The Securities and Exchange Commission charged former congressman Stephen Buyer with insider trading on Monday, accusing the Indiana Republican of abusing his role as a corporate consultant to exploit nonpublic information to reap more than $300,000 in illegal profits.

Stephen Buyer, former GOP congressman, accused of insider trading

“When insiders like Buyer — an attorney, a former prosecutor, and a retired congressman — monetize their access to material, nonpublic information, as alleged in this case, they not only violate the federal securities laws, but also undermine public trust and confidence in the fairness of our markets,” said Gurbir Grewal, who oversees the SEC enforcement division. “We are committed to doing all we can to maintain and enhance public trust by leveling the playing field and holding Buyer accountable for illegally profiting from his access.”

The allegations stem from trading activity that occurred after Buyer left Congress and established his own consulting and lobbying firm, the Steve Buyer Group, in 2011. In 2018, Buyer learned of T-Mobile’s plans to acquire Sprint after a golf outing with a client, a T-Mobile executive, according to the SEC. He began purchasing Sprint stock the next day. Then over the course of several more days and using four different accounts, he acquired 112,675 Sprint shares for roughly $568,000, regulators said.

Soon after the companies announced their nearly $27 billion merger, creating the second-largest wireless company in the nation, Buyer sold his Sprint shares, netting more than $107,000, the SEC said.

The agency alleged that Buyer took steps to conceal his trading activity in addition to using multiple accounts. Regulators alleged that he printed a public investment research document showing Sprint stock trades by insiders, then took handwritten notes on the document to give the false impression his trading was motivated by public information.

In 2019, the SEC alleged, Buyer correctly surmised through his work that one of his clients, Guidehouse, a consulting firm specializing in helping government clients, was planning to purchase Navigant, a management consultancy. From June to August 2019, Buyer bought 46,654 shares of Navigant, totaling more than $1 million.

Buyer tried to conceal the insider trading, regulators said, by using six separate accounts and emailing himself and his son a public research document to give the false impression that his stock buys were prompted by publicly available data, rather than material nonpublic information.

On the day the Navigant acquisition was announced publicly, less than two months after his first stock purchase, the SEC said, Buyer sold nearly all of his Navigant shares to collect more than $227,000 in profit.

SEC officials want Buyer to turn over $335,000 in illegal profits, plus interest and penalties, as well as to ban him from serving as an officer and director of any company. Federal officials also are seeking disgorgement from Buyer’s wife, Joni Lynn Buyer. Though not accused of any wrongdoing, she “profited when Buyer executed unlawful trades in her brokerage account.”

The U.S. attorney’s office for the Southern District of New York is also pursuing criminal charges in parallel to the SEC action. Buyer’s attorney, Andrew Goldstein of Cooley, told The Washington Post that his client is innocent. “His stock trades were lawful. He looks forward to being quickly vindicated,” he said in a statement.

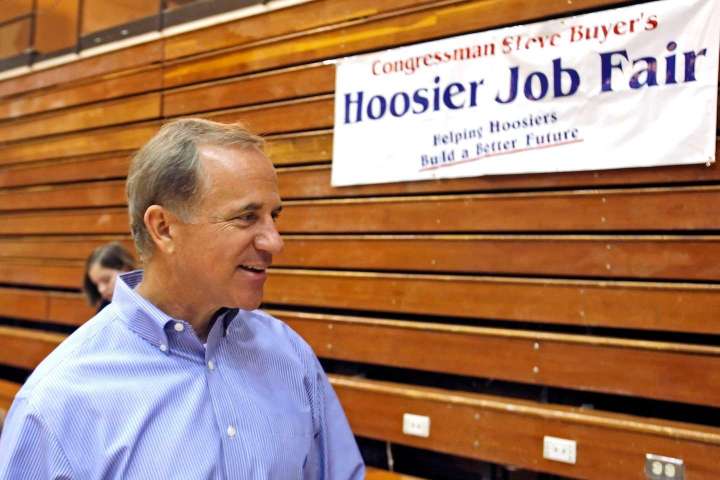

Buyer represented Indiana’s 4th and 5th districts from 1993 to 2011. Before his departure, according to news reports, he had faced questions about his private scholarship foundation, which had raised more than $880,000 without awarding any scholarships. He has defended his handling of the organization.

On Monday, the SEC also charged nine people in connection with three other unrelated insider trading cases that officials say collectively garnered nearly $7 million in ill-gotten gains. The others included an FBI agent in training, multiple Silicon Valley executives and an investment banker.