Daniel Snyder to receive NFL debt waiver to buy out Washington Football Team partners

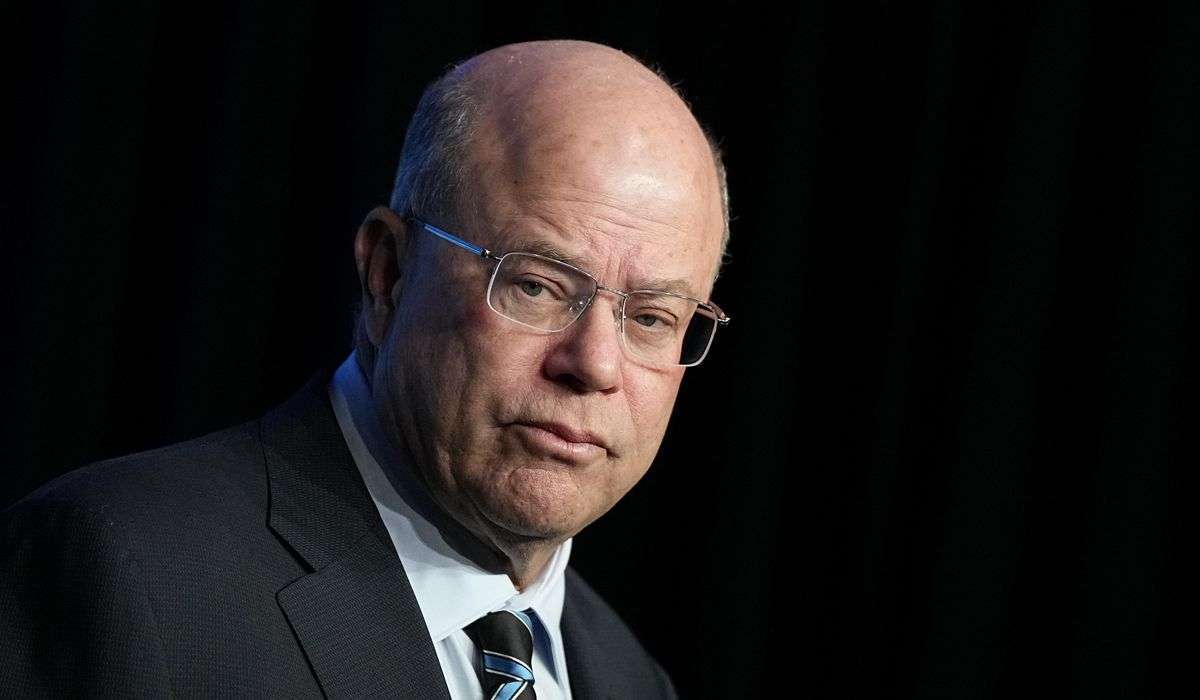

Snyder plans to pay approximately $875 million to purchase the shares held by Dwight Schar, Fred Smith and Robert Rothman, according to a person familiar with the proposed transaction. The deal would put ownership of the team entirely in the hands of Snyder and family members. It also would resolve an increasingly contentious dispute between Snyder and his limited partners that produced a grievance and NFL arbitration procedure and spilled into courtrooms.

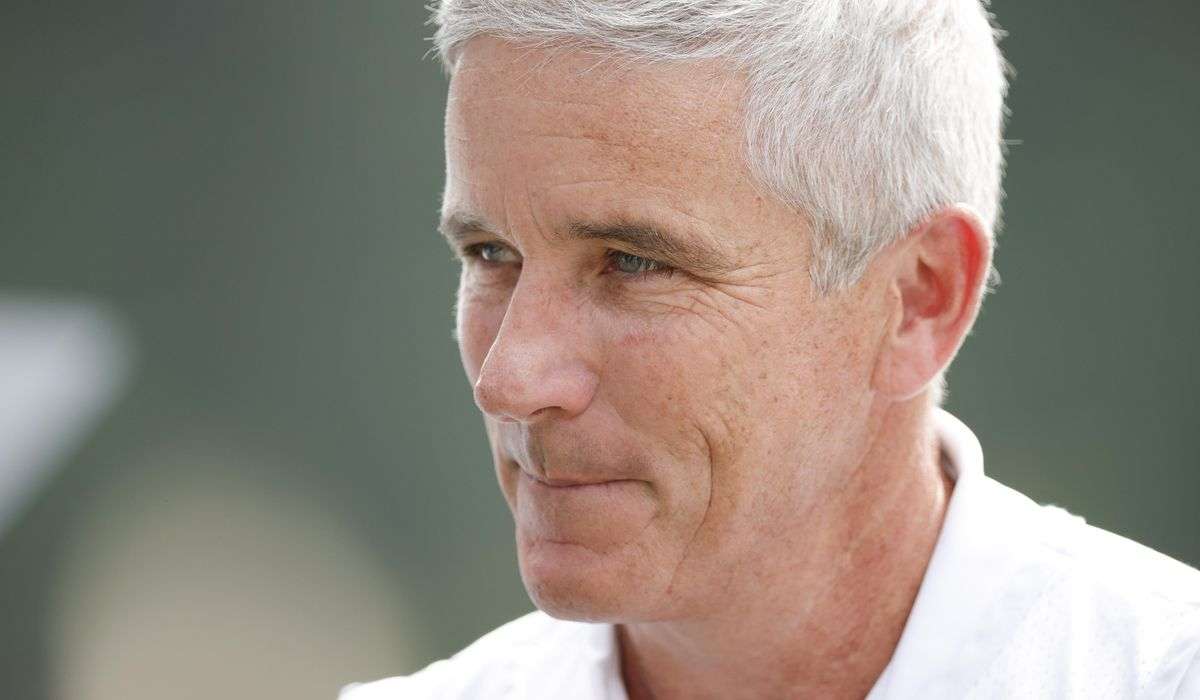

Schar, Smith and Rothman own about 40 percent of the team. The Washington Post reported in November that a group of investors from California had offered $900 million for the ownership shares of Schar, Smith and Rothman. The potential buyers were Behdad Eghbali and José Feliciano — the billionaire co-founders of Clearlake Capital, a private equity firm based in Santa Monica — and Feliciano’s wife, Kwanza Jones, a singer, songwriter and philanthropist who grew up in the Washington area.

Snyder initially attempted to exercise a right of first refusal to match the offers made to Smith and Rothman but not the offer made to Schar. That led to a dispute over whether Snyder could exercise his right of first refusal in such a selective manner.

The granting of the debt waiver was first reported by the Go Long newsletter and the New York Times.

The debt waiver and pending buyouts of Schar, Smith and Rothman do not impact the NFL’s ongoing investigation into allegations of sexual harassment in the team’s workplace, which is being led by attorney Beth Wilkinson. Those are “two separate matters,” and the review of those claims is ongoing, league spokesman Brian McCarthy said.

There remains little to no inclination among fellow owners and the league’s leadership to attempt to force Snyder to sell the franchise based upon the allegations, a person familiar with the inner workings of the NFL and the owners said in recent weeks. That is consistent with the initial indications in July, after the allegations first were reported by The Post. Multiple people with knowledge of the matter said then that the league would consider fining the team but the owners and NFL were not expected to take formal steps to try to compel Snyder to sell the franchise.

The NFL is empowered to discipline a team, its owner or employees under its personal conduct policy. League bylaws give the NFL and fellow owners the right to attempt to force the sale of a team if an owner is deemed to have engaged in conduct detrimental to the welfare of the league. Instead, Snyder now is poised to consolidate his ownership of the franchise that he purchased from the Jack Kent Cooke estate in 1999.

Nothing precludes Snyder from turning around and selling a minority stake in the franchise to help pay off the $450 million loan he’ll need to buy out Rothman, Smith and Schar.

By buying out his three longtime business partners himself, rather than allowing investment banker John Moag to find a buyer on behalf of the current limited partners, Snyder can control who his next partners, if any, would be.

Selling part of the team also would help Snyder raise money to fund the new stadium he long has envisioned once the team’s obligation to play at FedEx Field expires in 2027.

No new NFL stadium since 2015 has cost less than $1.1 billion — with SoFi Stadium in Inglewood, Calif., home of the Los Angeles Rams and Chargers, topping all with an estimated $5.5 billion price tag that included ancillary commercial development. The Las Vegas Raiders’ new stadium cost an estimated $1.9 billion when it opened in 2020. The Minnesota Vikings’ new home cost $1.1 billion in 2016; the Atlanta Falcons’ new stadium cost $1.5 billion.