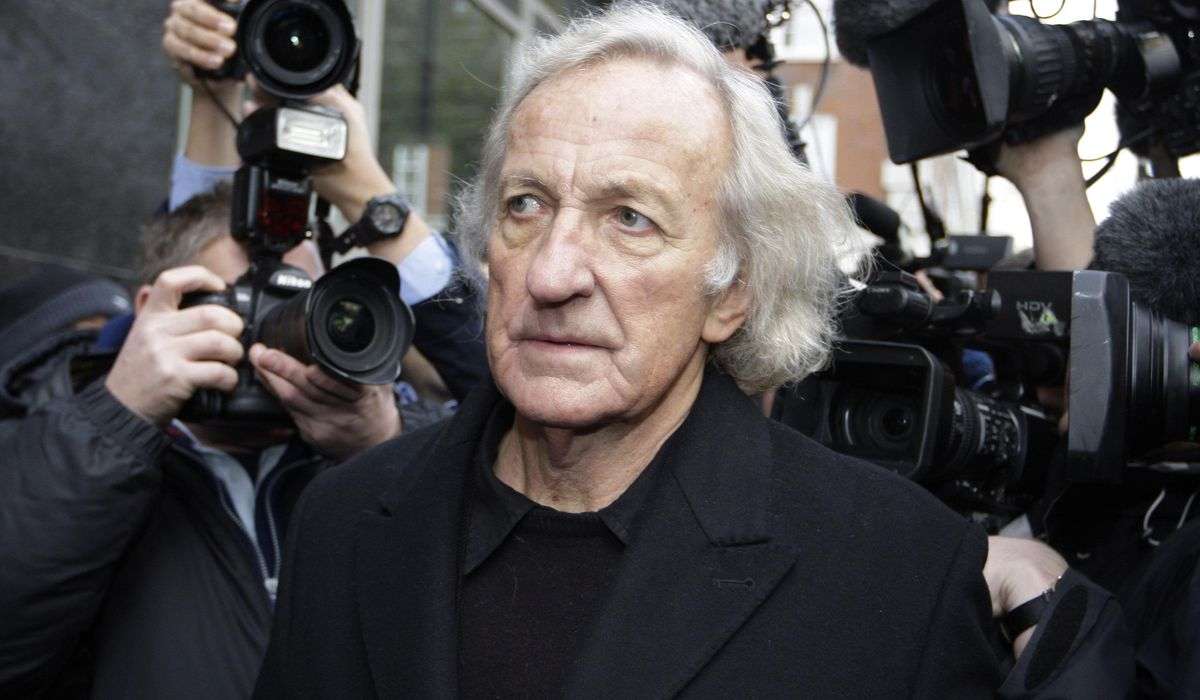

Economist Don Kohn, 79, spent 40 years in the Federal Reserve System, serving as a member and then vice chair of the Board of Governors from 2002 to 2010. Now he is a senior fellow at the Brookings Institution. He lives in Washington with his wife.

Ex-Fed economist offers odds on avoiding a recession: ‘Less than 50-50’

Unfortunately, there’s not one simple answer. It’s a combination of factors. Among them are the problems emerging from covid — people dropping out of the labor force, supply chain problems, shortages of chips for automobiles, things like that — that have put upward pressure on those prices. People sought more housing and further out from the city, so big demand for houses, putting upward pressure on prices.

Another issue is the Russian invasion of Ukraine, which cut off grain exports until very recently, and the boycott of Russian gas and petroleum has raised energy prices quite considerably. The economy was running very hot even before Ukraine pressure on gas and food prices added to that. Demand was very strong. We bounced back from the pandemic very quickly and had applied a lot of stimulus to the economy, both on the fiscal side, with several large fiscal packages, ending up with the American Rescue Plan under the Biden administration, and on the monetary side, where monetary policy reacted very strongly to the shutdown of the economy in March 2020 but kept its foot on the accelerator for quite some time after that.

You’ve said that demand strength was “aided and abetted,” by the stimulative fiscal and monetary policies, conveying a sense you thought they were too much?

With 20/20 hindsight, yes. It was hard to see at the time. When the American Rescue Plan was being passed, there was a lot of discussion of how we hadn’t applied enough help to the economy from fiscal policy coming out of the financial crisis of 2008-2009. So people wanted to make sure — the administration, certainly — that they did enough this time to get people back to work. It was: Push everything in that you could think of that might help. Then, on the monetary side, the Federal Reserve had some of the same thoughts in mind: Let’s not have a slow recovery from this. Let’s make sure that we can put people back to work quickly, the economy recovers quickly, the financial markets work well. So they went all-in on monetary stimulus.

Did you think that that was the right level at the time?

At the time, I thought we needed all the stimulus we could get, that the economy might recover very rapidly from covid as it opened back up. But no one knew. And therefore it was better to err on the side of doing too much than to err on the side of doing too little. I think the issue for the Federal Reserve is, when did it become clear that there was too much stimulus out there, and could they have withdrawn some of it earlier, particularly taking account of just how stimulative fiscal policy was?

Even Federal Reserve Chair Jerome Powell has said the Fed’s slow start to use its tools contributed to today’s inflation, and that a soft landing would be pretty hard to pull off at this point.

Yes. And I agree. They could have moved a little faster, a little sooner. But one of the misconceptions about inflation is it’s all the Fed’s fault. I think the Fed contributed to it, but there’s a lot of other stuff going on: covid, Putin, etc. The Fed had a role to play in letting it get this high. But, much to their credit, they recognize that and have taken steps to correct it.

As inflation continues to rise, what parallels do you see from the earlier era, during the late ’70s and early ’80s, when you were at the Fed under Chairman Volcker?

There are some parallels, but there are some really important differences. The parallels are so-called supply shocks. Back in the late ’70s, Iran cut off supplies of oil, which drove up petroleum prices. Problems in agriculture drove up agricultural prices. And those arrived in an environment of already very high inflation and in which people didn’t have confidence that the Fed would get inflation down.

Right now, I think people have that confidence. People say the Fed learned the lessons of the 1970s, and, as Jay Powell has often said, they’re not going to let this thing get out of control again. They recognize that Paul Volcker set an example that they can emulate. And Paul Volcker was not popular in some parts of the Congress during [that time]. Everybody looks back now and says, “Isn’t this wonderful?” But at the time there was quite a bit of tension.

I read that Chairman Volcker would receive two-by-fours and things like that in the mail from people frustrated by his actions.

So the two-by-fours were mailed from the builders and had messages on them like, “If it weren’t for you, this would be used in building a house.” That kind of thing. They were upset both about inflation and about the weak economy that resulted from Volcker’s efforts to tame inflation.

You must have been fairly young at the time. What was it like for you being on the inside when these enormously unpopular actions were being taken by the Fed?

It was exhilarating to a certain extent because we had been living in the 1970s, and inflation was getting worse and worse, and people inside the Federal Reserve hadn’t been willing to take the steps necessary to deal with it. So as a younger staff member, it was gratifying to see Chairman Volcker and the Federal Open Market Committee take those steps and do what was necessary.

It was a little scary and concerning because there was a very, very deep recession. In retrospect, it set the stage for three decades of growth. But at the time you didn’t know. And there were all these protests. So among the things that Chairman Volcker agreed to do with the consumer groups was to send people out to talk to consumer groups around the country. And I was part of that. I went to Seattle with a more-senior staff member. And that was a difficult thing. I mean, we were booed. We were asked difficult personal questions about our finances. There were a lot of unhappy people there.

When you were out there talking with folks and hearing their frustration, hearing their pain, how clear at the time did you feel that what the Fed was doing was right — or were you worried that maybe it was, in fact, a little too much?

No. I felt it was the right thing to do. The whole point of the protests was to bring home to the Federal Reserve that there were costs to this thing. I knew that. I remember a day on which the farmers circled the tractors around the Federal Reserve building protesting high interest rates. There was a lot of tension. But also a tremendous feeling that you were doing the right thing, and confidence that it would work out, eventually. But it would be nice to have it [happen] sooner rather than later.

Do you think of the recent Inflation Reduction Act as inflation reducing — or is its name more messaging?

I think it will have very, very minor effects on inflation. It will reduce drug prices and some other things. I see the “inflation reduction” part as helpful but not going to be its major effect. Its major effect will be dealing with climate change, and we badly, badly need to do that.

In this moment, what are the scenarios you most worry about?

On the inflation side, my worry is that it will take a while, and at some cost, to bring inflation back to within shouting distance of the Fed’s 2 percent [target] range. I’m worried there could be additional supply-side shocks. There could be additional problems growing out of the aggression against Ukraine and other types of aggression that might occur elsewhere in the world. I’m worried that the labor market is very tight and wages are going up very rapidly, which is helping people catch up with inflation, but if businesses start to build in rapid wage increases in the prices, you could get a spiraling effect.

How much pain do you think we’ll see? Do you think there’s going to be a little recession?

Not necessarily. I think it’s very difficult to predict that sort of thing. As Chair Powell said, there will be some pain. The unemployment rate needs to rise in order to take pressure off the labor market to reduce the vacancies relative to the people seeking jobs. How much it needs to rise is very hard to say and depends a lot on the stickiness of the wage/price process, whether there are additional supply shocks, how China ends up dealing with covid and those supply chain issues.

It’s tricky, I think, for people to understand the idea of unemployment going up being a good thing.

I think that’s right. I agree. And it’s not a good thing, right? The more people that are employed, the better. But when you push the envelope so hard that everybody’s prices are going up very rapidly, then it’s obviously too much. And some of the lower unemployment is just not sustainable in the context of those high inflation numbers that everybody dislikes. So you’ve got to bring it down. And even at a somewhat higher unemployment rate — I mean, we’re at 3.5 [percent] now; if we were at 4, 4.5, that’s still a very low unemployment rate in U.S. history. Even 5 percent would be a fairly low unemployment rate. And what that means is not that a bunch of people are permanently thrown out of work, but it might take them a little longer to find a new job, etc. So it’s not great. There’s pain, for sure. But the gain over time will more than compensate for the near-term pain.

We talked about what could go wrong, but, as you look ahead, what do you think could go right?

I think the best-case scenario is there’s some rise in the unemployment rate, but not a big rise. Pressure comes off the labor markets pretty quickly, wage increases are lower and price increases are a lot lower, and this thing simmers down pretty quickly over the next couple years. No more shocks, no more bad things coming out of Ukraine or other aggressions, covid effects wearing off and people returning to the labor force. But that’s when everything goes right and nothing goes wrong.

Which happens all the time. So if you were a betting man, what would you say is the likelihood of that type of best-case scenario?

Less than 50-50. Unfortunately, there are just a lot of things out there in the world that could go wrong. I certainly hope that the best case is what happens, but even in adverse cases, the Fed keeps its eye on the stable prices/maximum employment goals that will come out the other end. So the worst case is it takes us longer to get there. The best case is it takes us less time. But we’ll get there.

This interview has been edited and condensed.