Baseball survived a difficult 2020, but 2021 could be even worse

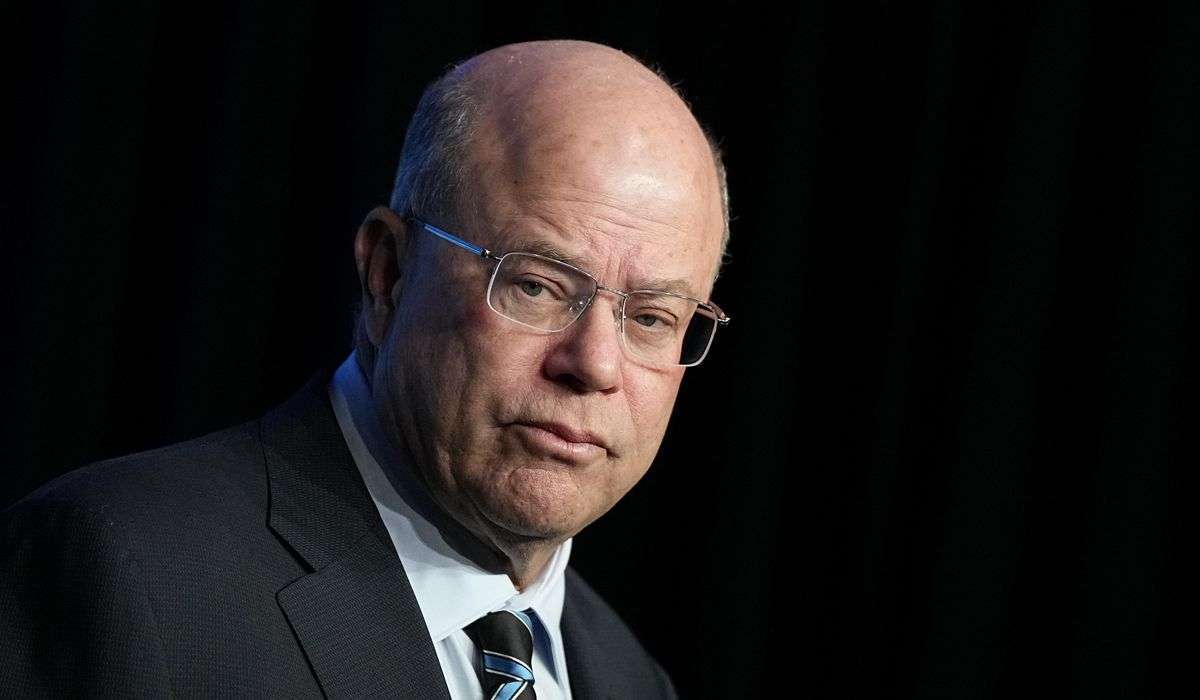

In September, Commissioner Rob Manfred told The Washington Post that MLB expects to suffer operating losses of $3 billion in 2020, the result of a regular season shortened to 60 games and held entirely without fans in attendance. In the past few days, it has become clear, if it wasn’t already, that teams intend to pass those losses on to the players.

Some 12 hours after the final pitch of the 2020 World Series — held at a neutral site for the first time in history, in front of a crowd limited to around one-quarter capacity — the MLB Players Association released its list of 147 free agents, none of whom, it is safe to say, would have chosen to arrive at that career benchmark in the middle of a global pandemic.

By late last week, their ranks had swollen by another two dozen or so as teams declined the options on players with long-term deals, among them Washington Nationals stalwarts Adam Eaton, Howie Kendrick, Aníbal Sánchez and Eric Thames; Tampa Bay Rays pitcher Charlie Morton, who went 3-1 with a 2.70 ERA this postseason; and St. Louis Cardinals second baseman Kolten Wong, who could earn his second straight Gold Glove Award when the 2020 winners are announced Tuesday.

“Revenues are going down, so it will be most likely [that] payroll will go down,” Cardinals president of baseball operations John Mozeliak told reporters following the Wong news. “ … When you go from having 3.3 or 3.4 million fans in your ballpark to having zero, that’s a big hit.”

By Dec. 2, the list of available free agents will have grown even larger, when teams face the deadline for tendering contracts — or not — to arbitration-eligible players on their rosters. The sport already is bracing for an influx of non-tenders that only will add to the glut of free agent inventory, with the inevitable effect of depressing salaries for all.

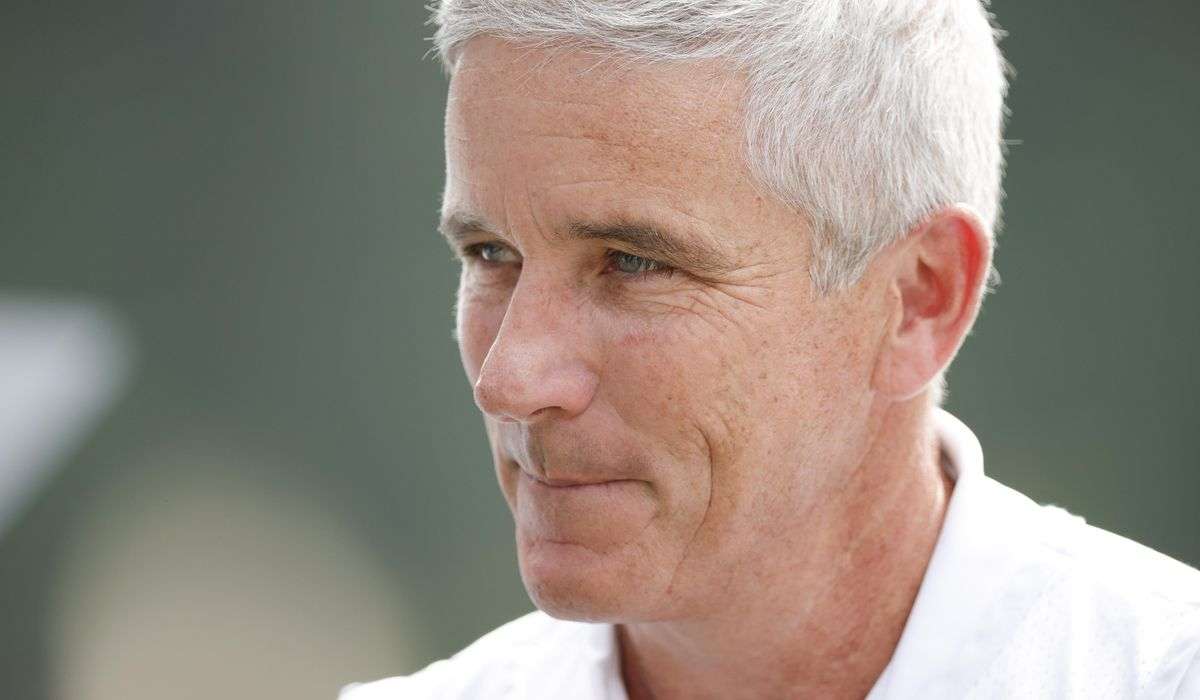

Even under the best of circumstances, this free agent market would have represented a step backward from the big-money spending spree of a year ago, when three superstars — pitchers Stephen Strasburg and Gerrit Cole and third baseman Anthony Rendon, the latter two both 29 entering free agency — landed contracts totaling 23 years and $814 million.

This offseason, the top free agents — pitcher Trevor Bauer, outfielders George Springer and Marcell Ozuna, and catcher J.T. Realmuto — all will be at least 30 next year. (The would-be headliner of this market, 28-year-old right fielder Mookie Betts, came off the board in July, when the Los Angeles Dodgers signed him to a 12-year, $365 million extension.)

Given the way the industry still pays for premium talent even in a downturn, some still could wind up with nine-figure deals. It is the next tier of free agents, and the next below that, who could really feel the effects of the belt-tightening across the game.

The best hope for those free agents is that a handful (or more) of teams — perhaps the New York Mets, under new owner Steve Cohen; or mid-tier teams who made significant progress in 2020, such as the San Diego Padres, Toronto Blue Jays and Chicago White Sox — see the market downturn as a competitive opportunity to add pieces for 2021.

But no one has any clarity about what that season might look like, including the possibility of fans in the stands, given the unknowable trajectory of the coronavirus and the status of a potential vaccine. There is a 162-game schedule with an April 1 Opening Day in place, but the sport is likely to be at the mercy of individual states and municipalities — and, in the case of the Blue Jays, the Canadian government — much as it was in 2020.

At the same time, National League teams don’t know whether there will be a designated hitter in that league in 2021, a decision that will affect the markets for free agent hitters such as Nelson Cruz and Edwin Encarnación. That is among the handful of issues that must be negotiated with the union ahead of next season. Another one: the makeup of the postseason, which is likely to be somewhere between the 10-team field of previous years and the 16-team field of 2020.

But those negotiations will take place against the backdrop of deteriorating relations between MLB and the union, which had been trending poorly for several years and were made even worse by contentious talks in April, May and June over the shape of the 2020 season. Later this offseason, the union is expected to file a grievance alleging MLB did not make a good-faith effort to play as many games as possible in 2020, as required by the agreement the sides signed in March.

Baseball’s long-term economic health appears strong, as evidenced by the Mets’ sale to Cohen for $2.4 billion and a new, $3.75 billion television deal with Turner Sports. But the short-term outlook is bad and getting worse, affecting not only the player markets but entire organizations. A majority of teams have instituted at least one round of layoffs and/or furloughs in their front offices and player-development and scouting staffs.

“You have certain operating expenses that just don’t go away,” Mozeliak said. “ … Obviously, we are trying to figure out how we can best forecast revenue for next year.”

It would be lovely to think that once the country gets past the coronavirus crisis, baseball will be fine. But looming out in the distance is the expiration of the sport’s current labor agreement in December 2021. In normal times, this would be the offseason to begin negotiating a new one, but the immediate crisis makes that difficult to imagine. Each week and month that ticks off the calendar makes it more likely there is a work stoppage before 2022.

For baseball, 2020 featured an ugly labor battle that played out in public, a season reduced by 63 percent, a couple of major coronavirus outbreaks that came close to shutting down the season and total regular season attendance of zero.

But as the coming months wear on, it may be possible to look back and regard 2020 as the good old days.