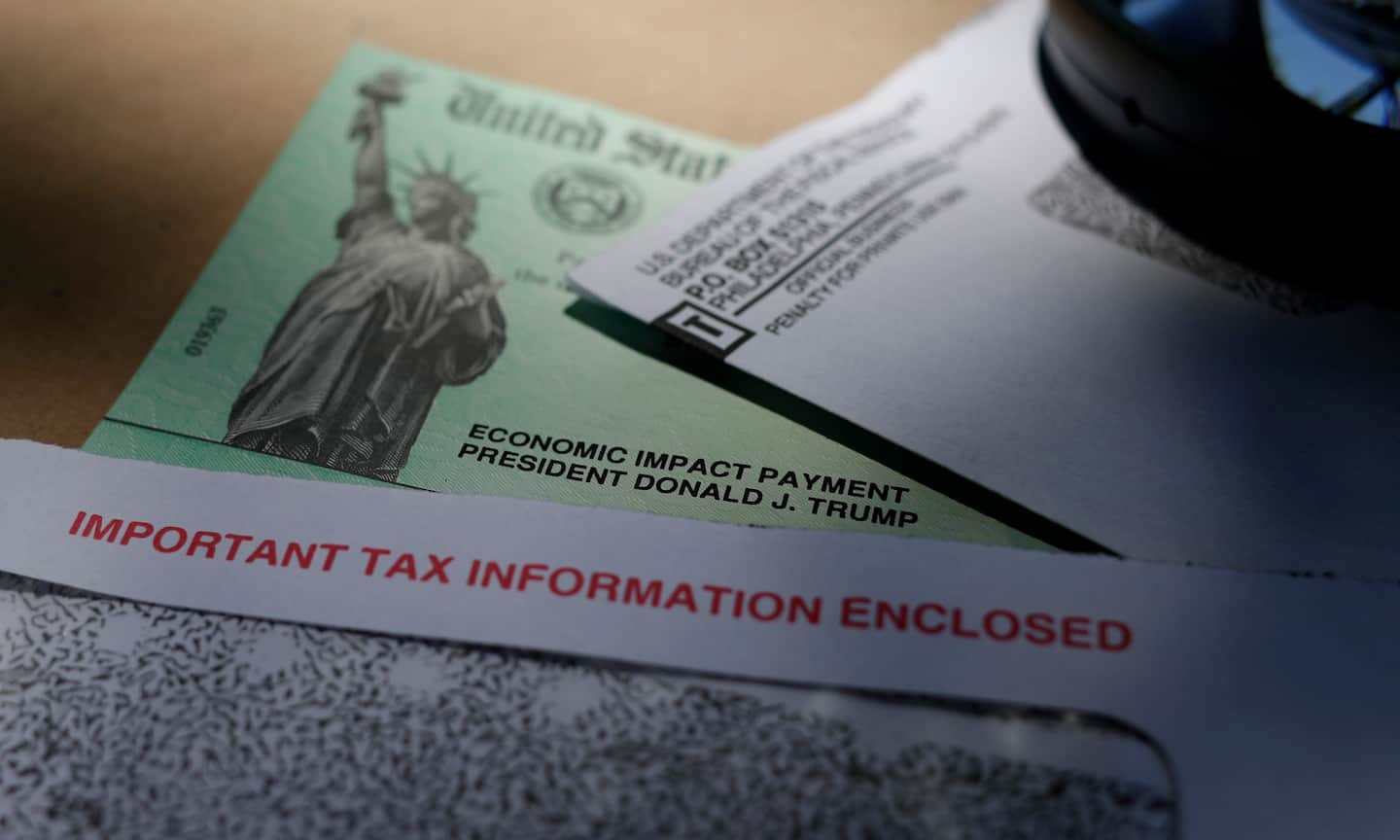

Here’s how college students could collect $1,800 in stimulus payments

Many college students lost jobs or had their income decrease because of the pandemic and had hoped they could get much-needed stimulus payments. But for many people there was an irritating catch to the stimulus funds: The money wasn’t available if you were claimed as a dependent on another taxpayer’s return.

However, when the 2021 tax season opens, many young adults could qualify for a combined $1,800 ($1,200 from the Cares Act and $600 from the second round of economic impact payments). This is because the stimulus payment is actually an advance credit. On Line 30 of the 2020 Form 1040 or 1040-S, it’s referred to as the “recovery rebate credit.”

“College students may now also be able to claim the stimulus payment in the form of a recovery rebate credit as long as they are not claimed as a dependent,” said Lisa Greene-Lewis, a certified public accountant and tax expert for TurboTax.

Other adult dependents, including elderly parents or disabled adult relatives, could also receive a stimulus payment if they, too, aren’t claimed as dependents for 2020.

The IRS uses a “support” test to determine if you can claim someone on your taxes, according to Therese Tippie, a CPA, tax manager and financial planner at EP Wealth Advisors in Torrance, Calif.

“Generally, support includes food, lodging, clothing, education and medical expenses,” Tippie said. “If it was the parent, then the parent should claim the child as a dependent. If not, the child can claim themself.”

Parents don’t have to claim the dependent. Just realize that you must have a dependent to claim head-of-household status, Tippie said. “If the parent does not have a dependent, he or she would file single, which is usually less favorable than head of household.”

“It is up to a parent whether they claim their student,” Greene-Lewis said. If the parent is supporting their college student and they are eligible for tax benefits — like lower tax rates for head of household and benefits such as the “other dependent” credit, the earned-income tax credit (EITC) or education credits — then they should claim their student. If the college student worked and needs to file based on income threshold requirements, or if they would like to file for a refund, then their parent can choose not to claim them as a dependent, Greene-Lewis said.

Parents who take only the dependent care credit of $500 because they earn too much to qualify for other deductions and credits might want to consider not claiming their young adult child as a dependent for 2020.

However, in terms of financial strategy, allowing a dependent college student or young adult to file a return to claim the $1,800 in stimulus money should be weighed against what credits and deductions you may be giving up, which could increase the taxes you owe. Parents who drop a child as a dependent could affect their eligibility for the EITC, which can be worth up to $3,584 for one qualifying child; the American opportunity tax credit (up to $2,500); or the lifetime learning credit (up to $2,000), Greene-Lewis pointed out.

If your income is too high to qualify for these tax breaks, you may not see a significant increase in your tax bill if you don’t claim your child as a dependent. “But a single parent claiming head of household, however, would not be able to claim head of household if their college student claimed themselves,” Greene-Lewis said.

Before deciding whether to claim your child as a dependent for the 2020 tax year, or to allow them to claim their own stimulus payment, you should consider the effect on your tax situation, according to Deenice Galloway of the Maryland-based Expert Tax & Consulting Service.

Galloway had a client whose dependent daughter — without her mother’s knowledge — filed her own return to collect the $1,200 stimulus payment. Doing so meant her mother no longer qualified for head of household. The change in the mother’s filing status could have resulted in a $4,000 tax bill, Galloway said. The mother found out when her federal return was rejected by the IRS.

“She literally cussed the daughter out,” Galloway said, chuckling.

The daughter had to file an amended return, and she returned the $1,200 stimulus payment to the IRS.

“You really have to look at the individual situation,” Galloway said. “It really can impact those individuals filing as head of household.”

Experts also point out that not claiming your young adult child for 2020 doesn’t mean you can’t switch back for 2021.

“Dependency can be reviewed on a year-by-year basis,” Tippie said.

Reader Question of the Week

If you have a personal finance or retirement question, send it to colorofmoney@washpost.com. In the subject line put “Question of the Week.” Please note that questions may be edited for clarity.

Q: I am VERY confused about 2021 required minimum distributions (RMD). We did repay the 2020 RMD. Normally we allow our financial services firm to decide how much to remove from our accounts. What are the rules for 2021 for RMDs?

A: Tucked in the Cares Act were several provisions that cover retirement accounts, including the suspension of RMDs for 2020. The measure was adopted because seniors were concerned they would have to take distributions from their retirement accounts when the stock market significantly dropped as the coronavirus spread in the United States. During the last financial crisis, when the stock market crashed, Congress suspended RMDs for 2009.

You are required by law to take withdrawals from your IRA, SIMPLE IRA, SEP IRA or retirement plan — such as a 401(k) — once you reach 72. (It was 70½ before 2020.) But the Cares Act waives RMD payments for 2020, including for inherited IRAs.

“This tax break became part of the Cares Act because Congress didn’t want to penalize people of retirement age by forcing them to sell stock during a market crash,” wrote Washington Post columnist Allan Sloan. “Such a crash seemed to be well underway in late March, when the Cares Act was being discussed. For instance, if someone age 75, who has a 4.37 percent required distribution . . . had all her money in a Standard & Poor’s 500 index fund, she would have had to withdraw 8.74 percent of her fund’s balance to meet that requirement if the market were down 50 percent.”

The tax break favored wealthier seniors. “It was worth nothing to people who need to take their full minimum distributions to pay their bills,” Sloan argued.

People who took an RMD before the Cares Act passed could roll those funds back into a retirement account, according to the IRS.

But for 2021, the old rules for RMDs apply.

“The straightforward answer is the requirement for taking a required minimum distribution is back for 2021,” says Melissa Ridolfi, senior vice president for retirement and cash management at Fidelity Investments. “Older Americans who had previously been taking distributions may need to relearn the habit, or just as importantly, those turning 72 in either 2020 or 2021 could be taking a distribution for the first time. Given last year’s waiver, it’s easy to see why there’s confusion, but 2020 should be viewed as the exception rather than the rule.”

Keep in mind that although your IRA custodian or retirement plan administrator may calculate your RMD, you’re ultimately responsible to double check that it’s the correct amount. The IRS has worksheets you can use at irs.gov.

You do not want to miss the RMD deadline. The penalty for failing to properly take your RMD is substantial. If you don’t take any distributions, or if the distributions are not large enough, you may have to pay a 50 percent tax on the amount not withdrawn as required. “That’s a significant hit, especially if this money is being used to cover living expenses,” Ridolfi said.

Retirement Rants and Raves

What are you expecting in 2021 as it relates to your financial life? What are your retirement savings goals? What did you learn in 2020? Were there mistakes you want to correct in the new year? I’m also interested in your experiences or concerns about retirement or aging. You can rant or rave. Send your comments to colorofmoney@washpost.com. Please include your name, city and state. In the subject line, put “Retirement Rants and Raves.” Please note that your comments may be edited for clarity.

“Mine is not really a rant or a rave but more a sigh of relief,” wrote David Kessler from Spotsylvania County, Va. “I retired from teaching after 25 years, and while I understand the current teachers’ pain, I’m very glad I don’t have to share it. Teaching this year would be (and is for those I’ve talked to) a complete nightmare for a huge number of reasons, from fear of contagion in person to trying to teach online with little support to kids without the skills or resources to be successful with virtual learning. Teaching was a tough job already. It’s no wonder so many students and teachers are having a tough time in this environment. I’ve sent a few online lessons to friends in need, but I’m very glad I got out before this all hit.”