Mortgage rates stuck in neutral amid economic uncertainty

Freddie Mac, the federally chartered mortgage investor, aggregates rates from about 80 lenders across the country to come up with weekly national average mortgage rates. It uses rates for high-quality borrowers with strong credit scores and large down payments. Because of the criteria, these rates are not available to every borrower.

The survey is based on home purchase mortgages, which means rates for refinances may be higher. The price adjustment for refinance transactions that went into effect in December is adding to the cost. The adjustment, which applies to all Fannie Mae and Freddie Mac refinances, is 0.5 percent of the loan amount. That works out to $1,500 on a $300,000 loan.

The 15-year fixed-rate average slipped to 2.19 percent with an average 0.6 point. It was 2.21 percent a week ago and 2.97 percent a year ago. The five-year adjustable-rate average edged up to 2.79 percent with an average 0.2 point. It was 2.78 percent a week ago and 3.28 percent a year ago.

“Mortgage rates were flat this week, holding firm near levels just above historic lows,” said Matthew Speakman, a Zillow economist. “In recent weeks, mortgage rates ticked upward, reacting to fiscal stimulus bill progress and signs of moderate improvement in the economy. However, rates leveled off in recent days, rising slightly following a lackluster jobs report and slipping on Wednesday after inflation data showed price pressures remained tame.”

The 30-year fixed-rate average spiked to its highest level in months to start the year, jumping to 2.79 percent in early January, a one-week gain of 14 basis points. (A basis point is 0.01 percentage point.) But since then, it has been treading water.

“After a topsy-turvy start to the year, mortgage rates have stabilized of late and appear to be waiting for more signals of the economy’s path forward before heading definitively in either direction,” Speakman said. “In the near-term, that path forward will depend largely on the fate of the next wave of fiscal relief and covid-19 vaccine developments.”

Bankrate.com, which puts out a weekly mortgage rate trend index, found that almost half the experts it surveyed predicted rates would stay about the same in the coming week, while more than a third expected them to rise.

Mitch Ohlbaum, a mortgage banker with Macoy Capital Partners in Beverly Hills, Calif., expects that rates will hold steady.

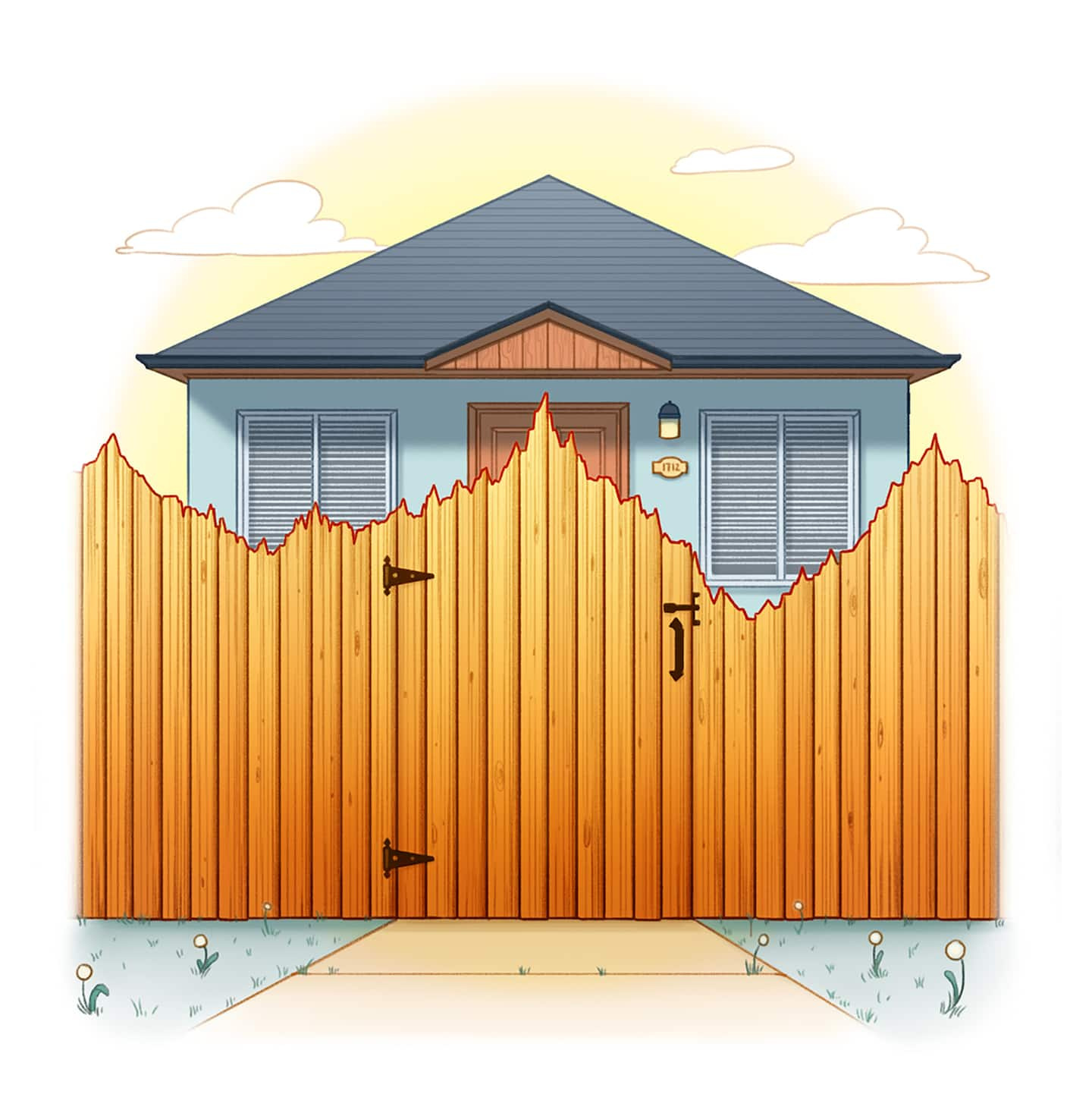

“We are seeing lots of economic data coming from all areas, and it is just not consistent enough to get a sense of where the country stands economically,” he said. “We see skyrocketing home prices on one side and hiring and rehiring far below expectations on the other side. The new administration is working on a major stimulus package to keep the economy moving ahead, and yet the stock market is soaring. As I have said in the past, the market hates uncertainty, and that is what we are experiencing now.”

Meanwhile, mortgage applications pulled back last week. According to the latest data from the Mortgage Bankers Association (MBA), the market composite index — a measure of total loan application volume — decreased 4.1 percent from a week earlier. The purchase index fell 5 percent from the previous week but was 17 percent higher than a year ago. The refinance index was down 4 percent but was 46 percent higher than a year ago. The refinance share of mortgage activity accounted for 70.2 percent of applications.

“Mortgage rates have increased in recent weeks, pulled higher by the likelihood of additional fiscal stimulus and expectations that covid-19 vaccines will slow the pandemic and boost economic growth later this year,” said Bob Broeksmit, MBA president and CEO. “The uptick in rates led to a decrease in refinances last week, but activity is still far above year-ago levels. Purchase applications also continue to increase on an annual basis, and the average loan balance again climbed to a new high of $402,200. Home-buyer demand in most of the country is robust this winter, and activity is strong at the upper end of the market, where housing supply is less constrained.”

The MBA also released its mortgage credit availability index (MCAI) that showed credit availability increased in January. The MCAI rose 2 percent to 124.6 last month. An increase in the MCAI indicates lending standards are loosening, while a decrease signals they are tightening.

“Improvements were driven by the conventional segment of the mortgage market, as lenders added ARM [adjustable-rate mortgage] loans with lower credit score and higher [loan-to-value] requirements,” said Joel Kan, an MBA economist. “Despite ARM loans accounting for a very small share of loan applications in recent months, lenders are likely looking ahead to a strong home-buying season by expanding their product offerings. … Even with overall credit availability picking up in three of the past four months, credit supply is still at its tightest level since 2014.”