Calculate how much more mortgages will cost as interest rates rise

Mortgage rates are near their highest point since the Great Recession, adding thousands in costs for would-be home buyers. The average interest rate for a 30-year fixed mortgage has risen to 5.3 percent as of July 7, according to the Freddie Mac, up from an average of about 3 percent in December.

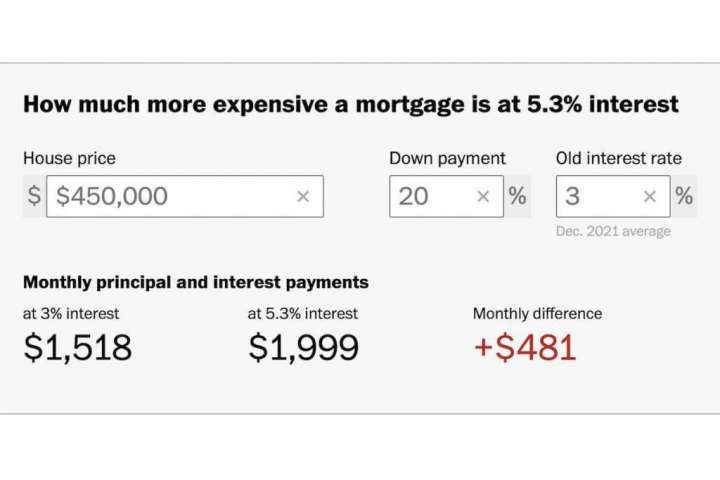

Below, you can see how this jump affects the monthly cost of a typical mortgage. If you already have a mortgage, plug in your existing interest rate to see how much more expensive it would be if you signed today.

How much more expensive a mortgage is at 5.3% interest

Dec. 2021 average

Monthly principal and interest payments

at 3% interest$0

at 5.3% interest$0

Monthly differenceDifference$0

Note: Calculations are based on a fixed 30-year mortgage. Calculations ignore mortgage insurance, closing costs, HOA feeds, property taxes, and other payments.

While the principal — the amount borrowed that needs to be paid back — stays the same, the change in interest payments can be enormous. Over the course of a 30-year mortgage, additional interest can add up to hundreds of thousands of dollars.

Total payments over a 30-year mortgage

After putting 20% down on a $450K house

$360K

principal

$360K

principal

The 5.3 percent figure is just the average 30-year rate. The actual rate that a home buyer gets depends on other factors such as income, debt, credit history and the size of the down payment.

To tame inflation, the Federal Reserve has been aggressively raising interest rates. This makes buying a home even more expensive in a market where home values have been skyrocketing. However, the housing market appears to be cooling, with May sales down 10 percent year-over-year, according to Redfin. But home prices in most metro areas haven’t yet been affected.