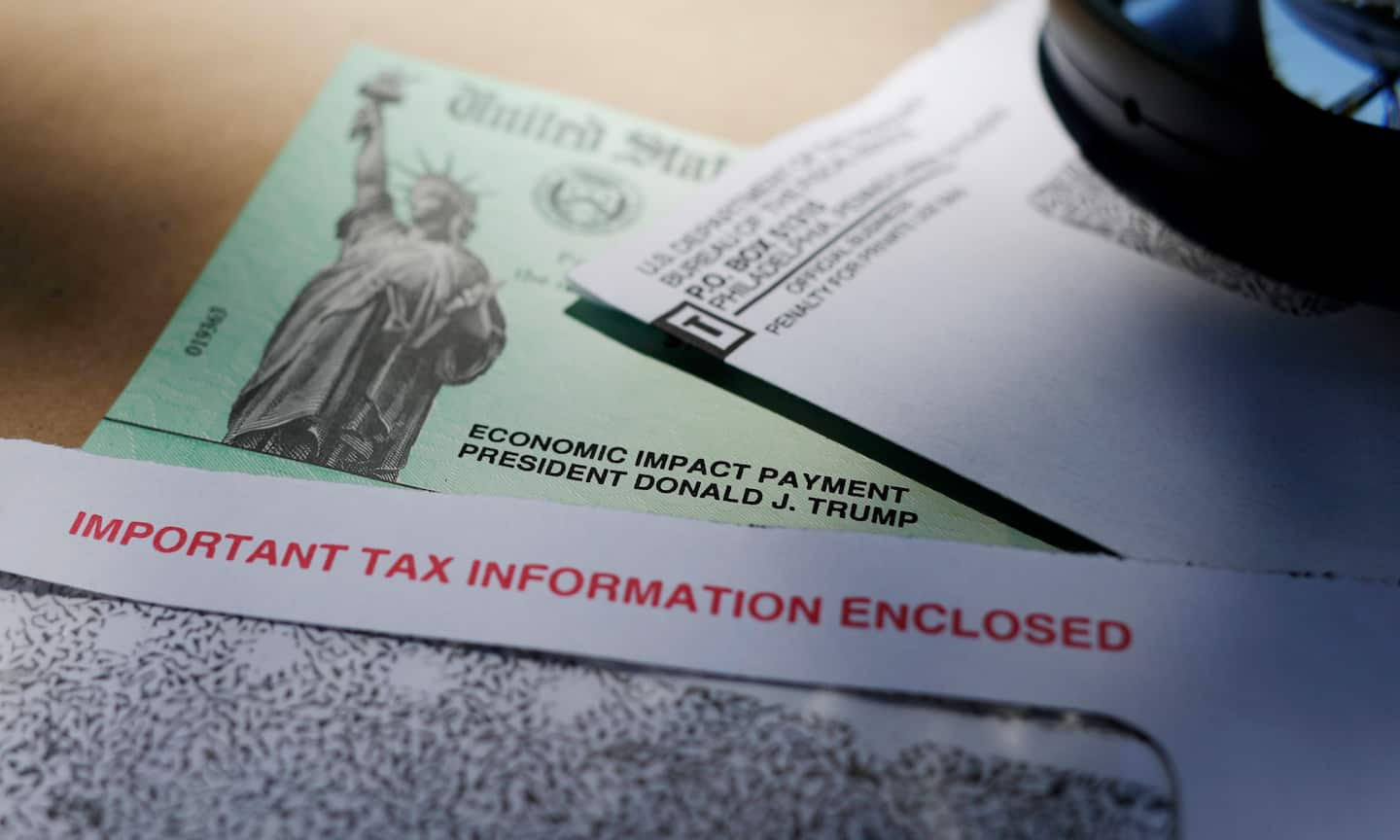

The IRS is making a final push to get stimulus payments to millions of Americans

Most Americans eligible for an economic impact payment or stimulus payment were automatically sent the money based on their 2018 or 2019 federal return. As of July 31, the IRS had disbursed 163.9 million economic impact payments totaling $273.5 billion, according to a report last month from the Government Accountability Office.

The IRS created an online non-filers tool that could be used by Americans who earn too little to file a tax return but are eligible for a stimulus payment. At least 9 million people have yet to collect a stimulus payment, because they don’t typically file a tax return, according to the agency.

Under the Cares Act, stimulus payments must be made by Dec. 31. If people don’t receive the payment — which is actually an advance credit — they have to wait until they file a 2020 federal return next year.

To have enough time to issue stimulus payments before the end of the year, the IRS set Nov. 21 by 3 p.m. Eastern time as the deadline for people to use the non-filers tool. Low-income Americans who are non-filers were previously told they had until Oct. 15 to claim a payment.

Most people receiving Social Security, Supplemental Security Income (SSI), Veteran and Railroad Retirement benefits should have received a payment already. However, if you have not gotten a payment and you fall into one of these beneficiary categories or you have a non-beneficiary spouse who still hasn’t received a payment, you’ll also need to use the non-filers tool by Nov. 21, the IRS said in an update to its economic impact payment information page.

Beginning two weeks after registering, people can track the status of their payment using the “Get My Payment” tool at irs.gov. The stimulus payment will be delivered faster if you elect direct deposit. Otherwise, you’ll be mailed a check.

The Nov. 21 deadline also now applies to parents who receive Social Security, survivor or disability benefits, SSI, Veterans Affairs or Railroad Retirement benefits and who did not get the extra $500 payment. The IRS had told parents they had only until Sept. 30 to use the non-filers portal.

These federal beneficiaries were automatically sent stimulus payments even if they didn’t file tax returns. But they were required to go online within a very short window and use the non-filers tool to claim the $500 stimulus payment. Thousands of parents, some disabled themselves and caring for disabled children, didn’t even know about the deadline.

Several parents living in Philadelphia filed a lawsuit against the Treasury Department and the IRS challenging the decision not to send payments to those who missed the deadlines. Community Legal Services of Philadelphia, Villanova University’s Federal Tax Law Clinic and the Berger Montague law firm have teamed up to challenge the IRS’s refusal to send supplemental payments.

“I am pleased that IRS will now provide federal benefits recipients the same extension to use the portal that it was giving all other non-filers,” said Jennifer Burdick, an attorney with Community Legal Services. “Americans are experiencing unforeseen financial burdens due to the pandemic, and it makes good sense to give parents with disabilities the same opportunity to get the income their families need to get through the year.”

Federal beneficiaries who used the non-filers tool May 5 through Aug. 15 to provide information on children eligible for the $500 payment don’t have to take further action, the IRS said. Payments will be automatically disbursed either by check or direct deposit.

Burdick said the IRS recently clarified that taxpayer assisters, ranging from social services organizations such as United Way to trusted friends, can use the non-filers portal on behalf of people who need help.

“This is a very important clarification, because the portal is not always accessible to people with disabilities,” Burdick said. “The IRS clarification makes the portal more accessible in the weeks leading up to the November 21st deadline.”

Since the non-filers tool launched in spring, more than 8 million people who normally aren’t required to file a tax return have registered for the payments, the IRS said.

Reader Question of the Week

If you have a personal finance or retirement question, send it to colorofmoney@washpost.com. In the subject line, put “Question of the Week.”

Q: I’m a disabled veteran receiving Social Security disability, and my wife works full time. We still haven’t received our stimulus check. My wife filed our taxes incorrectly by not applying the standard deduction in 2018, and the result caused us to owe the IRS nearly $6,000. We set up a payment schedule with the IRS and have faithfully been paying. We also filed for 2019. We meet the financial eligibility for a stimulus payment, but we still have not received it, nor have we gotten any word from the IRS. What can we do?

A: Don’t worry about the tax debt affecting your stimulus payment. The only offset allowed is for individuals who owe back child support. So, your stimulus payment would not have been taken to satisfy a past due tax debt.

If you have filed a 2019 return, you should automatically get a payment. It’s possible there’s just a delay in processing your return, which is slowing down the distribution of your stimulus payment. Double-check that you are actually eligible for a payment. The amount of your economic impact payment is based on your adjusted gross income (AGI). If you filed a return but aren’t sure of your AGI, you can find it on Line 8b on your 2019 federal tax return or Line 7 on your 2018 return.

Stimulus payments are reduced by 5 percent of the amount that your AGI exceeds $150,000 for taxpayers filing a joint return; $112,500 for taxpayers filing as head of household; and $75,000 for all others.

If you are eligible for a payment, keep checking the “Get My Payment” tool or call 800-829-1040. The online tool will show “Payment Status Not Available” until the payment is being issued, the IRS says.

“If they filed a return for 2018, ordinarily, that should be good enough to result in a payment,” said IRS spokesman Eric Smith. “But in any event, they should be able to check the status.”

Under new instructions released last week, the IRS says some federal beneficiaries who haven’t received a stimulus payment, who don’t usually file a tax return and who won’t file a return for 2019 may need to use the non-filers tool. Make sure to do so by Nov. 21. Again, don’t use the non-filers tool if you plan to file a 2019 return.

Retirement Rants and Raves

I’m interested in your experiences or concerns about retirement or aging. You can rant or rave. Send your comments to colorofmoney@washpost.com. Please include your name, city and state. In the subject line, put “Retirement Rants and Raves.”