The email subject line from a Maine resident simply said: “2 attempts to file 1040 online rejected.”

The IRS is rejecting some e-file tax returns. Here’s a simple fix.

Here’s another email I received from Charles H. of Issaquah, Wash.: “My wife and I are in the quagmire of having filed a paper tax return in 2020 which is still not processed. When we tried to file our 2021 return electronically and entered our 2020 AGI (an IRS security feature I guess) our 2021 return was rejected.”

It’s never been more important to file your tax return electronically. You don’t want to mail a paper return if you don’t have to. But a glitch tied to the massive return processing backlog at the IRS is making it harder for some taxpayers to file online.

Let me walk you through the e-file Kafkaesque situation.

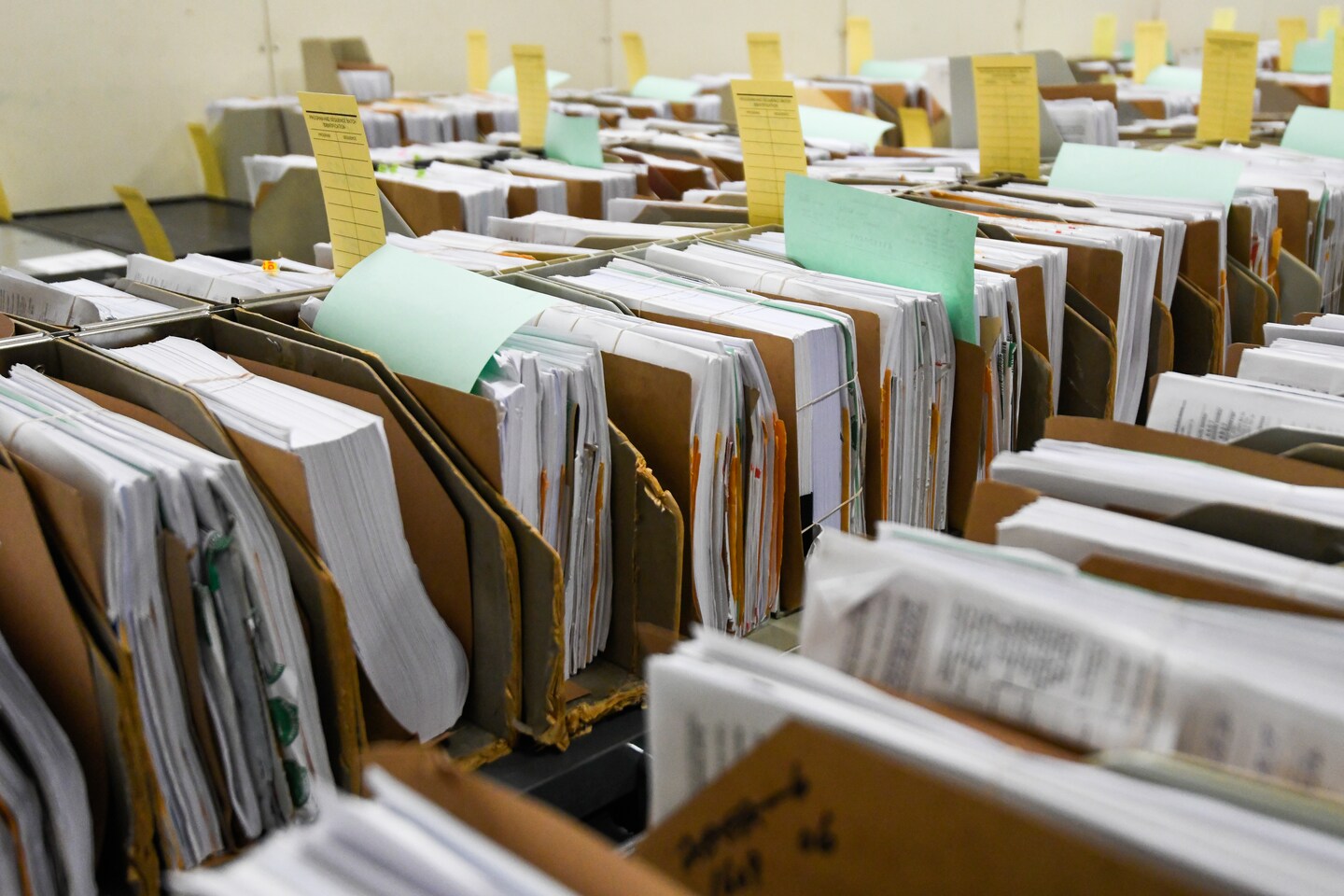

As of March 25, the IRS said it had 7.2 million unprocessed individual returns.

When you file electronically, one of the verification questions asks for your adjusted gross income, or AGI, from your most recent tax return.

If your return is in that backlog unprocessed, the IRS system doesn’t recognize your legit AGI. This can cause your e-file to be rejected.

A lot of people have no idea that’s why they can’t file electronically. Or they type in their AGI for 2020 assuming their return has been accepted by the IRS, but their e-filing is rejected.

And why would they assume their return has been processed?

The IRS cashed a check they sent with their 2020 return for taxes owed.

Some folks may have realized their returns haven’t been processed because they received what’s called a “CP80 Notice,” which is sent to a taxpayer when the IRS has credited a payment but has no record of the tax return being filed.

But others in the same situation may not realize their returns were sitting in a pile unprocessed because the IRS has paused sending out CP80 notices to them. (The agency realized the folly in asking people to send more paperwork.)

“The reject rate is similar to previous tax years for electronically filed returns that have AGI mismatches,” the IRS said in a statement.

The agency said it was unable to provide the specific breakdown of rejects related to an AGI mismatch.

You can print and mail your 2021 return, but if you’re expecting a refund that’s not the choice you want to make. If you file electronically, elect to have your refund sent by direct deposit to your bank account — and nothing goes wrong — the IRS says you are likely to get your money in three weeks or less.

The IRS has mentioned what to do if you find yourself in this situation but the workaround has still been missed by some taxpayers.

The Issaquah, Wash., couple was finally able to e-file their 2021 return after searching for a solution and reading about the fix in a column I wrote earlier this year.

Here’s the fix: Enter $0 (zero dollars) for your prior-year AGI, the IRS says.

If you used the non-filers tool last year to register for an advance child tax credit payment or to claim the third stimulus payment, enter $1 as your prior-year AGI.

By the way, if you filed an amended return last year, try using the AGI from your original return. Why? There’s a huge backlog for amended returns too. As of March 26, the IRS said it had 2.2 million unprocessed individual Forms 1040-X, which taxpayers used to add, change or correct information for an already-filed return.

Despite this glitch, as of March 25, the IRS had received more than 81 million individual income tax returns, slightly more than half of all the returns that it projects it will receive during 2022. The agency has issued 57.8 million refunds worth almost $189 billion. The average refund is $3,263.

If you’re having a problem and can’t get through to the IRS on the phone, the agency announced that many Taxpayer Assistance Centers (TACs) will be open around the country this Saturday, April 9 for face-to-face help, and no appointment is needed. Normally, TACs are only open by appointment on weekdays. Employees won’t be set up to do returns, but they can get help with, among other things, the advance child tax credit or third-round stimulus payment.

“We designed these extra weekend hours to make it easier for taxpayers to resolve an issue, inquire about their account or work with the IRS if they have an obligation they cannot meet,” IRS Wage & Investment Division Commissioner and Taxpayer Experience Officer Ken Corbin said in a statement.

Although many offices will be open, it’s not all of them. To find TAC near you open on April 9 for unscheduled walk-up help go to irs.gov and search for “IRS Face-to-Face Saturday Help.”

If you’re having a problem this tax season, I want to hear your story. Email me at colorofmoney@washpost.com.