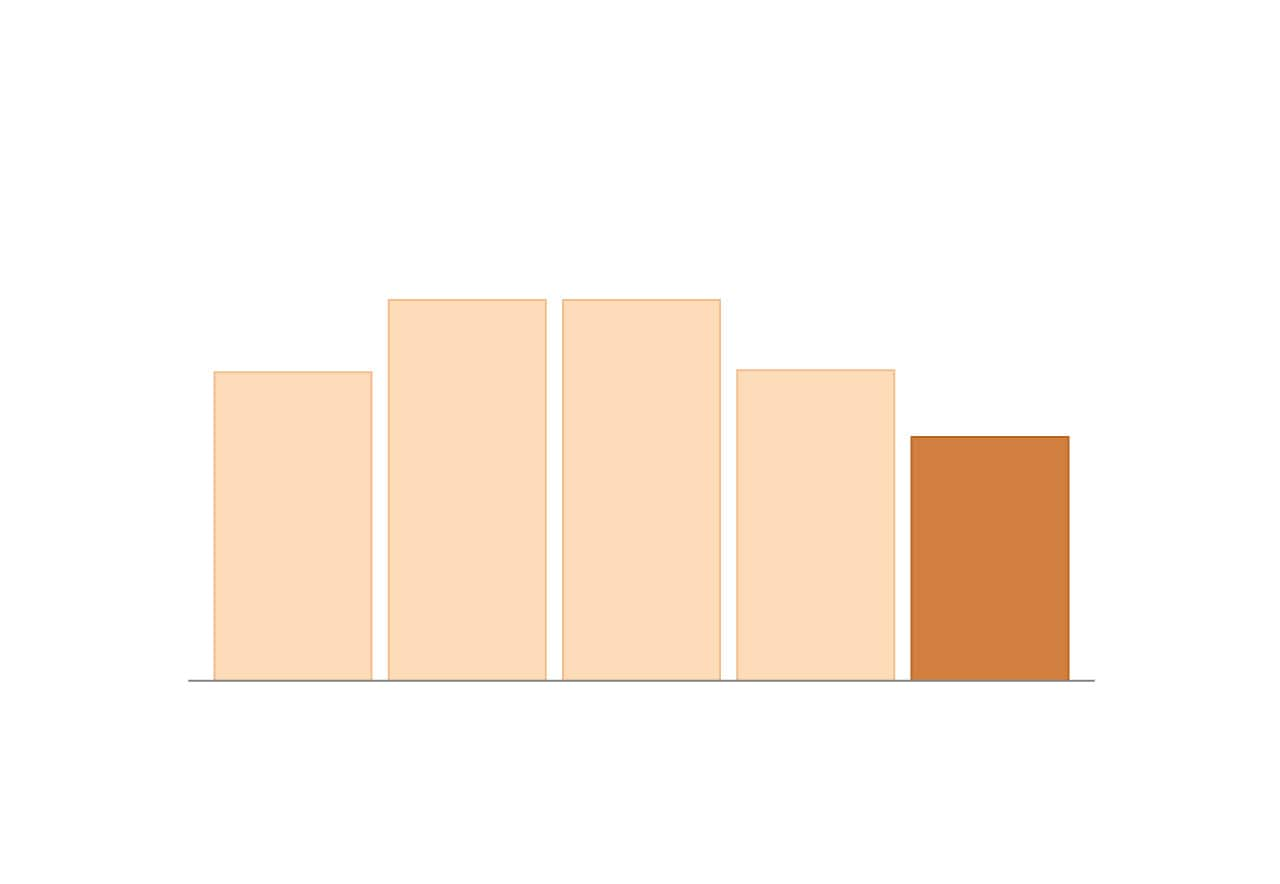

The headquarters of the Internal Revenue Service in Washington. (J. David Ake/AP)

The headquarters of the Internal Revenue Service in Washington. (J. David Ake/AP)

Kevin Schaul

Senior graphics editor covering corporate accountability

July 14 at 4:00 PM

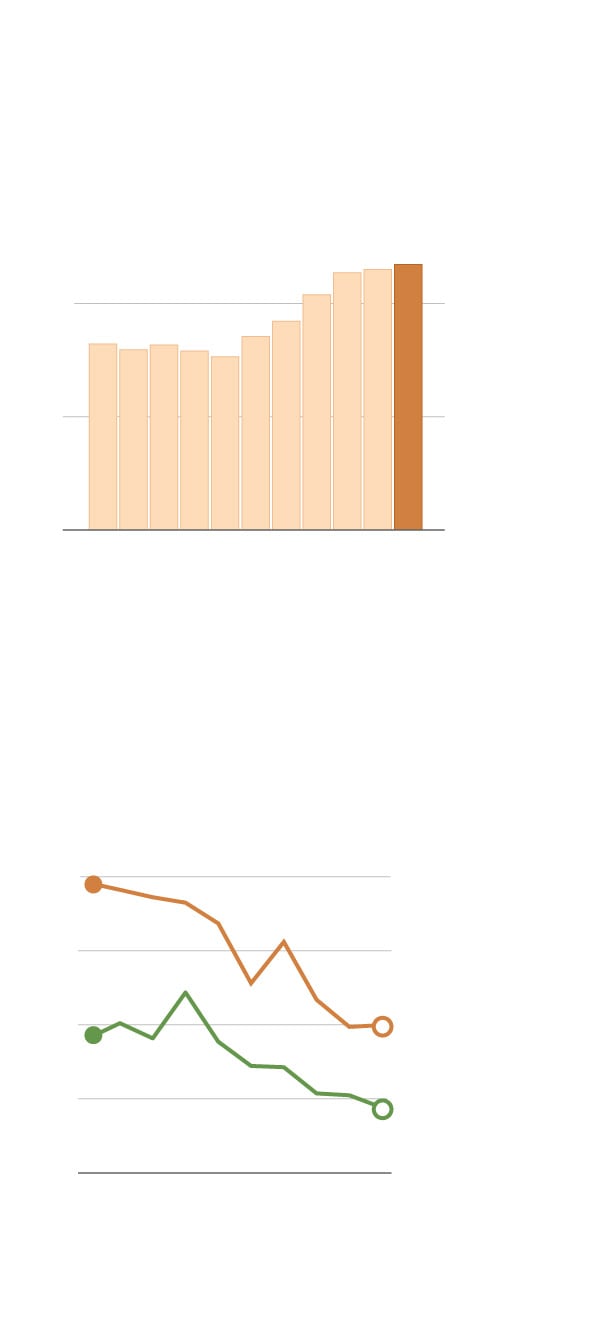

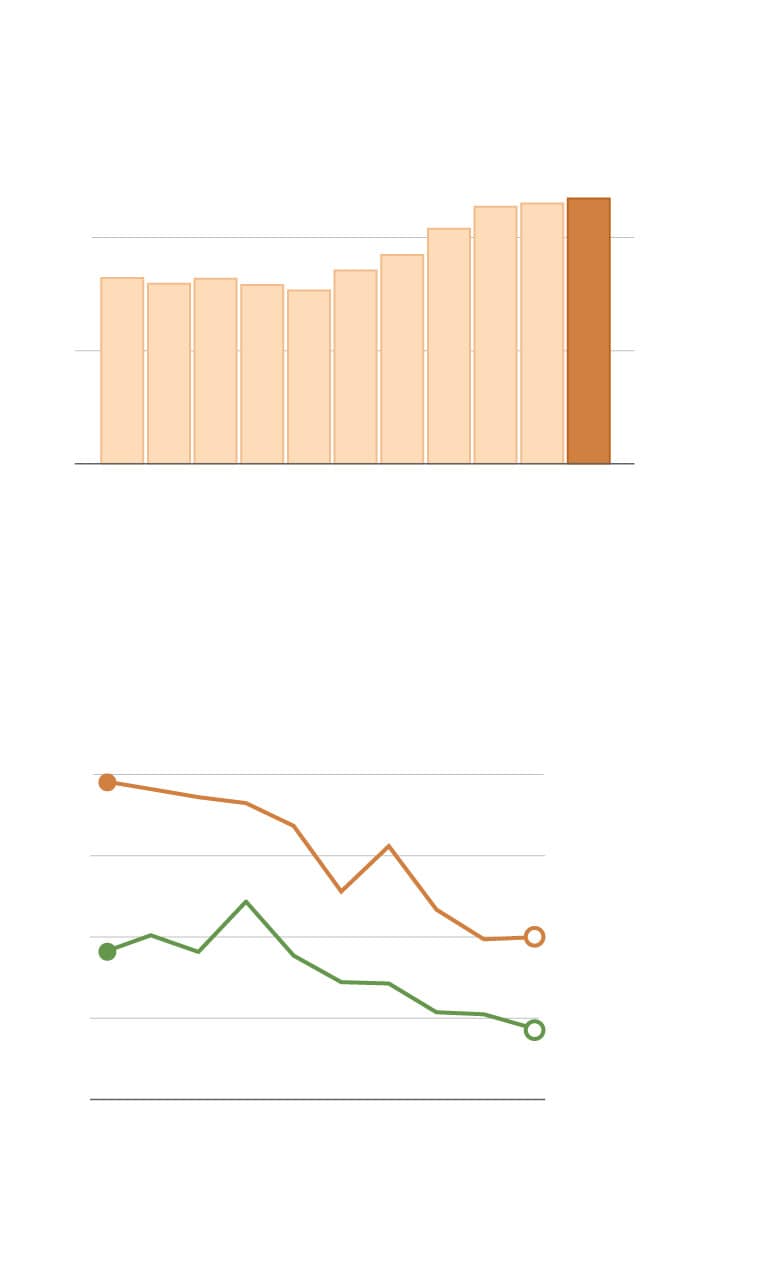

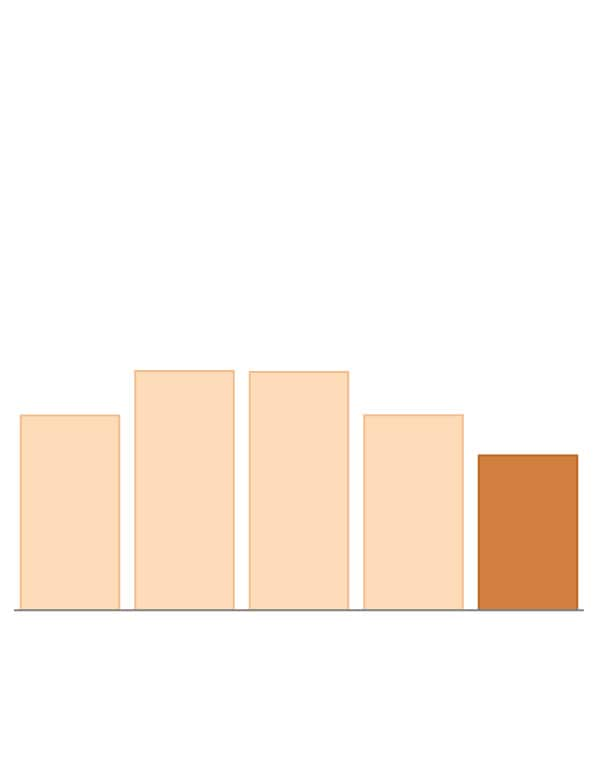

Federal audits of corporate tax returns have plunged in recent years, letting big companies claim elaborate tax breaks with less government scrutiny, according to a Washington Post analysis of company filings.

Accounting rules permit businesses to claim tax breaks even if they are likely to be overturned by tax authorities, legal experts said. In the past, the Internal Revenue Service audited virtually every tax return filed by large corporations and rejected tax breaks it deemed inappropriate, data show.

But during the Obama administration, congressional Republicans moved to slash the IRS budget, shrinking the agency’s staff and straining its ability to conduct audits. As a result, the federal government now examines just half of all large company tax returns, despite businesses claiming increasing tax benefits over this period that they say could be overturned by authorities, according to regulatory filings, interviews with tax policy experts and data from the IRS and financial researcher Calcbench.

Companies currently in the S&P 500 index had $235 billion in tax breaks awaiting audit at the end of last year, up 43 percent from a decade earlier, data show. These tax breaks, defined by companies as “unrecognized” or “uncertain” tax benefits, include deductions that companies see as unlikely to be approved by authorities because they rely on disputable interpretations of the tax code, experts said.

#g-irs-examination-rate-box,#g-irs-examination-rate-box .g-artboard{margin:0 auto}#g-irs-examination-rate-box p{margin:0}.g-aiAbs{position:absolute}.g-aiImg{display:block;width:100% !important}.g-aiSymbol{position:absolute;box-sizing:border-box}.g-aiPointText p{white-space:nowrap}#g-irs-examination-rate-xxsmall{position:relative;overflow:hidden}#g-irs-examination-rate-xxsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;font-size:16px !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-irs-examination-rate-xxsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:20px !important;line-height:22px !important}#g-irs-examination-rate-xxsmall .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important}#g-irs-examination-rate-xxsmall .g-pstyle2{font-size:12px !important;line-height:14px !important;height:14px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xxsmall .g-pstyle3{font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important}#g-irs-examination-rate-xxsmall .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:12px !important;line-height:14px !important;height:14px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xxsmall .g-pstyle5{font-size:12px !important;line-height:14px !important;height:14px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xxsmall .g-pstyle6{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:12px !important;line-height:14px !important;height:14px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xxsmall .g-pstyle7{height:20px !important}#g-irs-examination-rate-xxsmall .g-pstyle8{font-size:14px !important;line-height:15px !important;height:15px !important}#g-irs-examination-rate-xxsmall .g-pstyle9{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important}#g-irs-examination-rate-xxsmall .g-pstyle10{font-size:14px !important;line-height:17px !important;height:17px !important}#g-irs-examination-rate-xxsmall .g-pstyle11{font-size:14px !important;line-height:16px !important;height:16px !important}#g-irs-examination-rate-xsmall{position:relative;overflow:hidden}#g-irs-examination-rate-xsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;font-size:16px !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-irs-examination-rate-xsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:20px !important;line-height:22px !important}#g-irs-examination-rate-xsmall .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important}#g-irs-examination-rate-xsmall .g-pstyle2{font-size:12px !important;line-height:14px !important;height:14px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xsmall .g-pstyle3{font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important}#g-irs-examination-rate-xsmall .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:12px !important;line-height:14px !important;height:14px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xsmall .g-pstyle5{font-size:12px !important;line-height:14px !important;height:14px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xsmall .g-pstyle6{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:12px !important;line-height:14px !important;height:14px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-xsmall .g-pstyle7{height:20px !important}#g-irs-examination-rate-xsmall .g-pstyle8{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important}#g-irs-examination-rate-xsmall .g-pstyle9{font-size:14px !important;line-height:17px !important;height:17px !important}#g-irs-examination-rate-xsmall .g-pstyle10{font-size:14px !important;line-height:16px !important;height:16px !important}#g-irs-examination-rate-medium{position:relative;overflow:hidden}#g-irs-examination-rate-medium p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;font-size:16px !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-irs-examination-rate-medium .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:22px !important;line-height:26px !important;height:26px !important}#g-irs-examination-rate-medium .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:19px !important;height:19px !important;text-align:center !important}#g-irs-examination-rate-medium .g-pstyle2{font-size:14px !important;line-height:17px !important;height:17px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-medium .g-pstyle3{line-height:19px !important;height:19px !important;text-align:center !important}#g-irs-examination-rate-medium .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-medium .g-pstyle5{font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-medium .g-pstyle6{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-medium .g-pstyle7{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:19px !important;height:19px !important;text-align:right !important}#g-irs-examination-rate-medium .g-pstyle8{line-height:17px !important;height:17px !important}#g-irs-examination-rate-medium .g-pstyle9{line-height:19px !important;height:19px !important}#g-irs-examination-rate-medium .g-pstyle10{font-size:14px !important;line-height:16px !important;height:16px !important}#g-irs-examination-rate-large{position:relative;overflow:hidden}#g-irs-examination-rate-large p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;font-size:16px !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-irs-examination-rate-large .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:20px !important;line-height:24px !important;height:24px !important}#g-irs-examination-rate-large .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:19px !important;height:19px !important;text-align:center !important}#g-irs-examination-rate-large .g-pstyle2{line-height:19px !important;height:19px !important;text-align:center !important}#g-irs-examination-rate-large .g-pstyle3{font-size:14px !important;line-height:17px !important;height:17px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-large .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:19px !important;height:19px !important;text-align:right !important}#g-irs-examination-rate-large .g-pstyle5{line-height:17px !important;height:17px !important}#g-irs-examination-rate-large .g-pstyle6{line-height:19px !important;height:19px !important}#g-irs-examination-rate-large .g-pstyle7{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important;text-align:right !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-large .g-pstyle8{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-large .g-pstyle9{font-size:14px !important;line-height:17px !important;height:17px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-irs-examination-rate-large .g-pstyle10{font-size:14px !important;line-height:16px !important;height:16px !important}

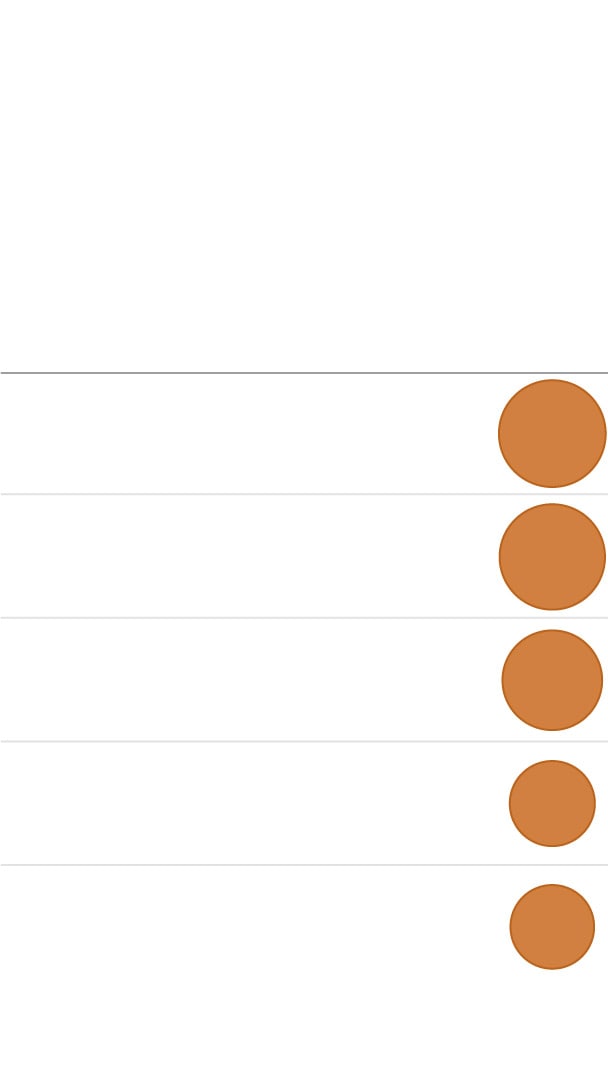

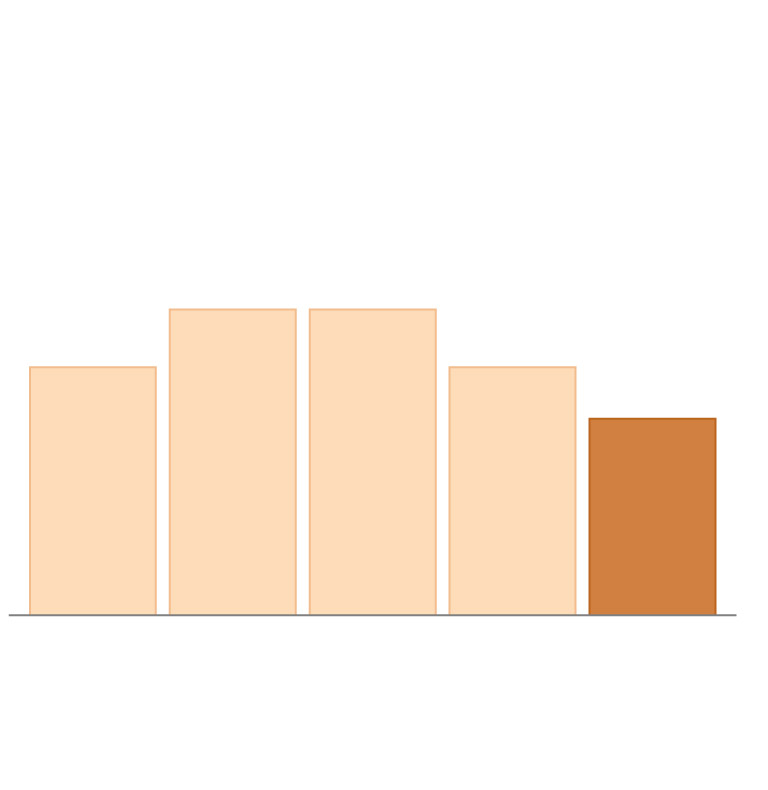

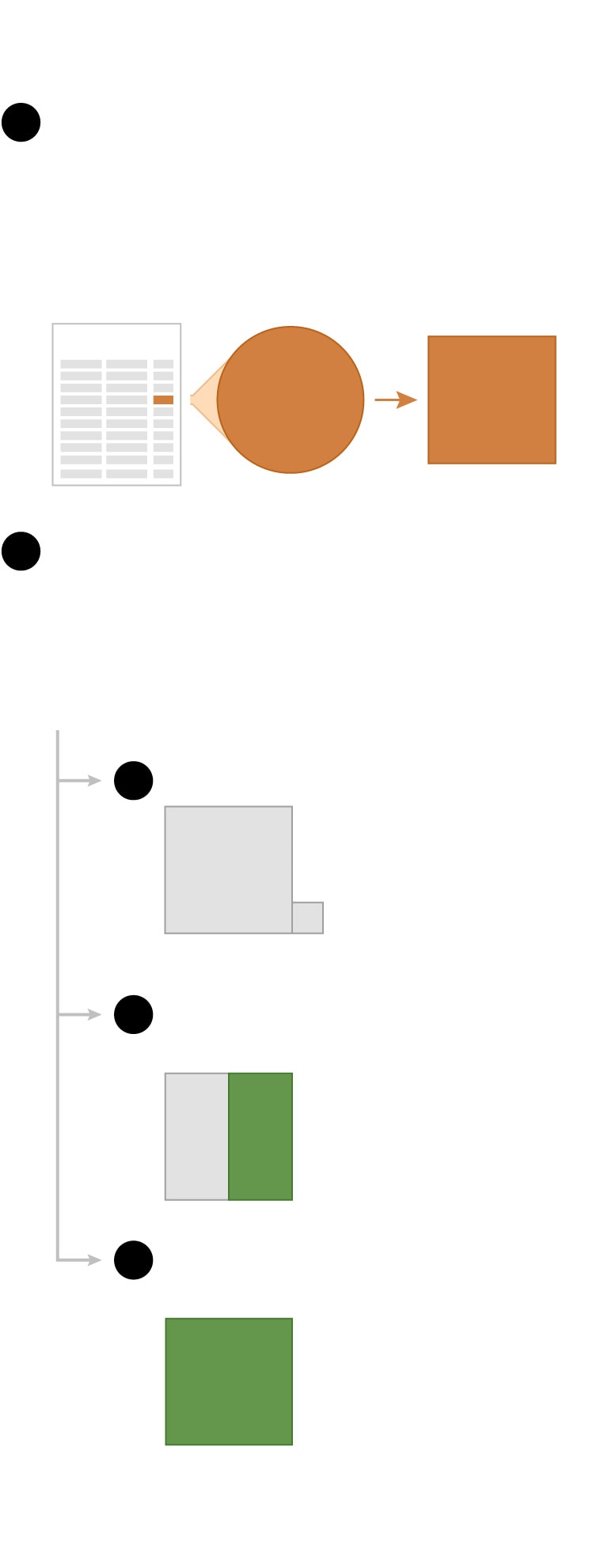

Companies are taking more

tax breaks …

Balance of unrecognized tax benefits

at the end of each year, among current

S&P 500 companies

… but the IRS examines fewer corporate tax returns

The number of returns examined

per 100 filed

Sources: Tax break data is from Calcbench.

Examination rate is an analysis of IRS data.

Companies are taking more tax breaks …

Balance of unrecognized tax benefits at the end of each year, among current S&P 500 companies

… but the IRS examines fewer corporate tax returns

Number of IRS examinations per 100 returns filed

Sources: Tax break data is from Calcbench.

Examination rate is an analysis of IRS data.

Companies are taking more tax breaks …

Balance of unrecognized tax benefits at the end of each year,

among current S&P 500 companies

… but the IRS examines fewer corporate tax returns

Number of IRS examinations per 100 returns filed

Sources: Tax break data is from Calcbench. Examination rate is an analysis of IRS data.

Companies took more tax breaks …

… but the IRS examines fewer corporate tax returns

Balance of unrecognized tax benefits at the end of each year, among current S&P 500 companies

Number of IRS examinations per 100 returns filed

Sources: Tax break data is from Calcbench. Examination rate is an analysis of IRS data.

#g-irs-examination-rate-xxsmall{display:none}@media (max-width:383px) and (min-width:260px){#g-irs-examination-rate-xxsmall{display:block}}#g-irs-examination-rate-xsmall{display:none}@media (max-width:639px) and (min-width:384px){#g-irs-examination-rate-xsmall{display:block}}#g-irs-examination-rate-medium{display:none}@media (max-width:959px) and (min-width:640px){#g-irs-examination-rate-medium{display:block}}#g-irs-examination-rate-large{display:none}@media (min-width:960px){#g-irs-examination-rate-large{display:block}}

This pattern — audits down, tax breaks up — shows how the IRS is increasingly outmatched. Gray areas in the tax code give businesses latitude when calculating their tax breaks, and it’s up to authorities to check them. But U.S. corporations, bolstered by armies of accountants and lawyers, may be rolling the dice on controversial interpretations of tax laws knowing the IRS is less equipped to pose a challenge, said Erin Towery, an associate professor of accounting at the University of Georgia.

“If companies perceive that the IRS is less likely to challenge their aggressive tax positions because of resource constraints, they may claim more aggressive tax positions,” said Towery, who researches corporate tax compliance.

The reduction in the IRS budget — largely the result of GOP hostility toward the agency — sapped the federal government of corporate tax revenue, researchers have found. With fewer audits, some tax breaks are never reviewed before the statute of limitations expires and businesses claim the savings on their earnings statements.

President Biden has proposed boosting IRS funding as part of an effort to increase U.S. tax revenue, an idea now at the heart of bipartisan efforts to raise money for federal infrastructure spending. Tax policy experts think more aggressive IRS enforcement — including new staff, training, increased reporting requirements and modern technology — could help the agency close the gap between what people pay and what they owe.

Charles P. Rettig, the IRS commissioner appointed by President Donald Trump who is still serving in that role under Biden, acknowledged in Senate testimony last month that the agency needs more resources to go after corporations and wealthy individuals who avoid paying taxes. A spokesman for the agency declined to answer questions about tax enforcement at individual companies.

Some of the same conservative groups that waged war on the IRS years ago are mobilizing against added funding. Expanded tax collection, they argue, would give the agency too much power to pry into the finances of small businesses and wealthy Americans.

[Conservative groups mount opposition to increase in IRS budget]

But when it comes to large businesses, the IRS already has a trove of financial data that could help it identify ripe targets for stricter enforcement.

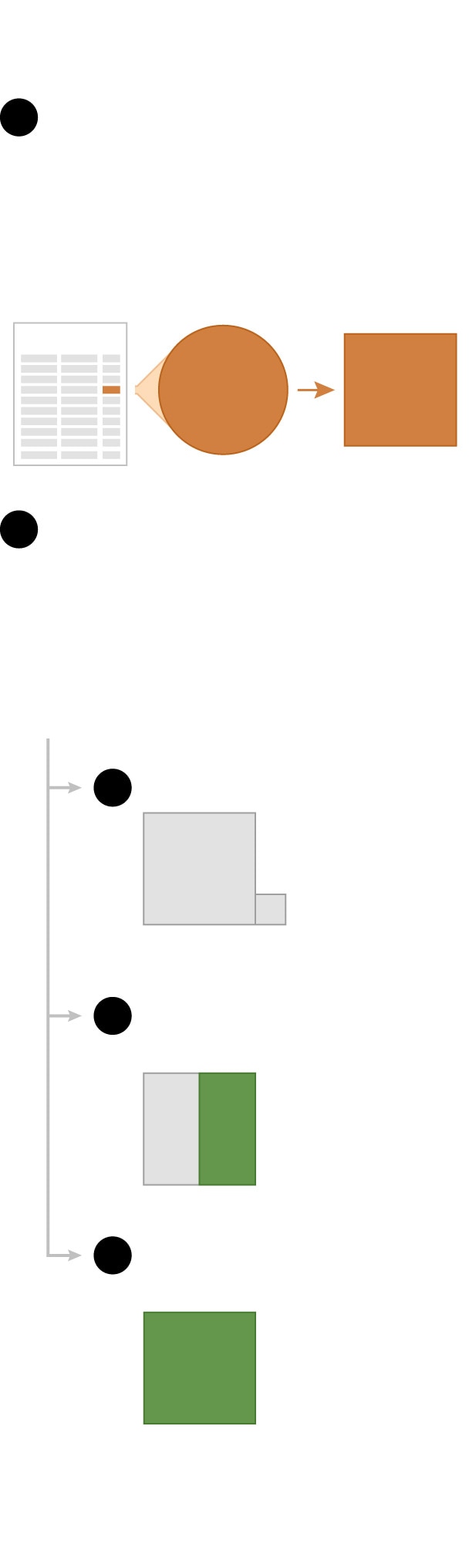

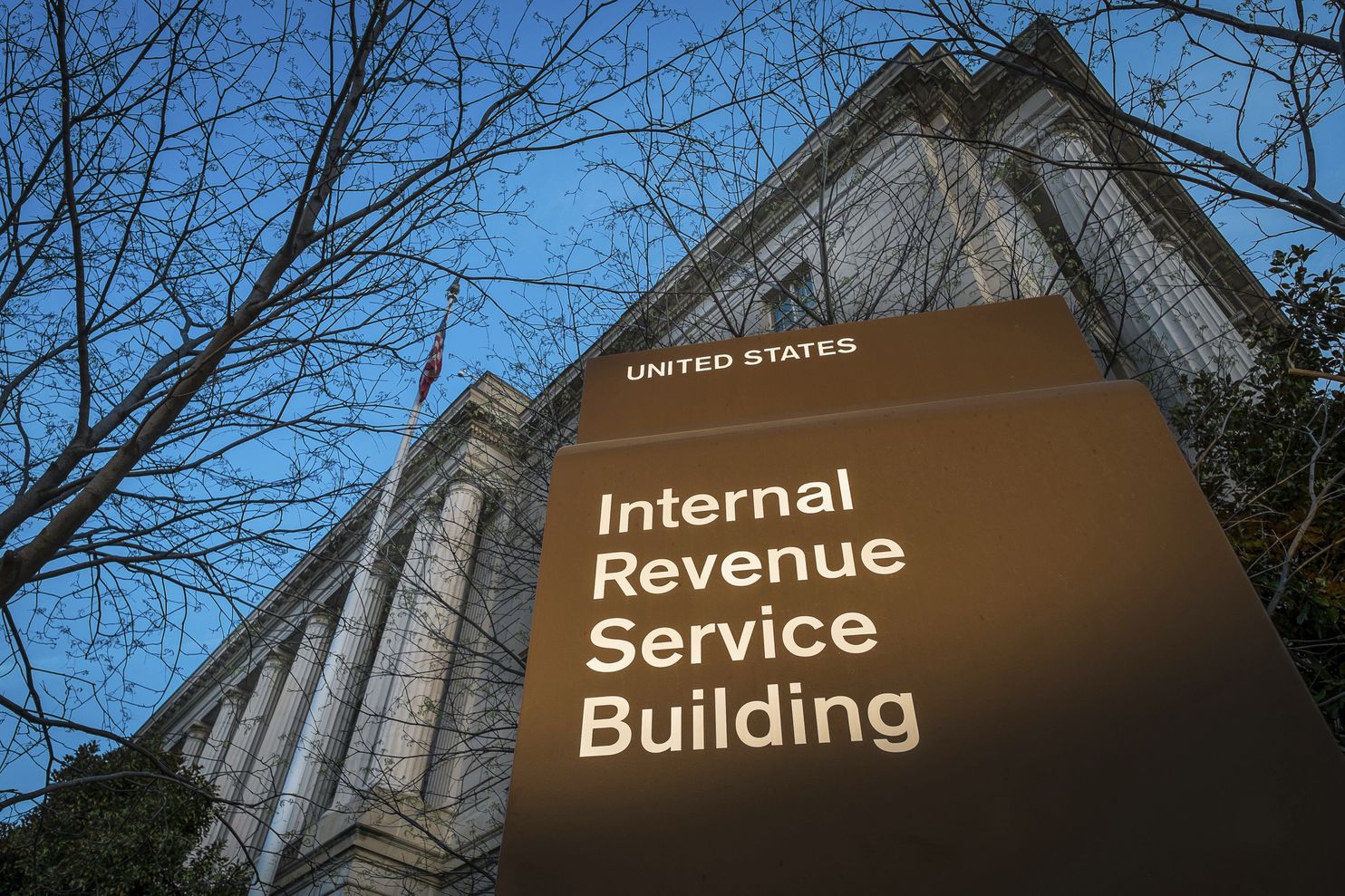

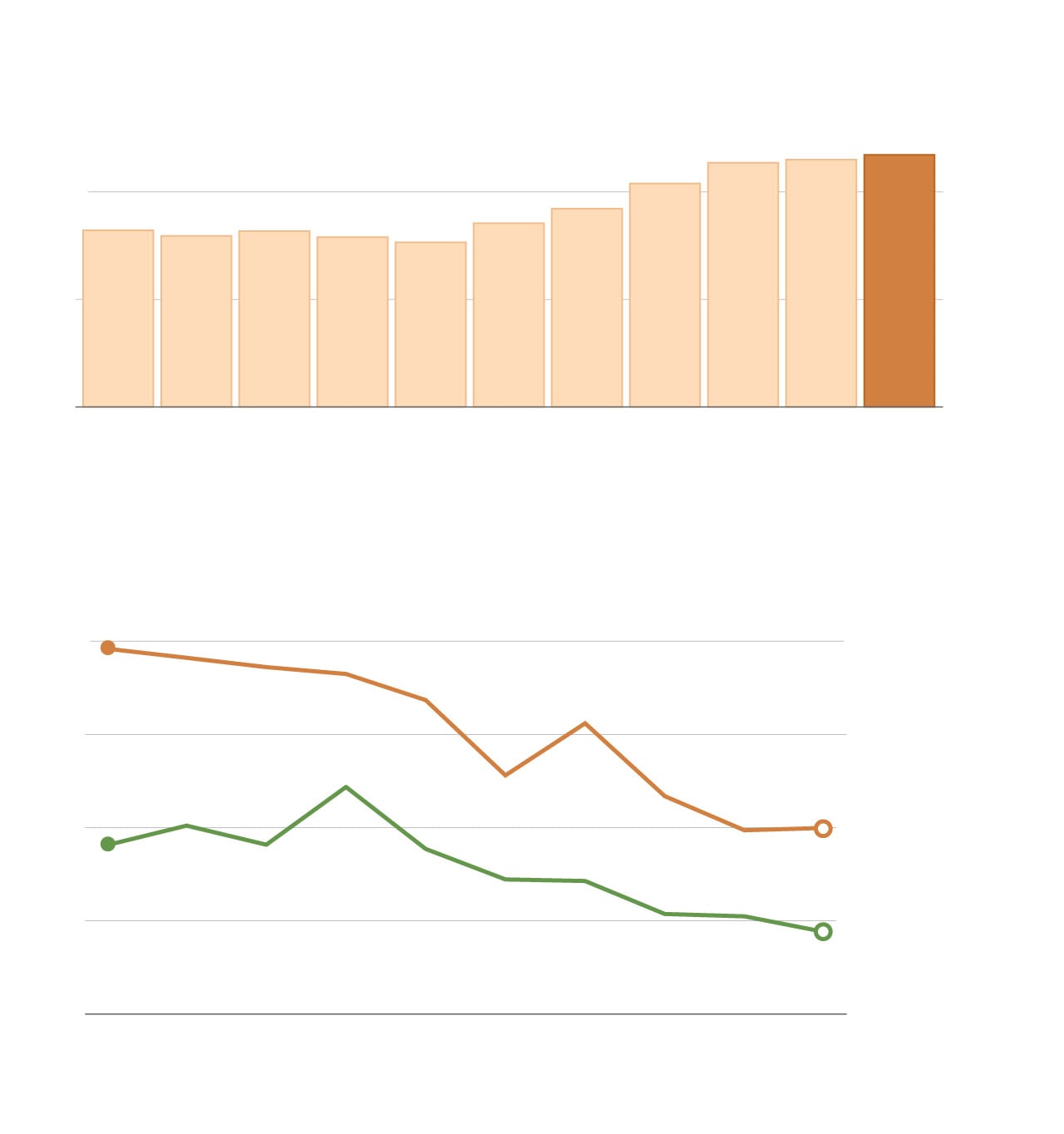

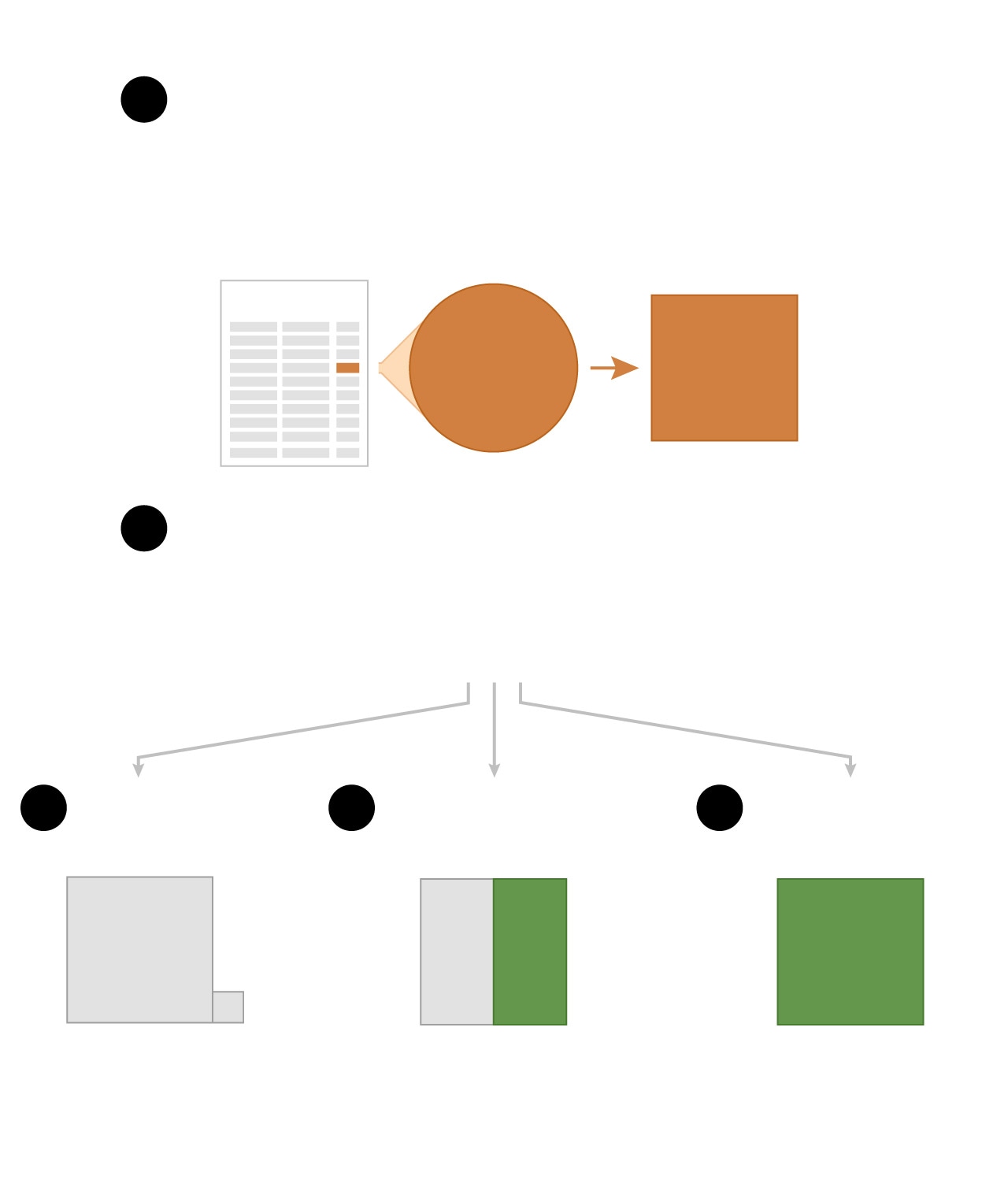

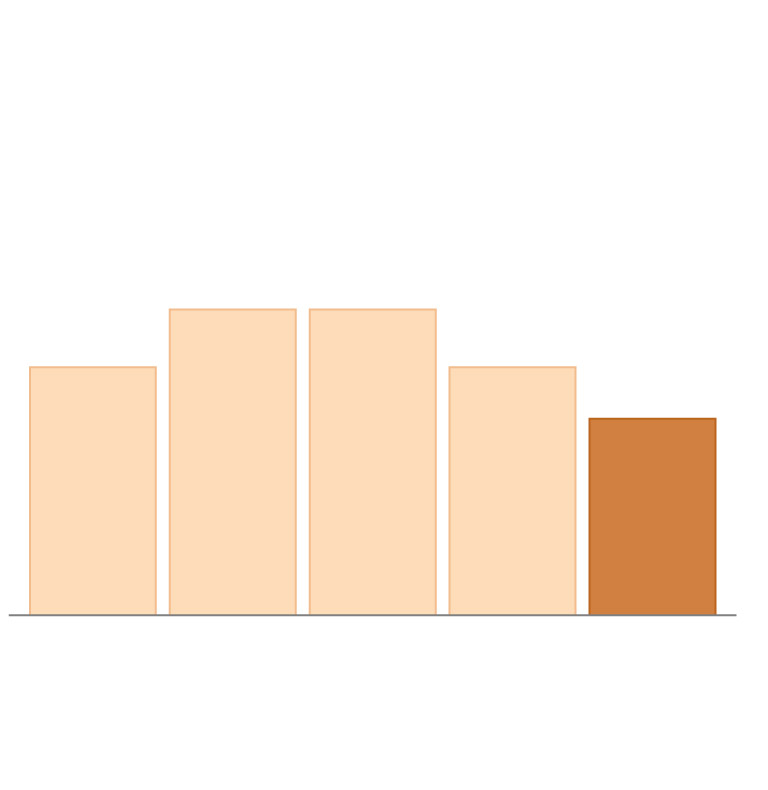

Since 2007, publicly traded firms have been required to estimate the likelihood of each tax benefit they take being rejected or approved by authorities, according to the Financial Accounting Standards Board. Any tax break with a greater than 50 percent likelihood of rejection is identified by the company as an unrecognized tax benefit. When making these assessments, companies are supposed to assume that all tax breaks will be examined by an authority.

#g-how-utb-works-box,#g-how-utb-works-box .g-artboard{margin:0 auto}#g-how-utb-works-box p{margin:0}#g-how-utb-works-box .g-aiAbs{position:absolute}#g-how-utb-works-box .g-aiImg{position:absolute;top:0;display:block;width:100% !important}#g-how-utb-works-box .g-aiSymbol{position:absolute;box-sizing:border-box}#g-how-utb-works-box .g-aiPointText p{white-space:nowrap}#g-how-utb-works-xxsmall{position:relative;overflow:hidden}#g-how-utb-works-xxsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:21px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:16px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-how-utb-works-xxsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:22px !important;font-size:20px !important}#g-how-utb-works-xxsmall .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:21px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-xxsmall .g-pstyle2{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:14px !important;height:14px !important;font-size:12px !important;text-align:center !important}#g-how-utb-works-xxsmall .g-pstyle3{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:15px !important;height:15px !important;font-size:12px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-xxsmall .g-pstyle4{height:21px !important}#g-how-utb-works-xxsmall .g-pstyle5{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:15px !important;height:15px !important;font-size:12px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-how-utb-works-xxsmall .g-pstyle6{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:17px !important;height:17px !important;font-size:12px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-how-utb-works-xsmall{position:relative;overflow:hidden}#g-how-utb-works-xsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:21px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:16px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-how-utb-works-xsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:22px !important;font-size:20px !important}#g-how-utb-works-xsmall .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:21px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-xsmall .g-pstyle2{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:14px !important;height:14px !important;font-size:12px !important;text-align:center !important}#g-how-utb-works-xsmall .g-pstyle3{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:17px !important;height:17px !important;font-size:14px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-xsmall .g-pstyle4{height:21px !important}#g-how-utb-works-xsmall .g-pstyle5{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:17px !important;height:17px !important;font-size:14px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-how-utb-works-xsmall .g-pstyle6{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:15px !important;height:15px !important;font-size:14px !important;text-align:center !important;color:rgb(98,98,98) !important}#g-how-utb-works-xsmall .g-pstyle7{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:15px !important;height:15px !important;font-size:14px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-medium{position:relative;overflow:hidden}#g-how-utb-works-medium p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:21px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:18px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-how-utb-works-medium .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:26px !important;font-size:22px !important}#g-how-utb-works-medium .g-pstyle1{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:21px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-medium .g-pstyle2{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:15px !important;height:15px !important;font-size:12px !important;text-align:center !important}#g-how-utb-works-medium .g-pstyle3{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:17px !important;height:17px !important;font-size:14px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-how-utb-works-medium .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:17px !important;height:17px !important;font-size:14px !important;text-align:center !important;color:rgb(98,98,98) !important}

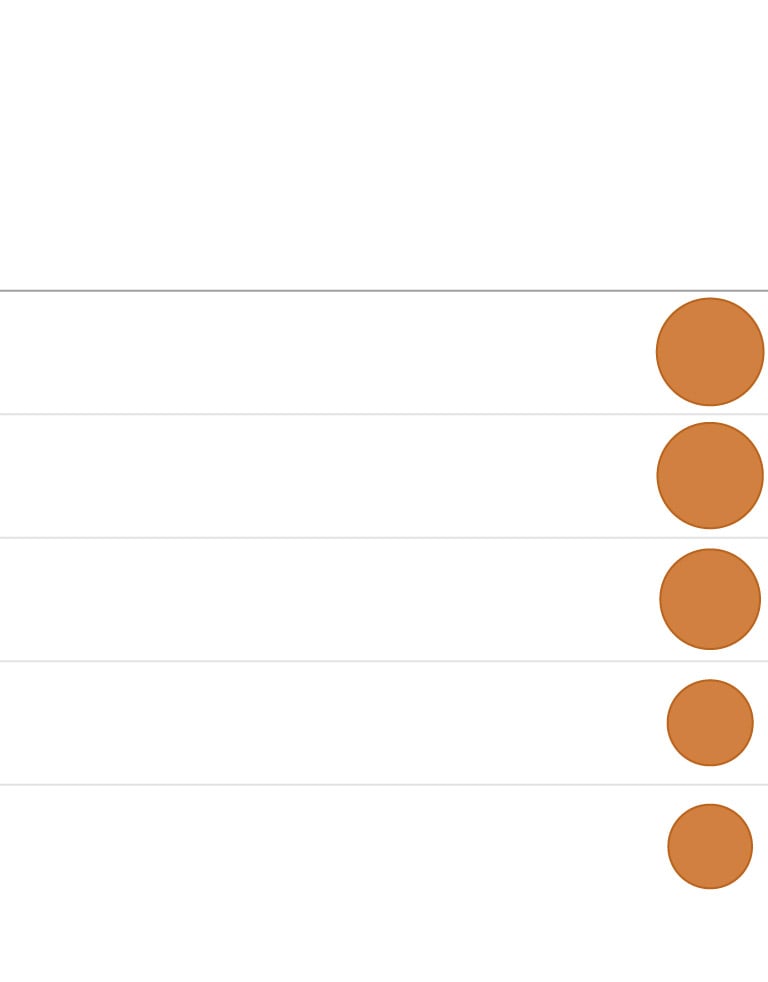

How companies lower their tax bills with ‘uncertain’ deductions

A company claims a tax break. The company estimates the tax break has a greater than 50 percent likelihood of being rejected by tax authorities. The company sets aside the tax benefit in a reserve.

$$$$

Unapproved

tax break

The clock starts ticking as the company waits for the tax break to be challenged. Typically the Internal Revenue Service has three years to audit.

A few things can happen from here.

The IRS could …

Approve some or all

of the tax break

Fail to review the

tax break in time

In these last two cases, the tax break becomes profit on the company’s earnings statement.

How companies lower their tax bills with ‘uncertain’ deductions

A company claims a tax break. The company estimates the tax break has a greater than 50 percent likelihood of being rejected by tax authorities. The company sets aside the tax benefit in a reserve.

$$$$

Unapproved

tax break

The clock starts ticking as the company waits for the tax break to be challenged. Typically the Internal Revenue Service has three years to audit.

A few things can happen from here.

The IRS could …

Approve some or all

of the tax break

Fail to review the

tax break in time

In these last two cases, the tax break becomes profit on the company’s earnings statement.

How companies lower their tax bills with ‘uncertain’ deductions

A company claims a tax break. The company estimates the tax break has a greater than 50 percent likelihood of being rejected by tax authorities. The company sets aside the tax benefit in a reserve.

$$$$

Unapproved

tax break

The clock starts ticking as the company waits for the tax break to be challenged. Typically the Internal Revenue Service has three years to audit.

A few things can happen from here. The IRS could …

Approve some or all of the tax break

Fail to review the tax break in time

In these two cases, the tax break becomes profit on the company’s earnings statement.

#g-how-utb-works-xxsmall{display:none}@media (max-width:383px) and (min-width:0){#g-how-utb-works-xxsmall{display:block}}#g-how-utb-works-xsmall{display:none}@media (max-width:639px) and (min-width:384px){#g-how-utb-works-xsmall{display:block}}#g-how-utb-works-medium{display:none}@media (min-width:640px){#g-how-utb-works-medium{display:block}}

Several experts compared an unrecognized tax benefit to a loan from the IRS, because the company eventually may have to pay back the savings, along with interest. When the IRS takes no action, or reviews the tax break and gives approval, the “loan” is essentially forgiven.

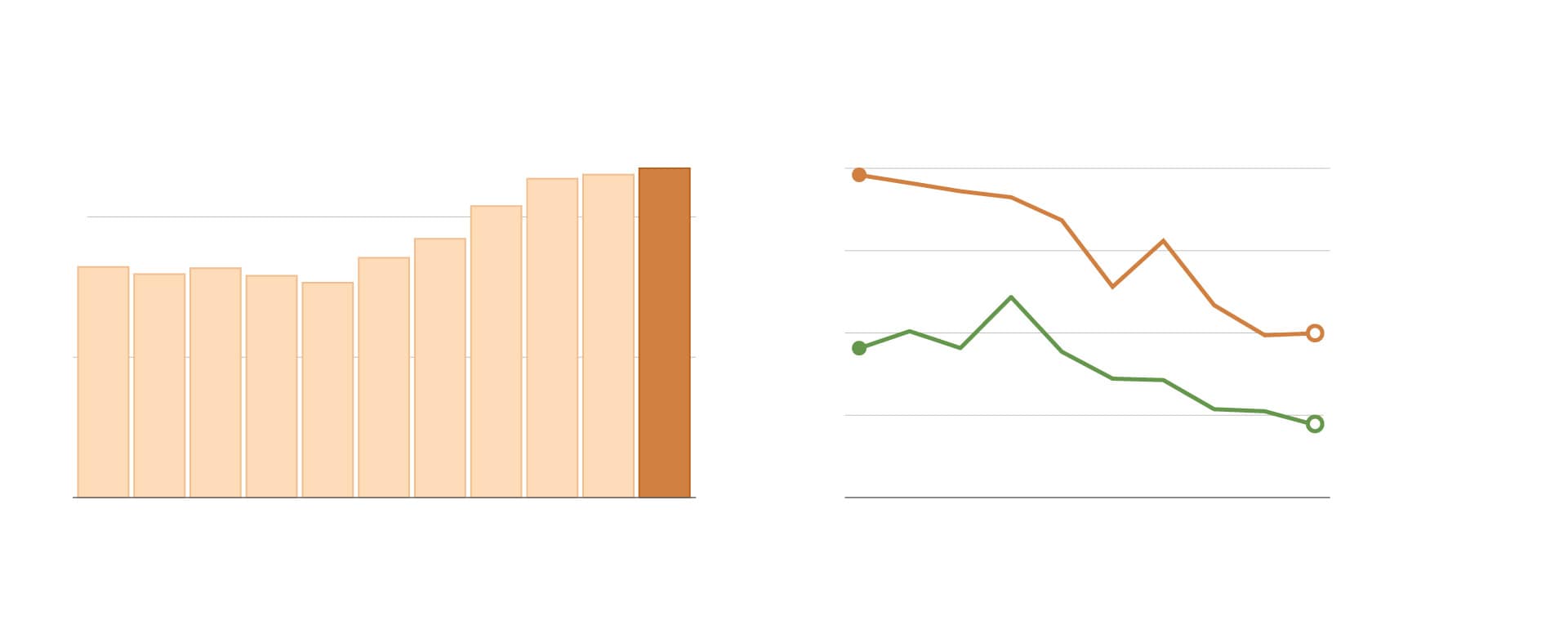

Broadcom, one of the world’s largest semiconductor manufacturers, paid zero income taxes the past two years despite generating $5.7 billion in profit over that period, regulatory filings show. Part of the reason, Broadcom has said, is because authorities never got around to auditing tax breaks the company took but acknowledged were not certain to be approved.

The chipmaker has collected billions of dollars in unrecognized tax benefits, including from its 2015 merger with rival chipmaker Avago. The company described that deal as “tax-free” to Broadcom shareholders even though U.S. companies typically owe the IRS when they acquire shares of another company. Broadcom, which had been based in San Jose, said it became a Singapore-based company when it merged with Singapore-based Avago, freeing it from paying any U.S. taxes on the deal. It relocated its headquarters back to California three years later.

When the deadline expired on some of Broadcom’s tax returns last year, the company recorded a $95 million gain because of “lapses of statutes of limitations,” it said in a filing, without indicating which tax break went unchallenged.

Broadcom did not respond to multiple requests for comment. The company told investors in its most recent annual report that the IRS may still require it to pay taxes on the Avago deal.

One challenge for the IRS is that each company tends to interpret tax laws differently, says Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy, a left-leaning Washington nonprofit organization. Corporate accountants are “exercising their own judgment about what constitutes [an unrecognized tax benefit] and what is not,” Gardner said.

Sometimes several companies all push for similar tax breaks, such as when large drug firms recently told investors they planned to deduct a portion of the cost of their multibillion-dollar opioid legal settlements from their taxes. U.S. tax laws generally restrict companies from deducting the cost of legal settlements from their taxes, with the exception of damages paid to victims as restitution for misdeeds. Cardinal Health, McKesson and AmerisourceBergen all labeled a portion of the deductions “unrecognized” because they didn’t know if the entire tax break would be allowed.

Representatives of all three companies declined to comment.

[Drug companies seek billion-dollar tax deductions from opioid settlement]

Some of the biggest U.S. firms, including Apple, AT&T, Exxon and Facebook, report the most uncertain tax benefits, partly because of the sheer size and complexity of their businesses. Tax breaks requested from state, federal and foreign governments are all combined in the same total for most firms, and some unrecognized tax benefits reflect uncertainty about the timing of when a tax break will be allowed, not if it will be allowed.

An Apple spokesman said the company is the largest taxpayer in the world and has paid more than $100 billion in corporate income tax over the past decade. An AT&T spokesman said the company only takes tax positions that are “legally supportable.” Representatives from Exxon and Facebook did not respond to requests seeking comment.

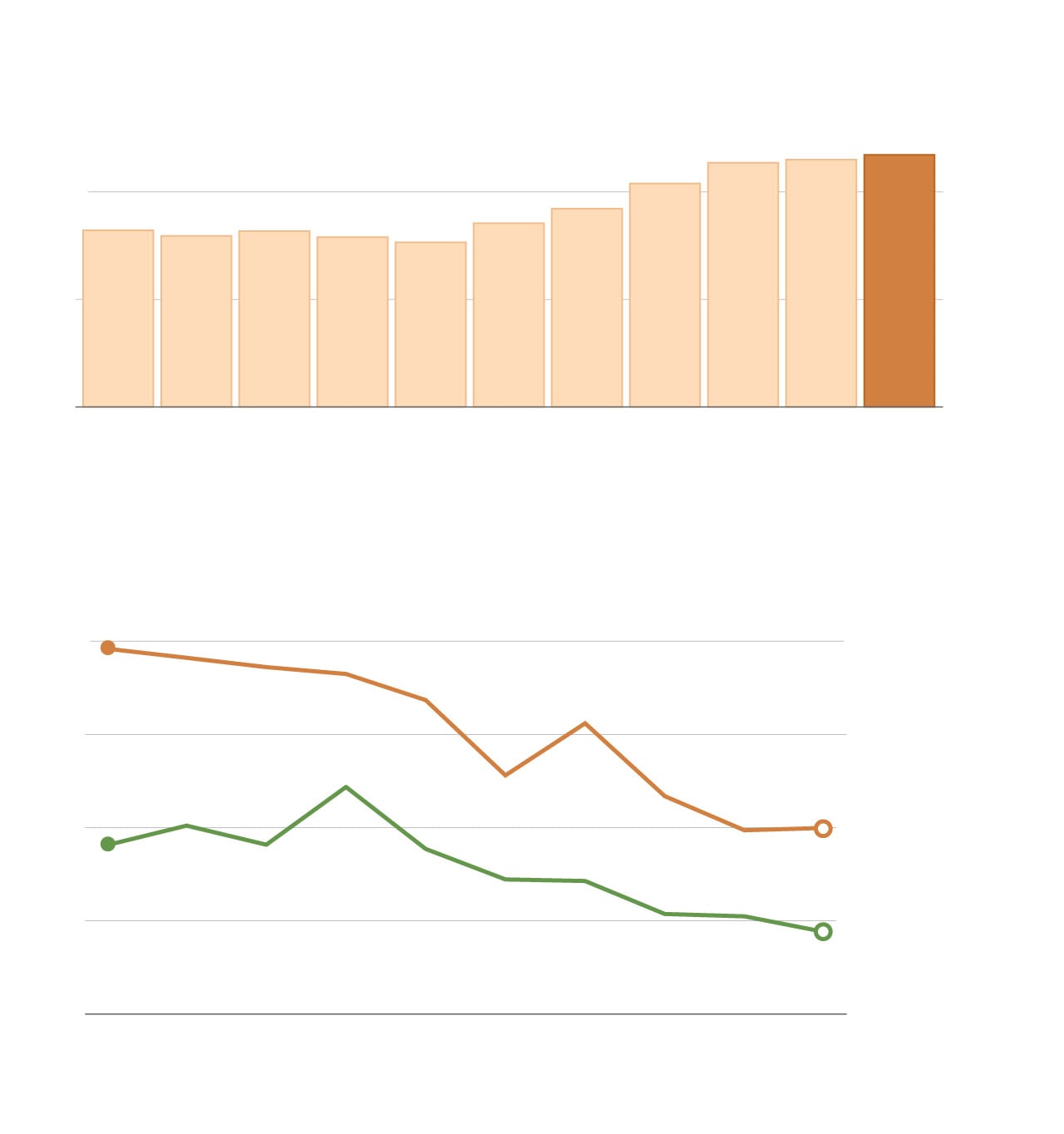

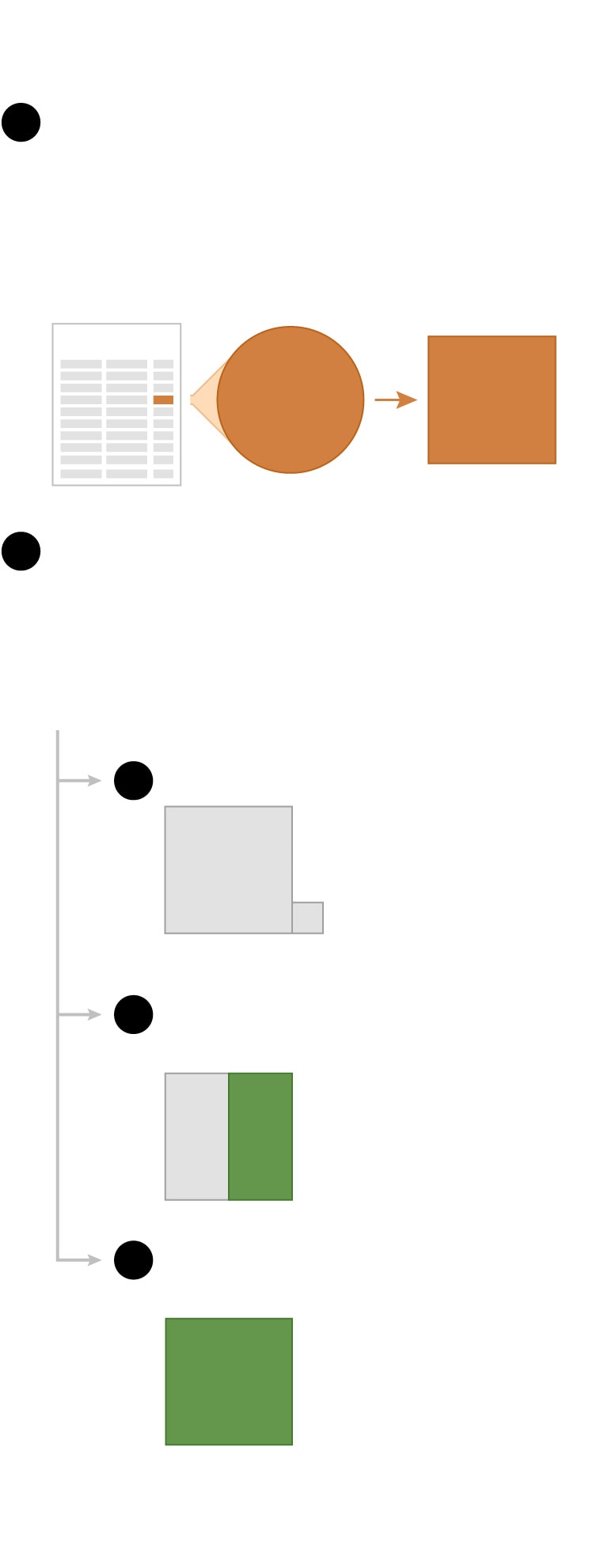

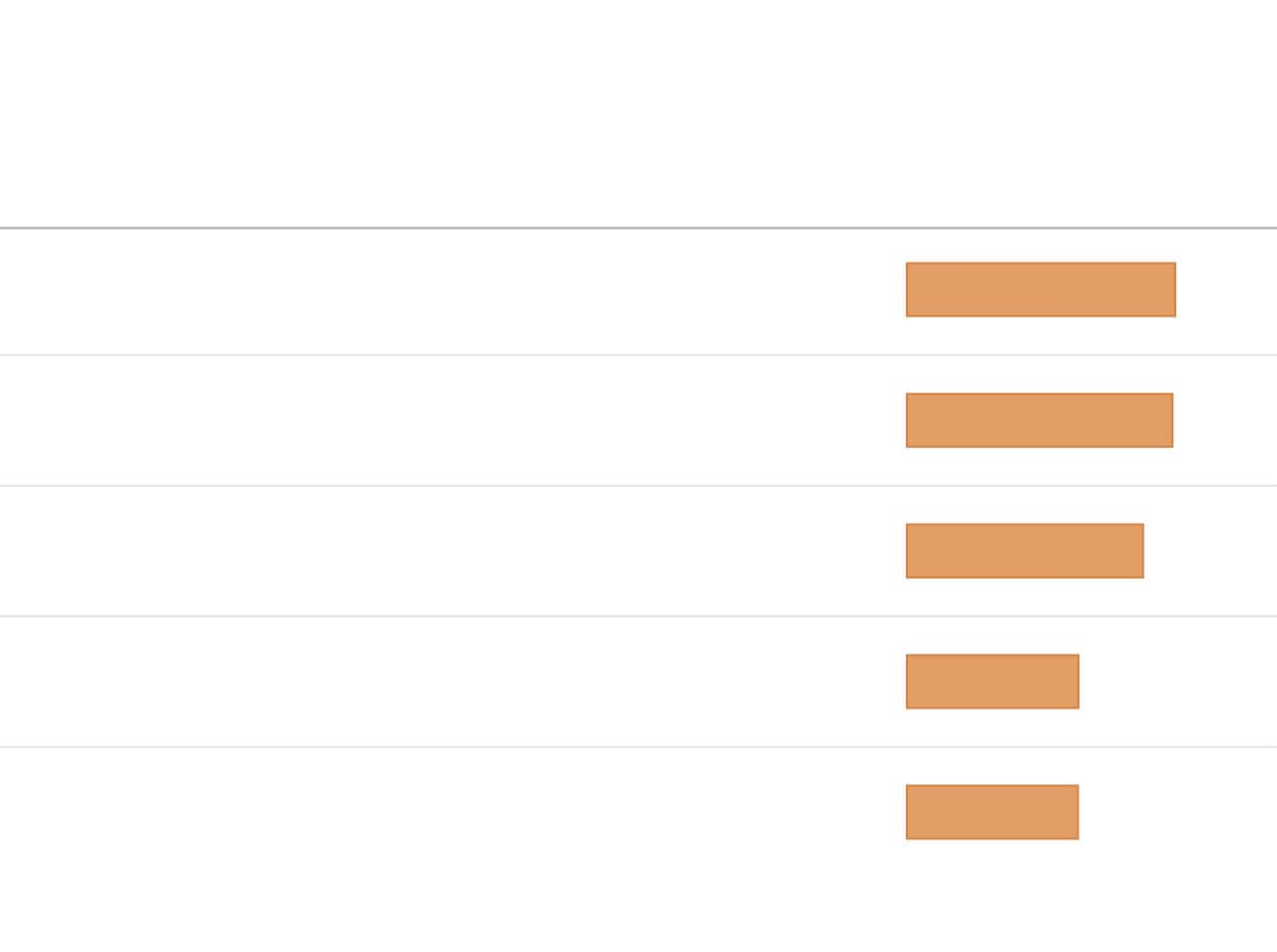

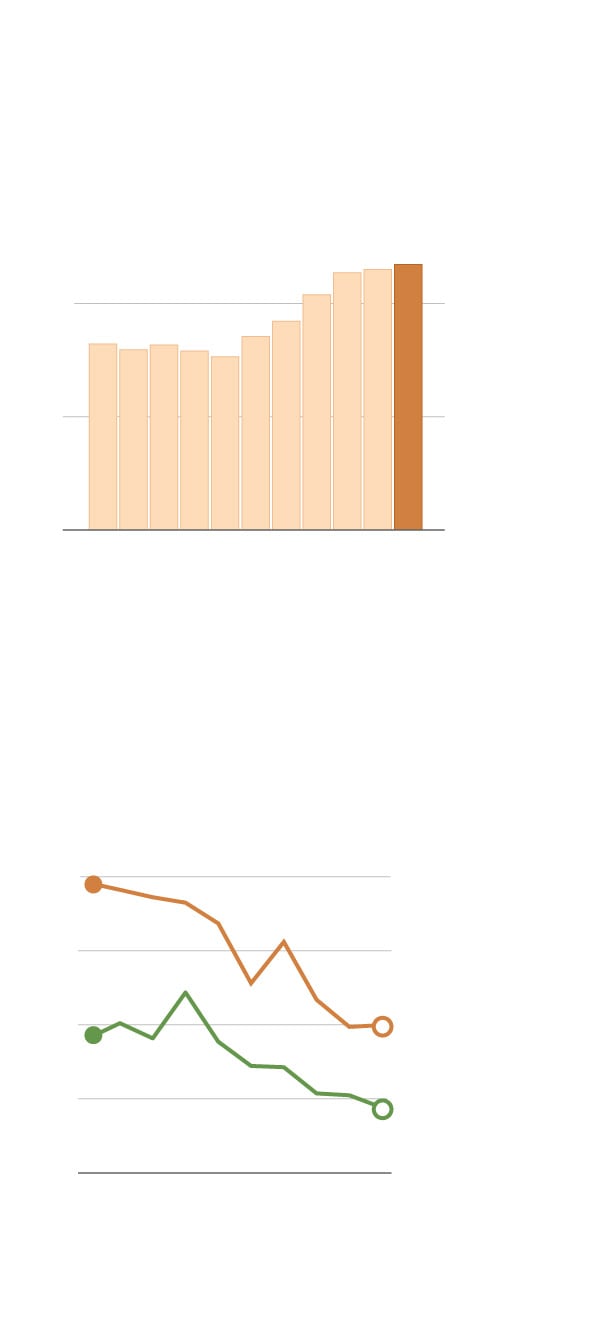

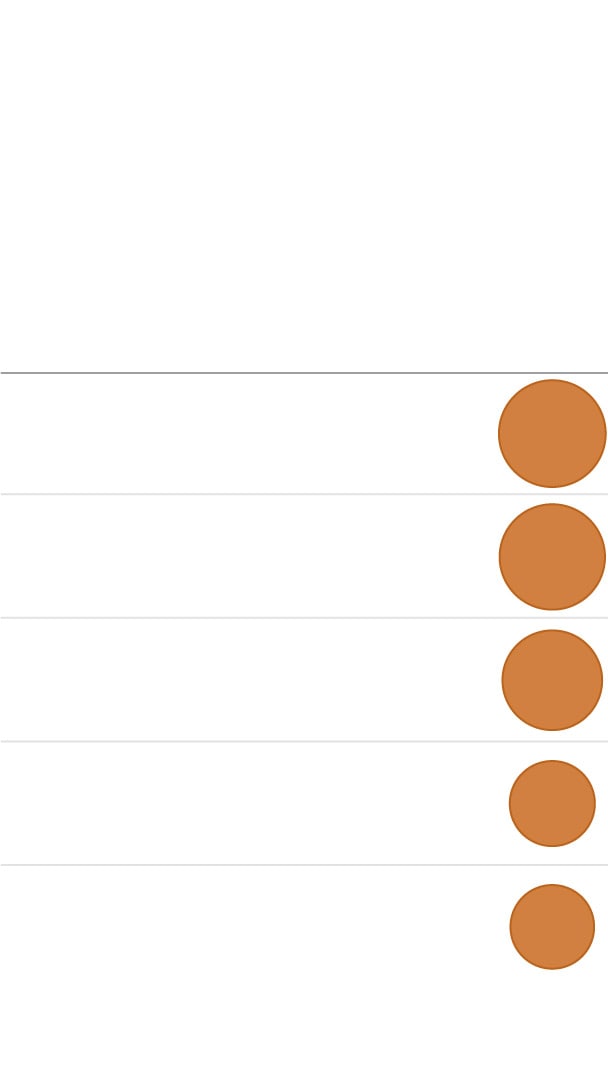

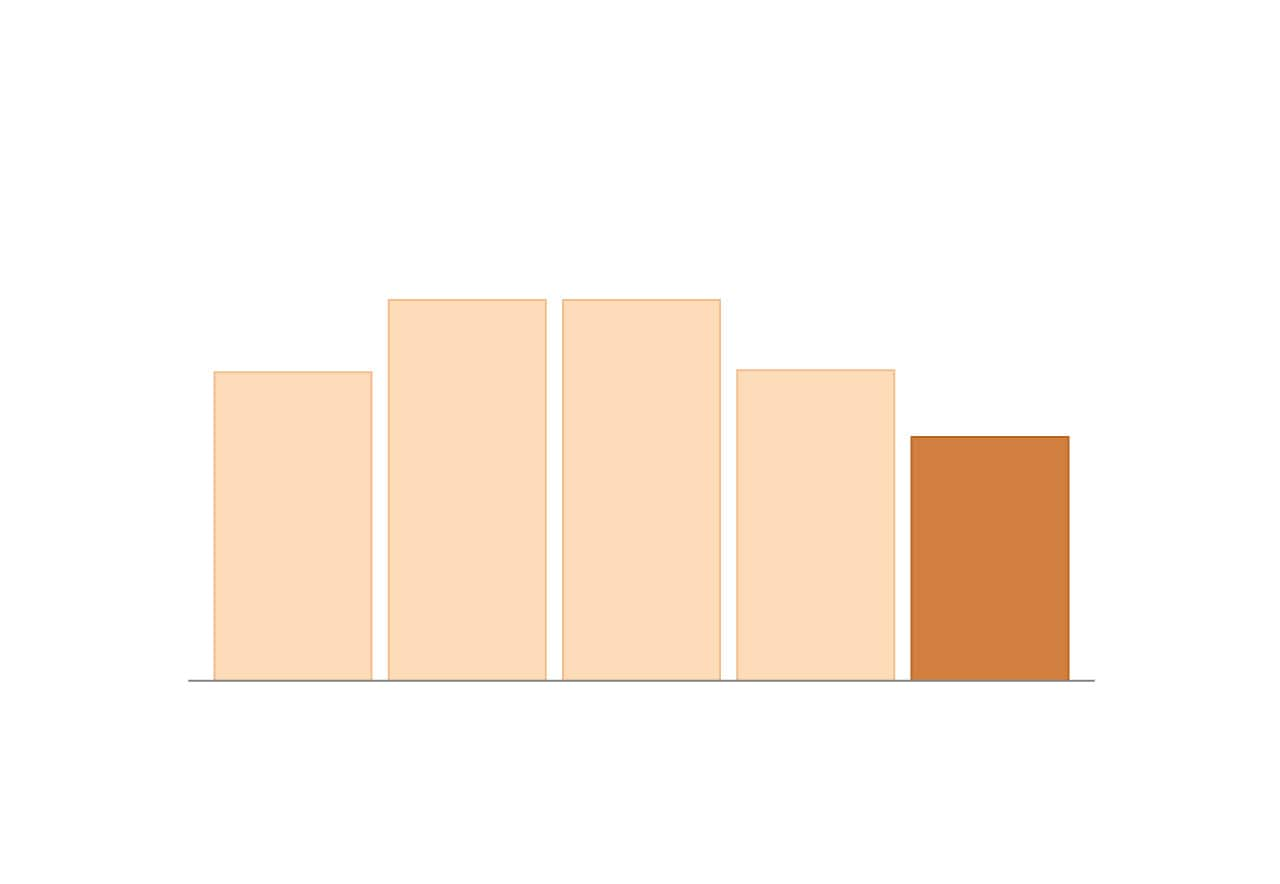

Another group of companies stands out for taking a large amount of unapproved tax breaks relative to the size of their businesses. Firms that are heavily loaded with tax uncertainty are potentially the kind of low-hanging fruit the IRS could go after with greater resources for enforcement, policy experts said.

#g-most-utb-box,#g-most-utb-box .g-artboard{margin:0 auto}#g-most-utb-box p{margin:0}#g-most-utb-box .g-aiAbs{position:absolute}#g-most-utb-box .g-aiImg{position:absolute;top:0;display:block;width:100% !important}#g-most-utb-box .g-aiSymbol{position:absolute;box-sizing:border-box}#g-most-utb-box .g-aiPointText p{white-space:nowrap}#g-most-utb-xxsmall{position:relative;overflow:hidden}#g-most-utb-xxsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:17px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:14px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-most-utb-xxsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:22px !important;height:22px !important;font-size:20px !important}#g-most-utb-xxsmall .g-pstyle1{line-height:20px !important;font-size:16px !important}#g-most-utb-xxsmall .g-pstyle2{line-height:14px !important;height:14px !important;font-size:12px !important;text-transform:uppercase !important}#g-most-utb-xxsmall .g-pstyle3{line-height:14px !important;height:14px !important;font-size:12px !important;text-align:right !important;text-transform:uppercase !important}#g-most-utb-xxsmall .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:17px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-most-utb-xxsmall .g-pstyle5{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:17px !important}#g-most-utb-xxsmall .g-pstyle6{height:17px !important}#g-most-utb-xxsmall .g-pstyle7{line-height:16px !important;height:16px !important}#g-most-utb-xsmall{position:relative;overflow:hidden}#g-most-utb-xsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:17px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:14px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-most-utb-xsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:22px !important;height:22px !important;font-size:20px !important}#g-most-utb-xsmall .g-pstyle1{line-height:20px !important;font-size:16px !important}#g-most-utb-xsmall .g-pstyle2{line-height:14px !important;height:14px !important;font-size:12px !important;text-transform:uppercase !important}#g-most-utb-xsmall .g-pstyle3{line-height:14px !important;height:14px !important;font-size:12px !important;text-align:right !important;text-transform:uppercase !important}#g-most-utb-xsmall .g-pstyle4{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:17px !important}#g-most-utb-xsmall .g-pstyle5{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;height:17px !important;text-align:center !important;color:rgb(255,255,255) !important}#g-most-utb-xsmall .g-pstyle6{height:17px !important}#g-most-utb-xsmall .g-pstyle7{line-height:16px !important;height:16px !important}#g-most-utb-medium{position:relative;overflow:hidden}#g-most-utb-medium p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:17px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:14px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-most-utb-medium .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:26px !important;height:26px !important;font-size:22px !important}#g-most-utb-medium .g-pstyle1{line-height:20px !important;font-size:16px !important}#g-most-utb-medium .g-pstyle2{height:17px !important;text-transform:uppercase !important}#g-most-utb-medium .g-pstyle3{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:19px !important;height:19px !important;font-size:16px !important}#g-most-utb-medium .g-pstyle4{height:17px !important}#g-most-utb-medium .g-pstyle5{line-height:16px !important;height:16px !important}

Five firms heavy on unapproved

tax breaks

Current S&P 500 companies with the most unrecognized tax benefits per $1 billion in assets

One example of

an unrecognized

tax benefit

Total UTBs per

$1B in assets

Deductions for costs of decommissioning nuclear plants

Deductions on

stock losses

Deductions on stock-

based compensation

Tax-free merger with Avago and tax-free relocation from Singapore to U.S.

Deduction for costs of settling asbestos lawsuit

Sources: Analysis of data provided by Calcbench,

SEC filings

Five firms heavy on unapproved

tax breaks

Current S&P 500 companies with the most unrecognized tax benefits per $1 billion in assets

One example of an

unrecognized tax benefit

Total UTBs per

$1B in assets

Deductions for costs of decommissioning nuclear plants

Deductions on stock losses

Deductions on stock-based

compensation

Tax-free merger with Avago and tax-free relocation from Singapore to U.S.

Deduction for costs of settling asbestos lawsuit

Sources: Analysis of data provided by Calcbench, SEC filings

Five firms heavy on unapproved tax breaks

Current S&P 500 companies with the most unrecognized tax benefits per $1 billion in assets

One example of an

unrecognized tax benefit

Total Unrecognized tax

benefits per $1B in assets

Deductions for costs of decommissioning nuclear plants

Deductions on stock losses

Deductions on stock-based compensation

Tax-free merger with Avago and tax-free relocation from Singapore to U.S.

Deduction for costs of settling asbestos lawsuit

Sources: Analysis of data provided by Calcbench, SEC filings

#g-most-utb-xxsmall{display:none}@media (max-width:383px) and (min-width:0){#g-most-utb-xxsmall{display:block}}#g-most-utb-xsmall{display:none}@media (max-width:639px) and (min-width:384px){#g-most-utb-xsmall{display:block}}#g-most-utb-medium{display:none}@media (min-width:640px){#g-most-utb-medium{display:block}}

A high volume of these tax breaks can signify that a company is taking more risk, said Dave Zion, who advises investors on how to assess the tax risks of publicly traded companies. “It’s an indicator of companies potentially pushing the envelope,” Zion said.

Power company Entergy, for example, took $3 billion in uncertain tax benefits when it adopted a “new method of accounting” for the costs of shutting down nuclear plants in 2015, a filing showed. Last year, the IRS partly denied this accounting method, forcing Entergy to pay the government about $2 billion plus interest — and letting it keep $1 billion in tax breaks, the filing said.

Jerry Nappi, a spokesman for Entergy, said the company seeks “ways to minimize the company’s tax burden” and passes those savings on to customers in the form of lower rates. He said the portion of the tax break allowed by the IRS resulted in a “significant benefit to customers.”

Among the other companies with a high proportion of uncertain tax benefits to assets are cybersecurity firm NortonLifeLock, packaging material manufacturer Sealed Air and flooring maker Mohawk Industries.

NortonLifeLock spokesman Jared Nelson said in an emailed statement the company’s current proportion of unrecognized tax benefits to assets is “distorted” because NortonLifeLock recently sold a large amount of assets but kept the tax breaks on its books. “We expect this ratio to be significantly lower moving forward,” he said.

A spokeswoman for Sealed Air declined to comment. A spokesman for Mohawk Industries did not respond to requests seeking comment.

[IRS faces 35 million unprocessed tax returns as backlog swells, watchdog says]

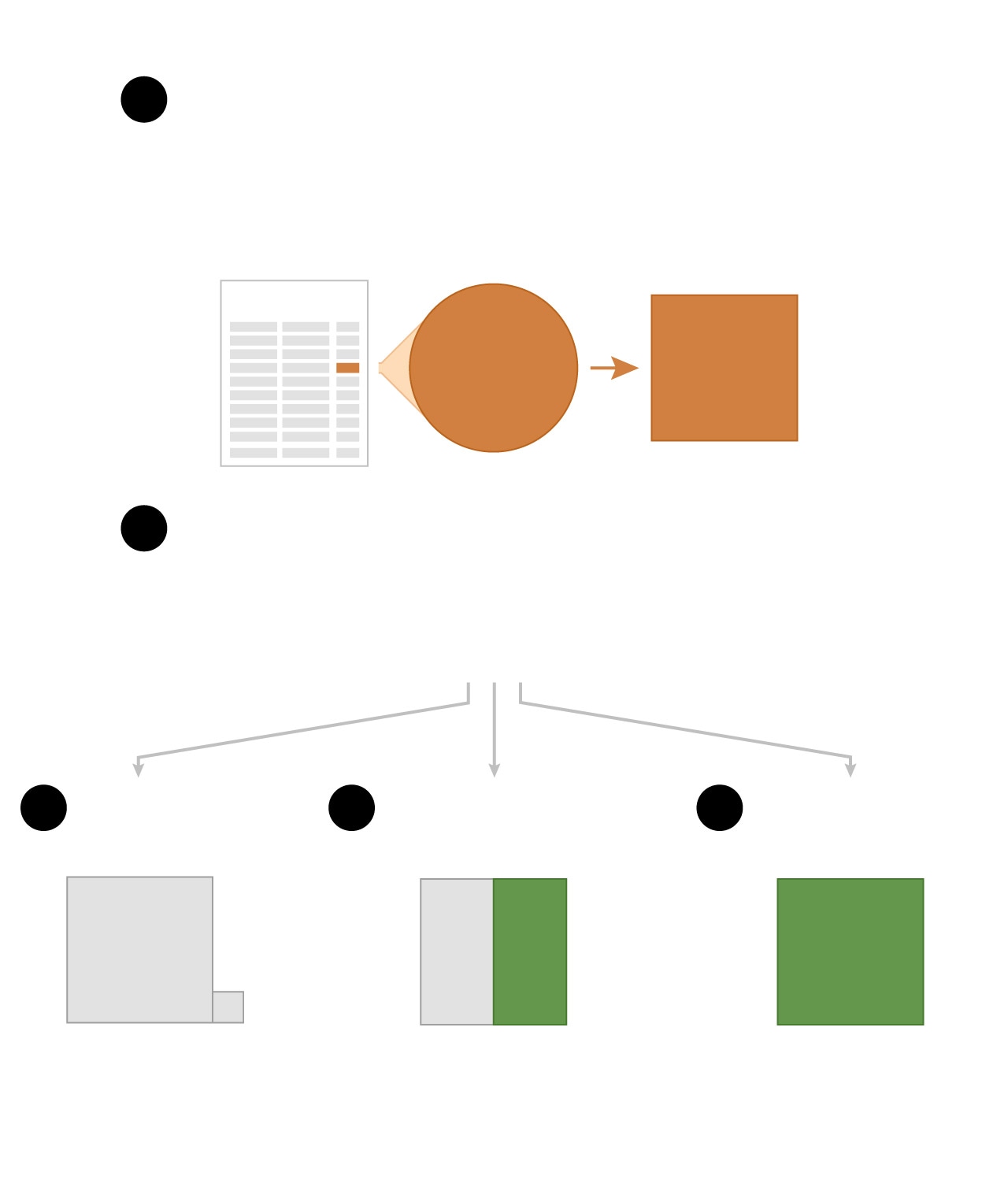

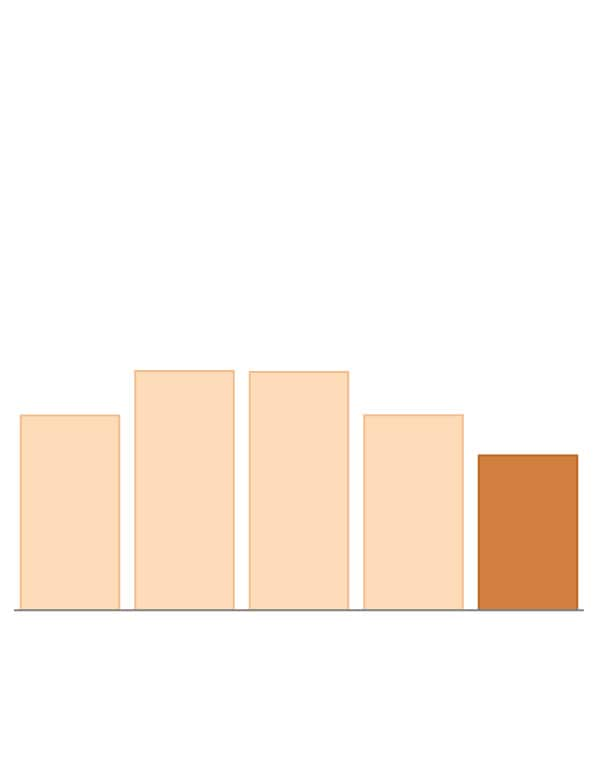

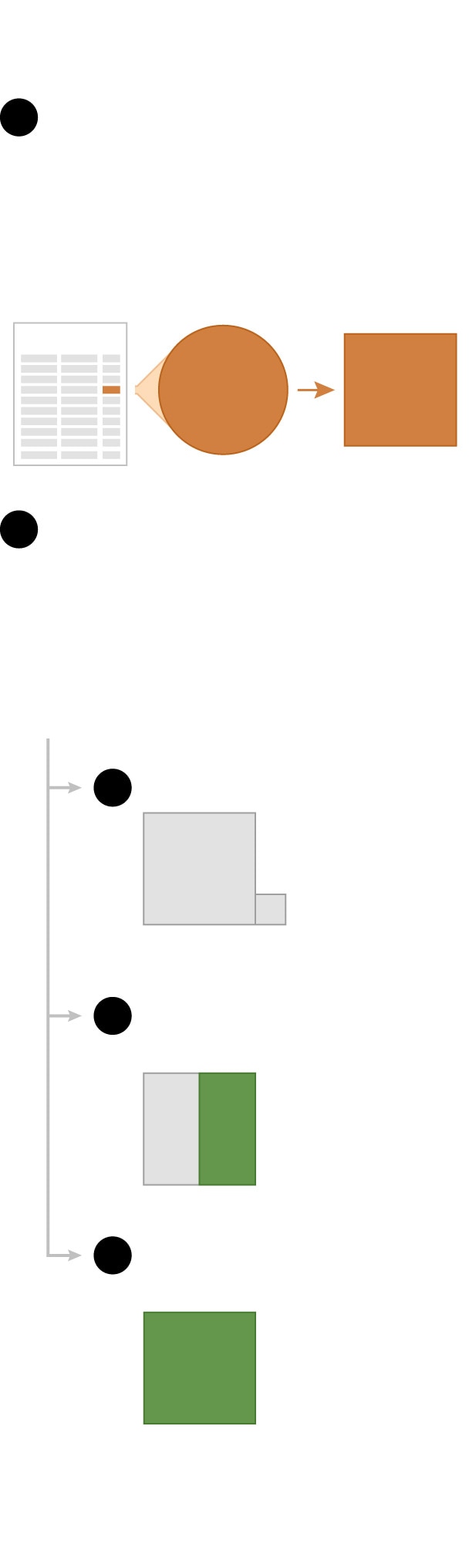

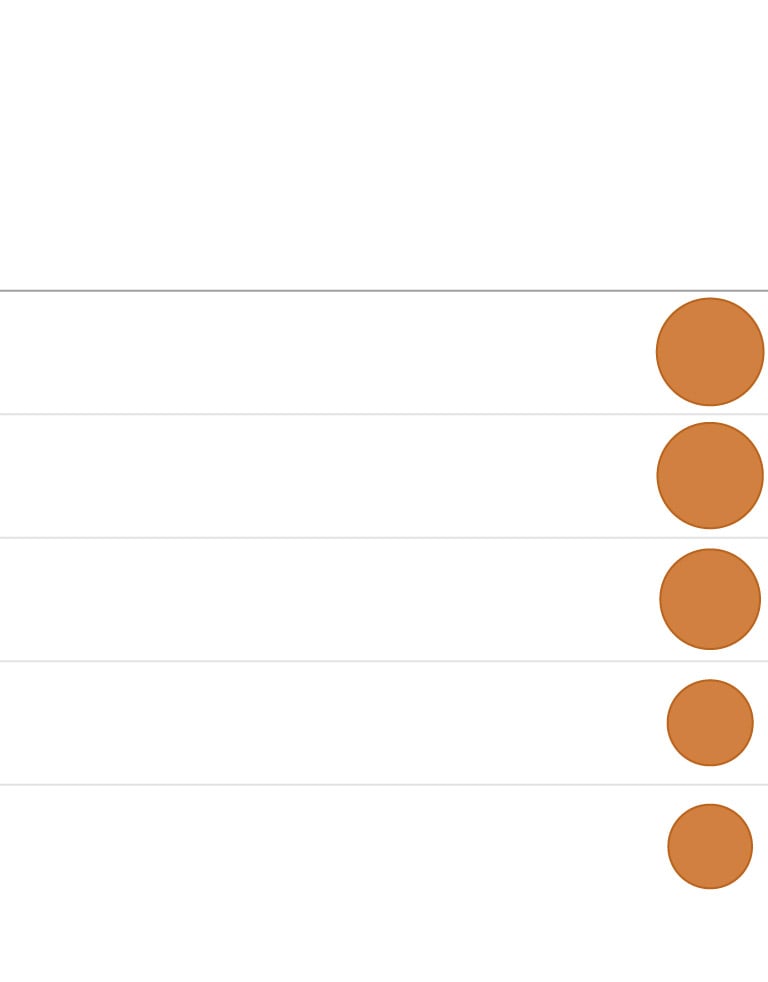

With the IRS struggling to keep up with corporate tax returns, the companies that have claimed the most unapproved tax breaks have been rewarded, data shows. Among S&P 500 companies, those with the largest proportion of unrecognized tax benefits to assets at the end of last year also reported paying the lowest effective tax rates over the past three years.

That’s because when authorities approve tax breaks or do not challenge them before the deadline, the company can then recognize the tax break, which may result in a lower effective tax rate and increased profit.

#g-utb-groups-box,#g-utb-groups-box .g-artboard{margin:0 auto}#g-utb-groups-box p{margin:0}#g-utb-groups-box .g-aiAbs{position:absolute}#g-utb-groups-box .g-aiImg{position:absolute;top:0;display:block;width:100% !important}#g-utb-groups-box .g-aiSymbol{position:absolute;box-sizing:border-box}#g-utb-groups-box .g-aiPointText p{white-space:nowrap}#g-utb-groups-xxsmall{position:relative;overflow:hidden}#g-utb-groups-xxsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:16px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-utb-groups-xxsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:22px !important;font-size:20px !important}#g-utb-groups-xxsmall .g-pstyle1{line-height:14px !important;height:14px !important;font-size:12px !important;text-align:center !important}#g-utb-groups-xxsmall .g-pstyle2{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:14px !important;height:14px !important;font-size:12px !important;text-align:center !important}#g-utb-groups-xxsmall .g-pstyle3{line-height:16px !important;height:16px !important;font-size:14px !important}#g-utb-groups-xsmall{position:relative;overflow:hidden}#g-utb-groups-xsmall p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:16px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-utb-groups-xsmall .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:22px !important;font-size:20px !important}#g-utb-groups-xsmall .g-pstyle1{line-height:17px !important;height:17px !important;font-size:14px !important;text-align:center !important}#g-utb-groups-xsmall .g-pstyle2{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:16px !important;height:16px !important;font-size:14px !important;text-align:center !important}#g-utb-groups-xsmall .g-pstyle3{line-height:16px !important;height:16px !important;font-size:14px !important;text-align:center !important}#g-utb-groups-xsmall .g-pstyle4{line-height:16px !important;height:16px !important;font-size:14px !important}#g-utb-groups-medium{position:relative;overflow:hidden}#g-utb-groups-medium p{font-family:FranklinITCProLight,FranklinITCStdLight,Helvetica,Arial,sans-serif !important;line-height:20px !important;filter:alpha(opacity=100) !important;-ms-filter:progid:DXImageTransform.Microsoft.Alpha(Opacity=100) !important;opacity:1 !important;letter-spacing:0 !important;font-size:16px !important;text-align:left !important;color:rgb(0,0,0) !important;text-transform:none !important;padding-bottom:0 !important;padding-top:0 !important;mix-blend-mode:normal !important;font-style:normal !important;height:auto !important;position:static !important}#g-utb-groups-medium .g-pstyle0{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:26px !important;font-size:22px !important}#g-utb-groups-medium .g-pstyle1{line-height:19px !important;height:19px !important;text-align:center !important}#g-utb-groups-medium .g-pstyle2{font-family:FranklinITCProBold,Helvetica,Arial,sans-serif !important;line-height:17px !important;height:17px !important;text-align:center !important}#g-utb-groups-medium .g-pstyle3{line-height:17px !important;height:17px !important;text-align:center !important}#g-utb-groups-medium .g-pstyle4{line-height:16px !important;height:16px !important;font-size:14px !important}

Companies with the most unapproved tax breaks had the lowest tax rates

Effective tax rates among S&P 500 companies from 2018 through 2020, grouped by unrecognized tax benefits

per assets

Lowest fifth

of companies

Source: Analysis of data from Calcbench

Companies with the most unapproved

tax breaks had the lowest tax rates

Effective tax rates among S&P 500 companies from 2018 through 2020, grouped

by unrecognized tax benefits per assets

Lowest fifth

of companies

Source: Analysis of data from Calcbench

Companies with the most unapproved tax breaks had the lowest tax rates

Effective tax rates among S&P 500 companies from 2018 through 2020, grouped by unrecognized tax benefits per assets

Lowest fifth

of companies

Source: Analysis of data from Calcbench

#g-utb-groups-xxsmall{display:none}@media (max-width:383px) and (min-width:0){#g-utb-groups-xxsmall{display:block}}#g-utb-groups-xsmall{display:none}@media (max-width:639px) and (min-width:384px){#g-utb-groups-xsmall{display:block}}#g-utb-groups-medium{display:none}@media (min-width:640px){#g-utb-groups-medium{display:block}}

#article-standard-content.single-column .article-body article>:not(.inline-content){max-width:640px}#article-topper{max-width:920px}.inline-photo.inline-photo-normal{max-width:900px;margin:0 auto 18px auto}

Terry Shevlin, a professor of accounting at the University of California at Irvine, said he is not surprised that companies with the most uncertain tax benefits are the ones with the lowest effective tax rates.

“They are both measures of tax avoidance,” he said.

About this story

Data on unrecognized tax benefits was provided by Calcbench. Included were 467 S&P 500 companies that had disclosed their 2020 data by mid-June.

The IRS examination rate is an analysis of IRS data based on a previous analysis by the Congressional Budget Office. The value charted is the number of examinations closed in a given fiscal year divided by the number of returns filed in the prior calendar year.