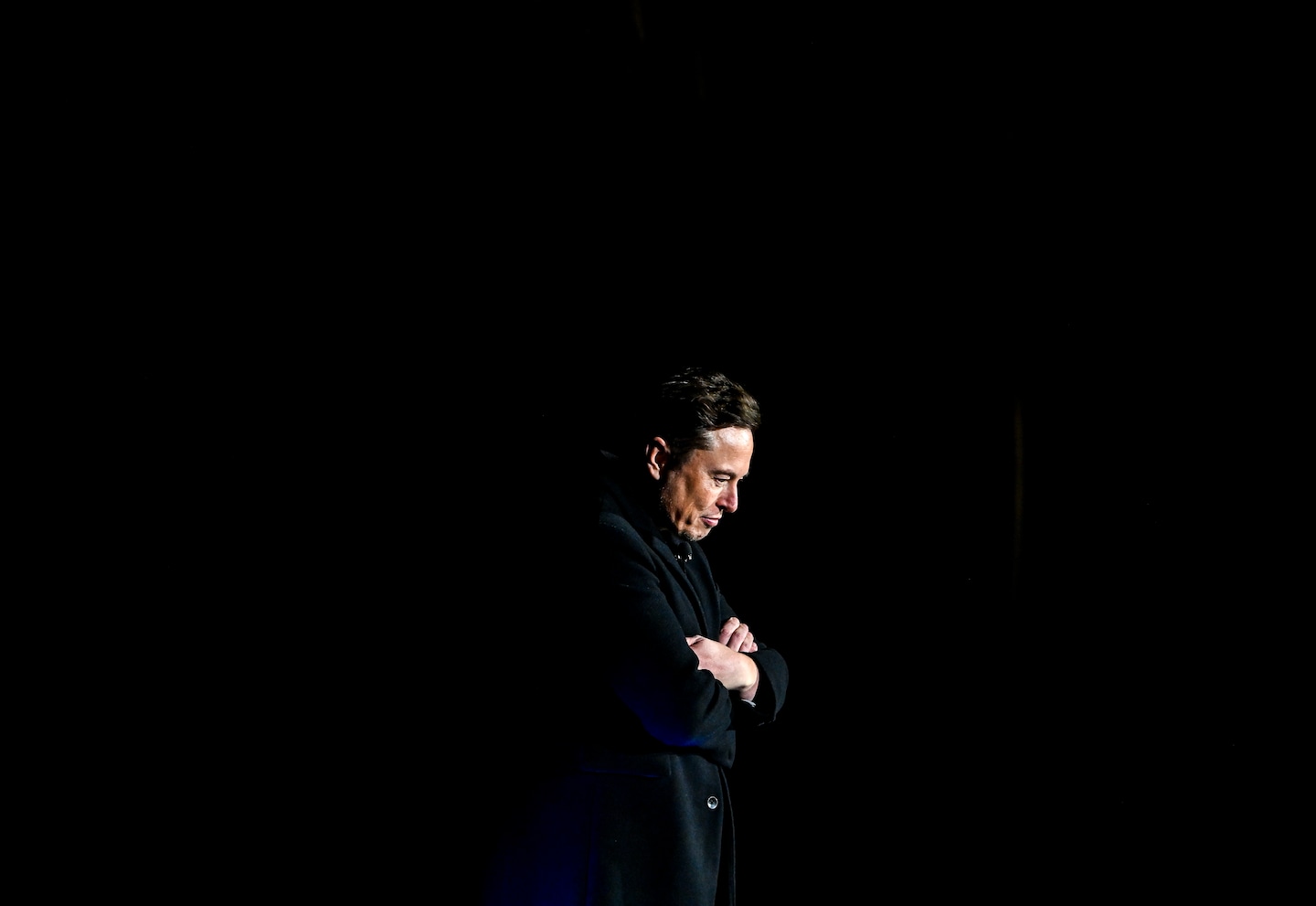

A cocky, publicity-seeking libertarian billionaire bets virtually all of his stock in his overvalued electric car company to finance a highly leveraged, $44 billion hostile takeover of an overvalued, money-losing social media platform, on which he boasts 84 million followers.

The flawed math behind Elon Musk’s Twitter deal

The only plot twist making for a better tale of speculative excess would be if Musk, a crypto evangelist, had arranged to pay in bitcoin.

I’m going to go out on a limb here and predict that we will come to see this deal as a market top, when sky-high valuations and over-indebtedness reach a convulsive crescendo in a megadeal driven by hype, overconfidence and ego. In many respects, it is reminiscent of AOL’s disastrous takeover of Time Warner two months before the massive tech and telecom bubble burst in the spring of 2000.

At some point in the not-too-distant future — once the hype has finally drained from the tech-crazy stock market and defaults start to roil the overleveraged credit markets, once housing prices fall back to earth and the crypto fantasy is dispelled, once we’ve settled into an extended period of stagflation — people will look back at this moment and say, “What were they smoking.”

Let’s put aside for a moment the overwrought debate about freedom of speech and content moderation and unpack the bubbly financial details of this transaction. For while Musk may be the world’s “richest” person, at least on paper, $44 billion may be a stretch even for him.

So far, Musk has arranged with a consortium of nine banks, led by Morgan Stanley, to borrow $13 billion secured by the assets and cash flow of Twitter itself — a common financing technique in the buyout world. The same banks have also agreed to lend an additional $12.5 billion using some of Musk’s Tesla stock as collateral.

Musk has not said where he plans to find the $21 billion in equity, or risk capital, that he has promised to invest in the deal. He could sell some of his Tesla stock, as he did last week, generating $8.5 billion before taxes. Or he could take on some hedge funds or fellow billionaires as partners, who presumably would want some say in how the company is run. The balance he’ll have to borrow by pledging his Tesla stock as collateral.

There are several problems with this financing scenario.

According to Tesla’s regulatory filings, Musk had already pledged about half of his 173 million shares of Tesla stock to fund other ventures and activities. He has now pledged an additional 40 percent to secure the new loans to buy Twitter. That leaves only 10 percent of his Tesla shares available as collateral. Because Tesla’s policies allow major shareholders to borrow only 25 percent of the value of each share that is pledged, that would appear to limit further borrowing against his Tesla shares to less than $5 billion.

All that borrowing might work out just dandy as long as the value of the collateral — Tesla stock (TSLA) — remains at or near the $1,000 per share it was trading at when the deal was announced last week. Yet in the week since the announcement, it dropped 15 percent, to $870, at least in part out of fear that the stock could get caught up in Musk’s Twitter misadventure. Should it fall below $750, Musk could run afoul of Tesla’s own leverage ratio. And if it were to fall much below $600, the banks could demand that Musk pony up additional collateral, requiring him to quickly sell some of his shares.

Should Tesla stock fall below $400, the banks would probably demand immediate repayment, triggering a massive, forced sale of Tesla shares, depressing the share price even further and prompting other investors to bail out of the stock.

A further decline in TSLA shares is a real possibility, given the bubble in tech stocks over the past two years, with already highly priced shares doubling in value. With last week’s dramatic sell-off, the tech-heavy Nasdaq has fallen 24 percent from its all-time high late last year, as the Federal Reserve has moved to raise interest rates and withdraw the extraordinary monetary stimulus that has propped up the pandemic-challenged economy and inflated the price of financial assets. Adding to the downward pressure, tech giants like Netflix, Apple and Amazon have reported or warned of disappointing earnings and sales growth, further undermining the confidence of a new generation of investors who’ve convinced themselves that tech stocks have nowhere to go but up.

Even when judged against the tech sector, however, Tesla has been a frothy outlier. Since March of 2020, Tesla shares have soared from $85 to as high as $1,243 in October, briefly giving the upstart carmaker a market value of more than $1 trillion — more than Toyota, Volkswagen, Daimler, Ford and GM combined.

Even with its shares down to below $900, Tesla is selling at a price 118 times its profit from the previous year. By comparison, Google’s parent, Alphabet, boasts a price-earnings ratio of 21, with Amazon at 38. By that or any other measure, Tesla remains overvalued.

Tesla is only now beginning to feel the impact of big league competition in the fast-growing market for electric cars, in which it boasts a technological head start as well as a good deal of cachet among environmentally conscious consumers. Those advantages brought Tesla rapid sales growth for the past two years, once its early production problems were ironed out, and allowed the company to charge premium prices that last quarter generated a copious operating profit margin of 37 percent.

Even with that impressive record, the only way the sky-high valuation for Tesla makes sense is if you think those profit margins and sales growth will continue into the future. But with Volkswagen, Ford and other competitors rushing to bring out their own lines of electric vehicles, that seems unlikely.

Another reason for Tesla’s inflated stock price is the relentless hype that Musk has created around it through his use of social and mainstream media to market his cars, his company and himself. The Twitter purchase is of a piece with that innovative and cost-effective marketing strategy.

But according to a recent study by David Kirsch and Mohsen Chowdhury of the Smith School of Business at the University of Maryland, those 84 million users following Musk on Twitter didn’t just show up on their own. Many were cultivated by bots — fake accounts programmed to respond to tweets by or about Musk or Tesla with tweets crafted to boost the company’s reputation, driving the momentum investing that’s inflated the tech bubble. The robots, they wrote, were also programmed to troll critics of the company with nasty or threatening messages.

Using a software program called Botometer, Kirsch and Chowdhury found that of 1.4 million tweets from the top 400 accounts posting to the “cashtag” $TSLA, 1 in 10 were from bots.

While it’s unclear who is behind the bot effort, and the two researchers are still working on directly linking tweets to movements in Tesla stock, the data “raises questions,” they write, about whether the activity was part of an organized effort to boost Tesla’s price.

Musk, of course, is no stranger to charges of market manipulation, having agreed to pay a $20 million fine to the Securities and Exchange Commission for doing just that, in connection with 2018 tweets in which he suggested he was prepared to take Tesla private. This year, Musk tried to nullify that settlement, which requires that his tweets be reviewed by a Tesla attorney. Just last week, a federal judge in New York denied that request. But Musk shows no sign of letting up in his battle with the SEC, which he regularly accuses of unconstitutionally muzzling his speech. That challenge to the SEC will continue to cast a legal shadow over the company and its stock price.

If Musk’s overvalued and rapidly declining currency — his Tesla stock — is one glaring problem with the Twitter deal, another is that he’s using it to overpay for a company that has lost money for the past two years as user growth has slowed. With no net earnings, it’s not possible to calculate its price-to-earnings ratio. But an alternative value measure — the ratio of stock price to sales — now stands at 8, which looks rather rich for a money-losing operation. (Highly profitable tech companies are selling at 4 to 6 times sales.)

Musk now boasts of plans to grow and monetize Twitter back to profitability, but that is hardly a sure thing. The social media platform is already shut out of the all-important Chinese market because of censorship, while many younger people are migrating to TikTok and Snapchat. And just last week, the European Union announced a bold set of regulations that will require platforms to take more aggressive steps to control disinformation, limit hate speech and disclose how their algorithms amplify divisive content. U.S. regulators are considering similar requirements.

There’s also the little matter of where Musk will find the money to service all those loans he’s taken out to buy Twitter. In the typical leveraged buyout, the purchaser looks to the company he’s buying to generate the cash to cover the interest payments on the buyout loans. Musk is now on the hook for about $1.25 billion in interest payments, assuming a 5 percent interest rate on those $25 billion in bank loans to buy Twitter. But the most free cash flow that Twitter has ever generated was $868 million back in 2018, and it’s been all downhill since then. Last year, in fact, Twitter’s free cash flow was a negative $370 million.

For all these reasons — the financing challenges, the bursting of the tech bubble, the economic and regulatory head winds facing both Tesla and Twitter — there’s an even chance Musk will walk away from this deal and pay the billion-dollar “breakup” fee required under the purchase agreement. Whether the deal goes through or not, however, it will have helped expose how thoroughly out of whack tech stocks — and stocks in general — have become in relation to the price of everything else.

The market’s wild swings in recent months are all the proof you need that the Great Repricing has begun. The giant economic and financial bubble created by a decade of aggressive government borrowing, money printing and persistently high trade deficits produced an economic mirage in which workers’ wages, interest rates and the price of goods were too low, while prices of stocks and real estate and credit instruments became too high. Now that fantasy of high growth and low inflation will need to give way to a painful period of low growth and high inflation as stock prices are brought in line with profits, credit in line with the prospects of repayment and house prices in line with the incomes of the people who live in them.

The question is not why this re-pricing is happening now, but why it didn’t happen years ago. And the way to think about what lies ahead is not that we will be less wealthy but, like Elon Musk, we were never really as wealthy as we thought we were.

Steven Pearlstein was a Post business and economics editor, writer and columnist for more than 30 years, winning the Pulitzer Prize for columns anticipating the 2008 financial crisis and recession. He is now the Robinson Professor of Public Affairs at George Mason University.