’s become a standard solution: Pay the bonus before bankruptcy, so bankruptcy law doesn’t apply,” said Adam Levitin, a Georgetown University law professor whose work focuses on bankruptcy and financial regulation.

While companies use bonuses to keep top executives from leaving during critical and uncertain times, “that doesn’t really apply in this economic climate,” he said.

“Where are these executives going to go? It’s not like there’s much of a market for high-priced CEOs right now.”

Nell Minow, an expert in corporate governance and vice chair of ValueEdge Advisors, believes such bonuses should be tied to specific metrics, such as resolving bankruptcy issues by a particular date or taking other steps to ensure the company’s long-term viability. If restructuring efforts fail, some companies will end up having to liquidate and shut down altogether.

“What we call this is ‘pay for pulse,’ ” she said. “There is absolutely no obligation other than being alive to earn these bonuses. They’re payments for sticking around — and there is no worse timing for that than in the middle of an economic and medical crisis.”

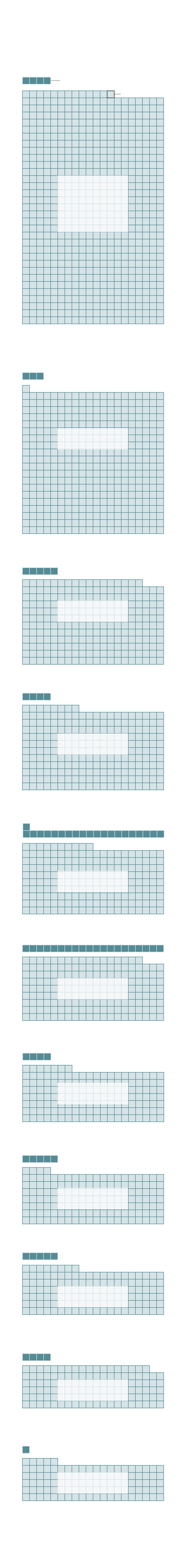

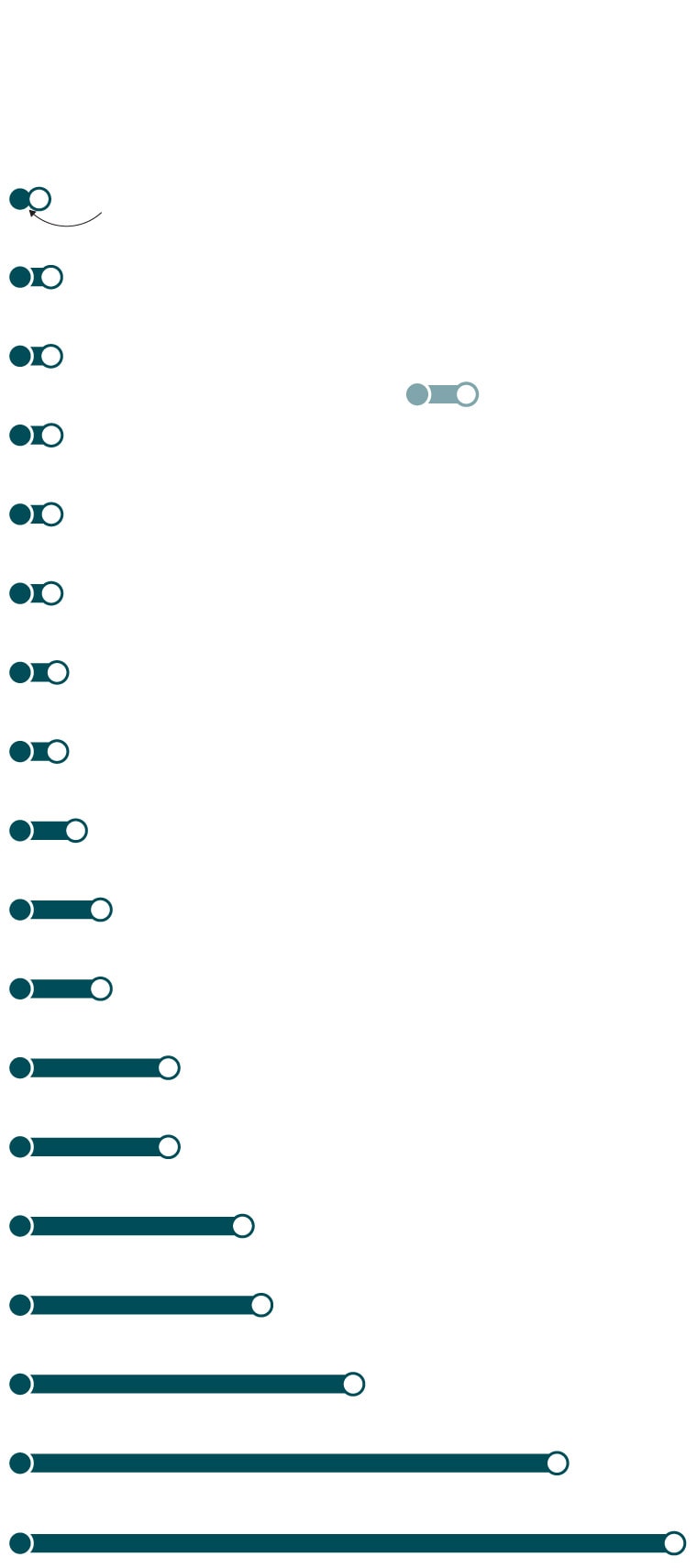

During the pandemic, companies

typically issued executive bonuses just days before declaring bankruptcy

Hertz Global

Gave bonus 3 days before declaring bankruptcy

J.C. Penney

Declares

bankruptcy

Bonus

given

Tuesday Morning

Diamond Offshore Drilling

Whiting Petroleum Corp

Extraction Oil & Gas

Tailored Brands

Neiman Marcus

CEC Entertainment

Ascena Retail Group

Briggs & Stratton

Chesapeake Energy

RTW Retailwinds

During the pandemic, companies typically issued executive bonuses just days before declaring bankruptcy

Hertz Global

Gave bonus 3 days before declaring bankruptcy

J.C. Penney

Declares

bankruptcy

Bonus

given

Tuesday Morning

Diamond Offshore Drilling

Whiting Petroleum Corp

Extraction Oil & Gas

Tailored Brands

Neiman Marcus

CEC Entertainment

Ascena Retail Group

Briggs & Stratton

Chesapeake Energy

RTW Retailwinds

During the pandemic, companies typically issued executive bonuses just days before declaring bankruptcy

Gave bonus 106 days before

declaring bankruptcy

Whiting Petroleum

Neiman Marcus

RTW Retailwinds

Diamond Offshore Drilling

Chesapeake Energy

J.C. Penney

Hertz Global

Tuesday Morning

CEC Entertainment

Declares

bankruptcy

Bonus

given

Extraction Oil & Gas

Briggs & Stratton

Ascena Retail Group

Tailored Brands

Five days before its Chapter 11 filing in May, J.C. Penney awarded $7.5 million to its four top executives, including CEO Jill Soltau. The department store chain, which hasn’t turned an annual profit in nearly a decade, entered bankruptcy with more than $8 billion in debt. It’s now working to close roughly 150 stores and eliminate thousands of jobs.

[What is Chapter 11 bankruptcy?]

Neither J.C. Penney nor representatives for Soltau responded to requests for comment.

Danyelle Ryone was furloughed from a J.C. Penney store in Poughkeepsie, N.Y., in March. A few weeks later, she learned through a Facebook post that her store was closing for good, which meant her job at the jewelry counter was gone, too.

Managers, she said, asked her to help liquidate the store but only for four hours a week. Instead, the 23-year-old filed for unemployment benefits and began looking for other work.

“It really shows how corporate businesses feel about their employees,” said Ryone, who now works at a bank. “They [are] literally profiting off of us losing our jobs.”

She has been through this before: Her last employer, Toys R Us, filed for bankruptcy in 2017 and shuttered all 735 stores — but not before awarding executives $8 million in bonuses. The company did not respond to a request for comment.

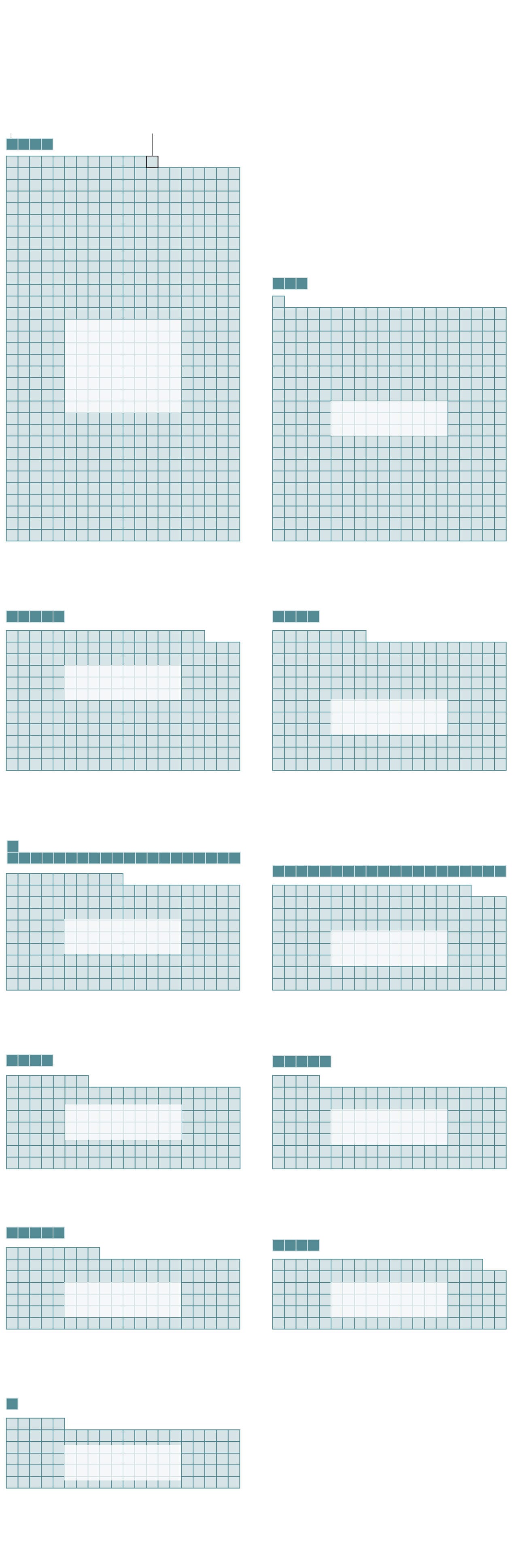

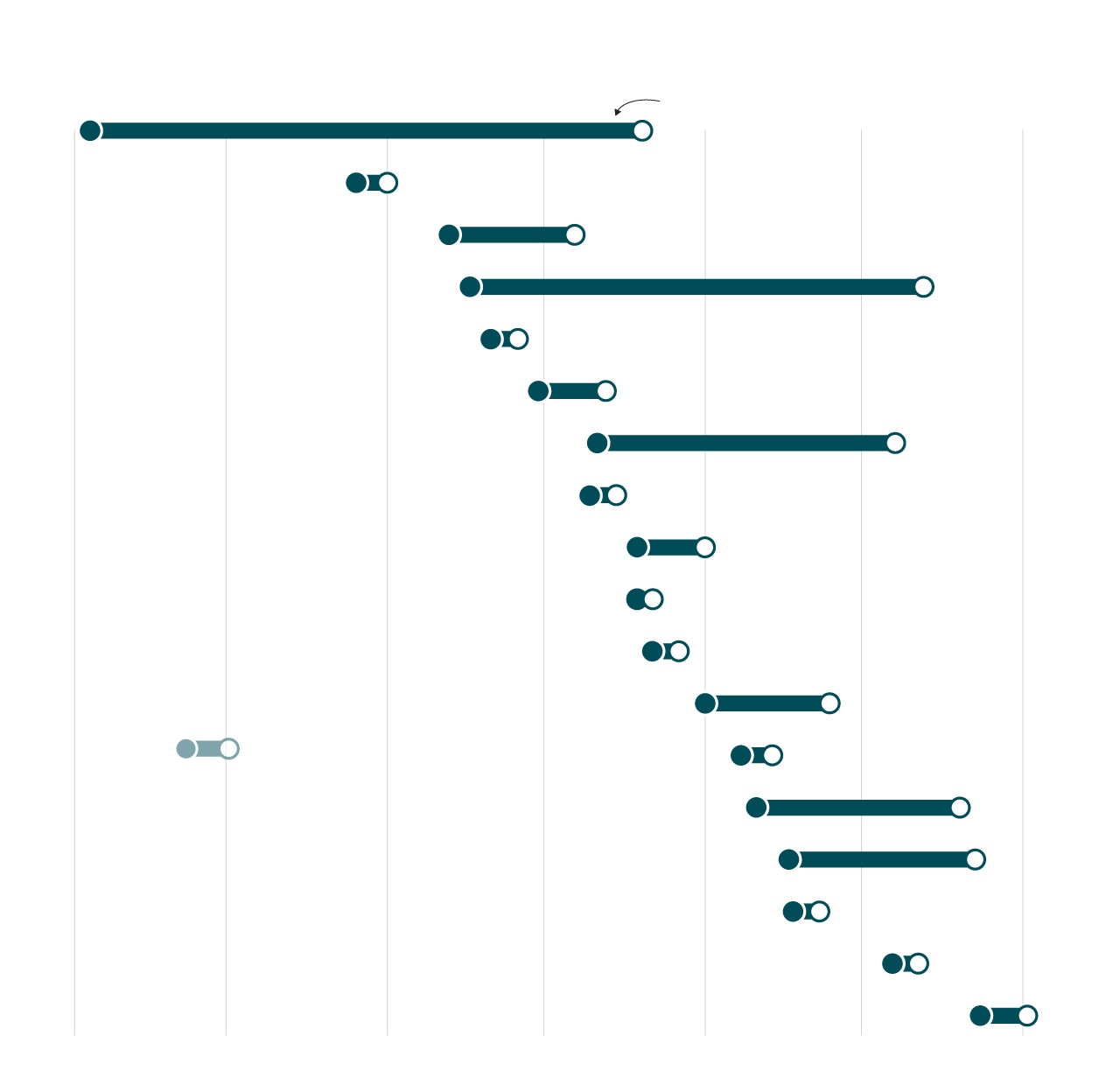

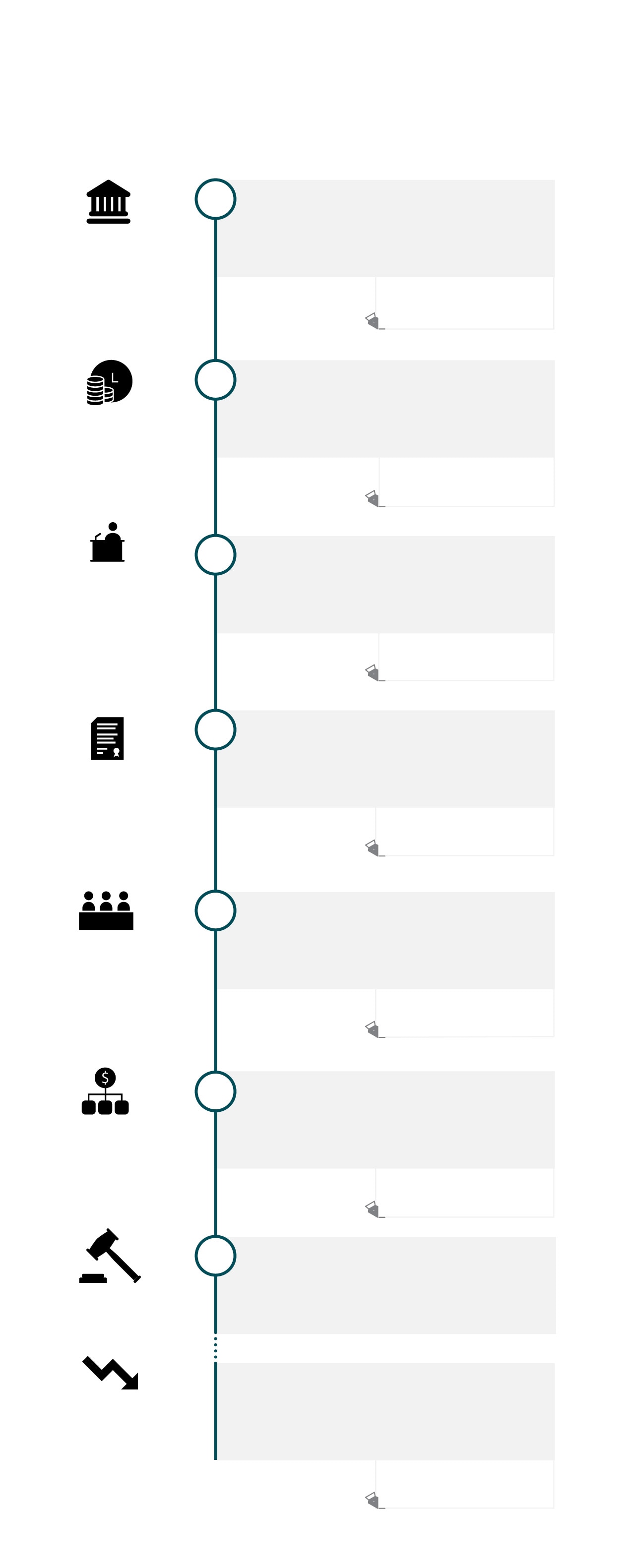

Chapter 11: The “reorganization” bankruptcy

When a company files for Chapter 11 bankruptcy protection, business operations continue while it works out a plan to restructure its debts and pay creditors. Though Chapter 11 is most commonly used for reorganization, it can be used to liquidate assets. Here’s how the process plays out:

Declare Bankrupcty

Petition with the bankruptcy court

The debtor files a voluntary petition outlining assets, liabilities, income, expenses and financial affairs. This process takes place in bankruptcy court under the supervision of a U.S. trustee.

The courts charge a $1,167 case filing fee

and $550 in miscellaneous fees.

The Relief

Automatic stay

The company continues to operate as usual, while an automatic stay provides a period of time in which creditors cannot pursue the debtor on any debt that arose before the filing.

Stockholder’s personal assets aren’t at risk,

only their stocks with the company.

Meeting of Creditors

341 meeting

The U.S. trustee and creditors conduct a meeting to question the debtor under oath concerning their acts, conduct, property, financial affairs and the administration of the case.

The debtor uses the tools of the

Bankrutpcy Code to reject leases,

contracts or object to claims.

Making a Plan

Disclosure statement and reorganization plan

The debtor submits a disclosure statement. This statement should contain enough information for a creditor to make an informed judgment about the debtor’s plan of reorganization.

There’s a 120-day period to file a plan with the

possibility of up to an 18-month extension.

More Hearings

Hearings on approval of disclosure

statement and confirmation of the plan

After the disclosure statement is approved, the court could hold two or three confirmation hearings before a final plan is approved to deal with any objections that arose.

A quick case could be less than six

months, while one with major

disputes could drag on for years.

The Confirmation

Distribution under the plan

The debtor is required to make payments and is bound by the provisions of the confirmed plan of reorganization. The plan creates new contractual rights, replacing pre-bankruptcy contracts.

The company could be sold during the process if there’s a buyer.

Case Closed

A final decree

The case closes after the debtor has substantially carried out the plan and their estate has been “fully administered,” meaning all bankruptcy claims have been resolved.

Other Outcomes

Conversion to Chapter 7 or dismissal

If the debtor fails to comply the with the Bankruptcy Code or court rules, the U.S. trustee or creditors may file a motion to have the case dismissed or converted to Chapter 7 for asset liquidation.

In Chapter 7, legal fees are paid first, then creditors and lastly stockholders if money is left.

Source: Megan Murray, attorney at Underwood Murray, a Tampa firm that specializes in bankruptcy law and uscourts.gov

Chapter 11: The “reorganization” bankruptcy

When a company files for Chapter 11 bankruptcy protection, business operations continue while it works out a plan to restructure its debts and pay creditors. Though Chapter 11 is most commonly used for reorganization, it can be used to liquidate assets. Here’s how the process plays out:

Declare Bankrupcty

Petition with the bankruptcy court

The debtor files a voluntary petition outlining assets, liabilities, income, expenses and financial affairs. This process takes place in bankruptcy court under the supervision of a U.S. trustee.

The courts charge a $1,167

case filing fee and $550 in

miscellaneous fees.

The Relief

Automatic stay

The company continues to operate as usual, while an automatic stay provides a period of time in which creditors cannot pursue the debtor on any debt that arose before the filing.

Stockholder’s personal assets

aren’t at risk, only their stocks

with the company.

Meeting of Creditors

341 meeting

The U.S. trustee and creditors conduct a meeting to question the debtor under oath concerning their acts, conduct, property, financial affairs and the administration of the case.

The debtor uses the tools of the

Bankrutpcy Code to reject leases,

contracts or object to claims.

Making a Plan

Disclosure statement and reorganization plan

The debtor submits a disclosure statement. This statement should contain enough information for a creditor to make an informed judgment about the debtor’s plan of reorganization.

There’s a 120-day period to file

a plan with the possibility of up

to an 18-month extension.

More Hearings

Hearings on approval of disclosure

statement and confirmation of the plan

After the disclosure statement is approved, the court could hold two or three confirmation hearings before a final plan is approved to deal with any objections that arose.

A quick case could be less than

six months, while one with major

disputes could drag on for years.

The Confirmation

Distribution under the plan

The debtor is required to make payments and is bound by the provisions of the confirmed plan of reorganization. The plan creates new contractual rights, replacing pre-bankruptcy contracts.

The company could be

sold during the process if

there’s a buyer.

Case Closed

A final decree

The case closes after the debtor has substantially carried out the plan and their estate has been “fully administered,” meaning all bankruptcy claims have been resolved.

Other Outcomes

Conversion to Chapter 7 or dismissal

If the debtor fails to comply the with the Bankruptcy Code or court rules, the U.S. trustee or creditors may file a motion to have the case dismissed or converted to Chapter 7 for asset liquidation.

In Chapter 7, legal fees are paid

first, then creditors and lastly

stockholders if money is left.

Source: Megan Murray, attorney at Underwood Murray, a Tampa firm that specializes in bankruptcy law and uscourts.gov

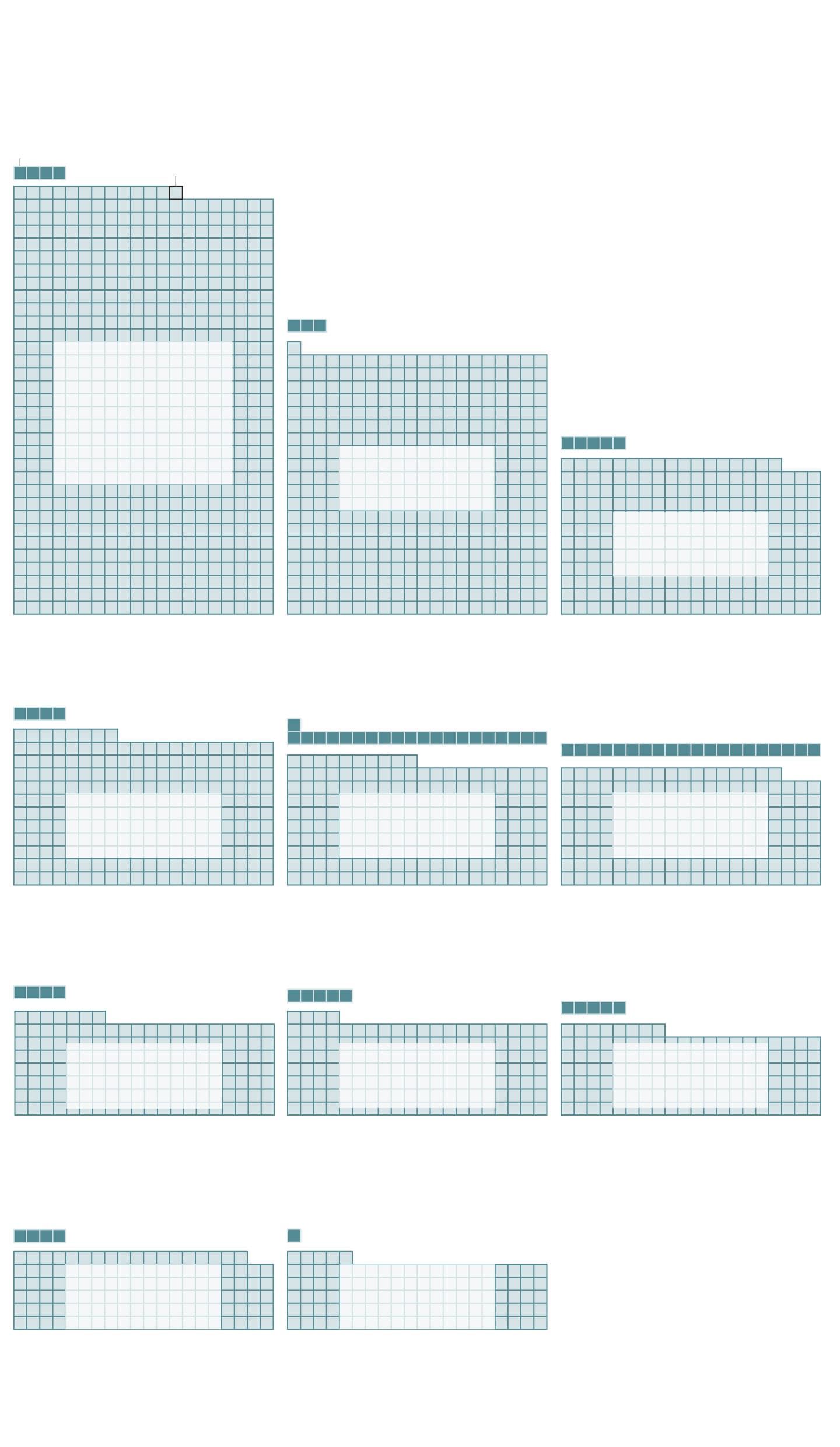

Chapter 11: The “reorganization” bankruptcy

When a company files for Chapter 11 bankruptcy protection, business operations continue while it works out a plan to restructure its debts and pay creditors. Though Chapter 11 is most commonly used for reorganization, it can be used to liquidate assets. Here’s how the process plays out:

The debtor files a voluntary petition outlining assets, liabilities, income, expenses and financial affairs. This process takes place in bankruptcy court under the supervision of a U.S. trustee.

Declare

Bankrupcty

Petition with the

bankruptcy court

The courts charge a $1,167

case filing fee and $550 in

miscellaneous fees.

The company continues to operate as usual, while an automatic stay provides a period of time in which creditors cannot pursue the debtor on any debt that arose before the filing.

The Relief

Automatic stay

Stockholder’s personal assets

aren’t at risk, only their stocks

with the company.

The U.S. trustee and creditors conduct a meeting to question the debtor under oath concerning their acts, conduct, property, financial affairs and the administration of the case.

Meeting

of Creditors

341 meeting

The debtor uses the tools of the

Bankrutpcy Code to reject leases,

contracts or object to claims.

The debtor submits a disclosure statement. This statement should contain enough information for a creditor to make an informed judgment about the debtor’s plan of reorganization.

Making a Plan

Disclosure statement and

reorganization plan

There’s a 120-day period to file

a plan with the possibility of up

to an 18-month extension.

After the disclosure statement is approved, the court could hold two or three confirmation hearings before a final plan is approved to deal with any objections that arose.

More Hearings

Hearings on approval of disclosure statement and confirmation of the plan

A quick case could be less than

six months, while one with major

disputes could drag on for years.

The debtor is required to make payments and is bound by the provisions of the confirmed plan of reorganization. The plan creates new contractual rights, replacing pre-bankruptcy contracts.

The Confirmation

Distribution under the plan

The company could be

sold during the process if

there’s a buyer.

The case closes after the debtor has substantially carried out the plan and their estate has been “fully administered,” meaning all bankruptcy claims have been resolved.

Case Closed

A final decree

If the debtor fails to comply the with the Bankruptcy Code or court rules, the U.S. trustee or creditors may file a motion to have the case dismissed or converted to Chapter 7 for asset liquidation.

Other Outcomes

Conversion to Chapter 7

or dismissal

In Chapter 7, legal fees are paid

first, then creditors and lastly

stockholders if money is left.

Source: Megan Murray, attorney at Underwood Murray, a Tampa firm that specializes in bankruptcy law and uscourts.gov

Some companies also have asked bankruptcy courts for permission to grant “incentive” bonuses during reorganization. Car rental giant Hertz, for example, paid out $16.2 million three days before its Chapter 11 filing in May, then asked the court if it could award another $14.6 million in incentive bonuses. The judge rejected the request, calling it “offensive,” but later approved a plan to pay managers as much as $8.2 million if they met certain financial goals. Hertz, which filed for bankruptcy with more than $24 billion in debt, has laid off 11,000 workers, or more than a third of its U.S. workforce, since March. The company declined to comment.

When most businesses were shutting down around his GNC store in March, Timothy Clark kept reporting to work. His job with the vitamin and nutrition retailer was considered “essential” — and he needed the paycheck — so he put aside his fears of catching the novel coronavirus or spreading it to his grandmother.

Three months in, GNC filed for bankruptcy and announced plans close at least 800 stores, including the one in Gibbstown, N.J., where Clark earned $10 an hour. All four store employees were let go, as were a “significant” number of colleagues.

But five days before the Chapter 11 filing, company executives collected nearly $4 million. CEO Kenneth Martindale’s bonus is among the few with a clawback clause: One-quarter of his $2.2 million payout must be returned if the company does not emerge from bankruptcy within a year. GNC and Martindale did not respond to requests for comment.

“I liked my job,” said Clark, 23, who now makes ends meet by delivering for DoorDash. But to “see how many people lost their jobs, compared to the money the executives made, gives me chills.”

Hornbuckle suspected bankruptcy was inevitable well before Chuck E. Cheese’s corporate parent filed in June. Working conditions had been declining for months at the chain’s headquarters in Irving, Tex., she and a colleague said. Managers had recently begun asking workers to pay for their own pizza at company-sponsored lunches.

She knew business was bad in early March because event and birthday party cancellations were piling up. She just didn’t realize she’d be out of work so quickly.

“I felt like I was barely crawling out of a barrel before,” she said. “Then the pandemic came, and it just knocked us back down again.”

Hornbuckle and her daughter, who works at a day-care center, pay $268 a week for their motel room. They rely on food stamps for groceries and don’t have much money left for anything else. For a while, when Hornbuckle was receiving an extra $600 a week in supplemental unemployment benefits, she was hopeful she’d be able to save up enough for an apartment. But that aid has expired, and there’s no telling when more federal stimulus might arrive.

So she keeps applying for jobs, hoping for a call back.

“We’re barely piecing together what we can,” she said. “My wheels are spinning all day long, constantly trying to figure out what I can do. All I want is some type of job with a decent salary so I can build my way back up.”