Mortgage rates unchanged heading into Thanksgiving holiday

Freddie Mac, the federally chartered mortgage investor, aggregates rates from about 80 lenders across the country to come up with weekly national average mortgage rates. It uses rates for high-quality borrowers who tend to have strong credit scores and large down payments. These rates are not available to every borrower.

The 15-year fixed-rate average also didn’t move, leveling off at 2.28 percent with an average 0.6 point. It was 3.15 percent a year ago. The five-year adjustable rate average spiked to 3.16 percent with an average 0.3 point. It was 2.85 percent a week ago and 3.43 percent a year ago.

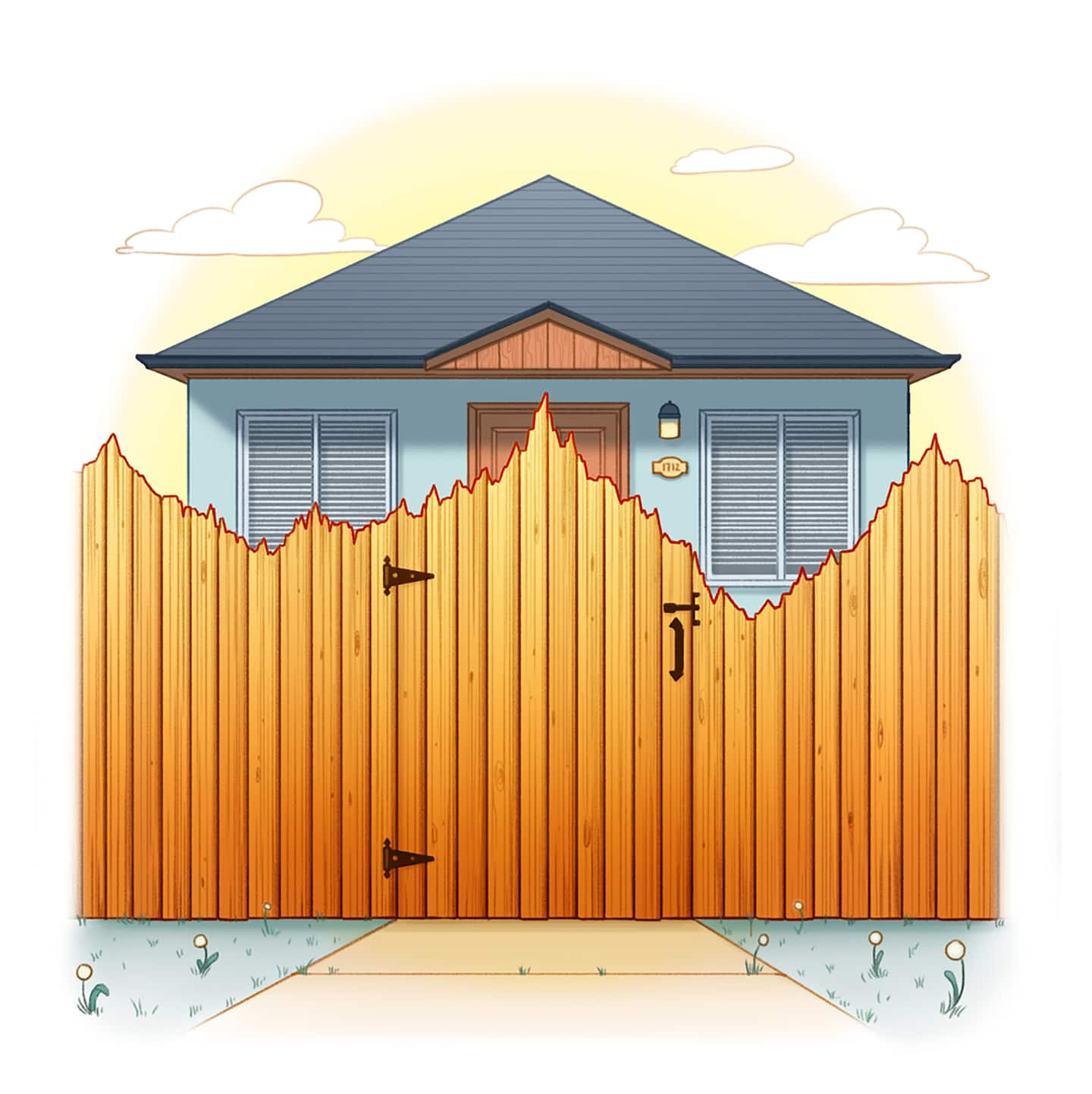

“Mortgage rates remain at record lows and while that has fueled a refinance boom, it’s been driven mainly by higher income borrowers,” Sam Khater, Freddie Mac’s chief economist, said in a statement. “With about 20 million borrowers eligible to refinance, lower- and middle-income borrowers are leaving money on the table by not taking advantage of low rates. On the homebuying side, demand continues to surge, and it has created a seller’s market where inventory is at a record low and home prices are rising, beginning to offset the benefits of the low rates.”

A report by Black Knight, the mortgage data and technology company, found that more than 19 million borrowers are what they describe as high-quality refinance candidates. These borrowers hold 30-year mortgages, have more than 20 percent equity in their homes, credit scores above 720 and are current on their payments. By refinancing at today’s rates, they could benefit by shaving off at least 75 basis points on their current rate. (A basis point is 0.01 percentage point.) That translates into a savings of $400 a month for 4.5 million borrowers and $500 a month for 2.7 borrowers.

Normally when the stock market hits a new high as it did this week, that’s bad for mortgage rates. Money shifts away from long-term bonds and into equities, causing bond prices to fall and rates to rise. But Tuesday’s record-high for the Dow came too late in the week to be factored into Freddie Mac’s survey. However, if investors’ optimism continues, the end of record-low rates may be around the corner.

That said, most experts don’t expect rates to move higher anytime soon. Bankrate.com, which puts out a weekly mortgage rate trend index, found nearly two-thirds of the experts it surveyed predict rates will hold steady in the coming week.

“With the holiday upon us it should be a quiet week for the markets,” said Gordon Miller, owner of Miller Lending Group in Cary, N.C. “I would expect rates to stay the same.”

Meanwhile, mortgages applications aren’t slowing down. According to the latest data from the Mortgage Bankers Association, the market composite index — a measure of total loan application volume — increased 3.9 percent last week. The purchase index rose 4 percent from the previous week and was 19 percent higher than a year ago. The refinance index went up 5 percent and was 79 percent higher than a year ago. The refinance share of mortgage activity accounted for 71.1 percent of applications.

“The decline in rates ignited borrower interest, with applications for both home purchases and refinancing increasing on a weekly and annual basis,” Joel Kan, an MBA economist, said in a statement. “The ongoing refinance wave has continued into November. Both the refinance index and the share of refinance applications were at their highest levels since April, as another week of lower rates drew more conventional loan borrowers into the market. Amidst strong competition for a limited supply of homes for sale, as well as rapidly increasing home prices, purchase applications increased for both conventional and government borrowers. Furthermore, purchase activity has surpassed year-ago levels for over six months.”