As the LIV Golf Invitational Series hops overseas this week, players will be ferried to the first tee box on tuk-tuks, the auto rickshaws that buzz around the busy streets in nearby Bangkok. The golfers will be staring down a pristine course called Stonehill that opened less than three months ago and measures a monstrous 7,815 yards.

For its next stop, LIV Golf looks to take on the world

“I think I need to eat a lot of curry and pad thai maybe and help my distance,” golfer Kevin Na joked with reporters this week, “find another 30 yards before I tee off.”

Coming to Thailand is part of LIV’s broader plan to woo new customers, fans, broadcasters and corporate sponsors and open revenue streams in markets around the globe.

The initial LIV reception has been chilly in the United States, where the backlash over LIV’s Saudi benefactors has not necessarily quieted. But the series is not as controversial elsewhere, particularly places where the upheaval of the PGA Tour didn’t make waves or LIV’s golf product isn’t strongly associated with the brutal murder of journalist Jamal Khashoggi.

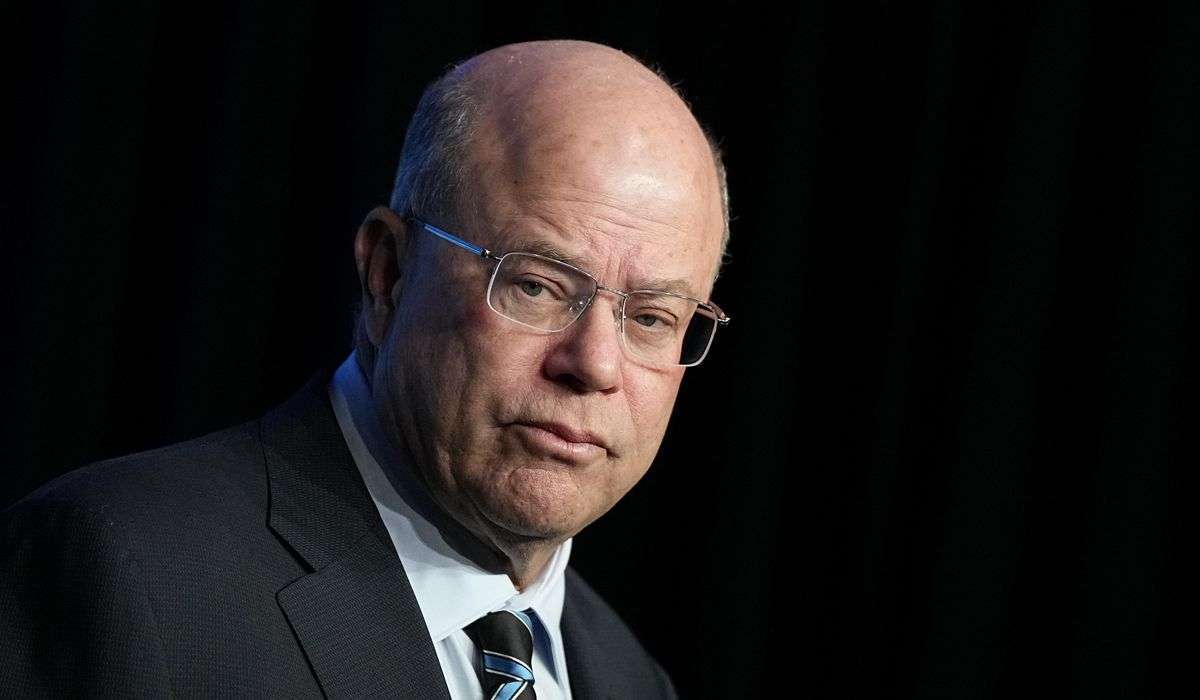

“From Day One, we’ve viewed golf as a global sport,” Atul Khosla, the LIV president and chief operating officer, said in recent interview. “We want to build a global golf lifestyle brand. That’s what we’re looking to achieve.”

LIV golfer Anirban Lahiri said he was aware of at least 20 people who were flying from India to Bangkok to watch him play at this week’s event, and he’s counting on a huge reception from the Thai fans.

“Obviously the perception back home is very different,” said Lahiri, who was born and raised in India. “People are looking at the golf. People are looking at the opportunity. People are excited about having one of their own playing here, playing at this stage.”

From Thailand, the LIV series will then head to Saudi Arabia for a tournament Oct. 14-16 in Jiddah before closing out its inaugural season with a team championship Oct. 28-30 in Miami.

Even after the tour’s first five events — four of which were staged the United States — LIV’s ambitious growth plans have received scant attention, overshadowed by the upstart’s legal squabbles with the PGA Tour, its frustrations with the Official World Golf Ranking and the chaos it has unleashed on the golf universe. By intention, this season is more of a soft launch.

“This is a beta test,” golfer Bryson DeChambeau said. “That’s what people forget is that we’re only just starting.”

LIV plans on rolling out a more polished product next year with a schedule that includes 12 teams competing in 14 events. Sites have not been announced yet, but Khosla says at least 30 percent of them will be overseas.

While three of LIV’s eight tournaments this year are being played internationally, the events are available to viewers across 180 countries, LIV officials say, through broadcast agreements, not necessarily rights deals. Free streaming services such as YouTube remain the dominant option in places such as the United States, and the group has yet to strike any television rights deals for next year.

In the United States, the LIV product has struggled to stir much interest from traditional networks that broadcast golf, according to multiple people familiar with discussions, or with streaming services, such as Amazon and Apple. A LIV spokesman maintains that the breakaway league “is just beginning its process and is in active discussions with several companies about broadcasting the LIV Golf League.”

While there appears to be a shrinking number of options in the United States, Khosla says LIV was intentional about a slow rollout, intending to use this year to familiarize broadcasters with its presentation and its product, which includes a team competition, a shotgun start, no cuts and 54-hole events.

“You can share what you want to show on a PowerPoint all day long, but the reality is you have to touch and feel it and watch it,” he said. “And the only way we could do that is, we had to build it first.”

LIV says some of its international golfers are taking on active roles and joining discussions with broadcasters back in their home countries (though no deals have been announced). LIV officials contend they were methodical in assembling their roster of golfers, mindful that their product was meant to resonate in all corners of the globe. Twenty-nine of the 48 players teeing off in Thailand on Friday were born outside the United States. The golfers have been sorted into teams that highlight their nationalities and backgrounds.

The Punch GC team, for example, is a group of Australians, led by Cameron Smith. The Fireballs are made up of players of Hispanic heritage, including Sergio Garcia. The Cleeks are group of European-born players, Stinger GC are all South Africans and the Iron Heads are all players of Asian descent.

The team concept is a cornerstone of the LIV blueprint, both on the course and commercially. Officials hope fans grow attached to the teams and form the type of staunch loyalties that serve as bedrock in other team sports.

“I already have people in India reaching out to me, saying, ‘Oh, is there any Crushers merchandise that we can buy?’” Lahiri said. “’I want a shirt, I want to come and rep your team.’ And these are kids in India. They probably would not have followed the team if I wasn’t on it.”

While the purses at LIV events are more generous for individual play — the top player in Thailand this weekend will pocket $4 million, while the winning team will share $3 million — LIV officials see fans growing attached to the teams and those teams growing in value. The four-man squads aren’t a team in name only, they say, but they’re functioning separately, hiring their own staff, taking control of their own branding and merchandising with the ability to sell their own commercial rights.

In the future, LIV officials can see teams wearing their own corporate patches, and even serving as host to the events. The Aussie squad, for example, essentially would be the home team for an event in Melbourne, and the U.K. team could host an event in Scotland.

“There is a strong opportunity here for us to be able to build team value over time, and we get it,” Khosla said. “This is not happening overnight by any means. This will take years, but that is how teams are built.”

Eventually, Khosla said that LIV might not function as a centralized league, and the franchises eventually could be sold off and operated independently, like most team sports.

“So far, we’ve had actually some good interest from the institutional investors or single investors that have the funding to be able to own a team, have a desire to own a golf team and are passionate about golf,” he said.

For now, the league owns the teams, while some players have a small equity stake. When teams earn prize money at an event, that money goes into a team pool, and Khosla says the players will draw a salary from their respective teams, earning a percentage of total revenue that team generates.

“We are absolutely aspiring for them to build and have a significant value,” he said. “We are too early to tell you what the valuation is, but it is not uncommon for sports teams early on to go for a few hundred million dollars.”

The business model and LIV’s lofty ambitions, however far-fetched they might seem in this early stage, are scantly visible right now. There is no corporate signage at events, no advertisers on the free broadcasts and tickets to domestic events were easy to come by and could be had for next to nothing. Saudi Arabia’s Public Investment Fund has committed at least $2 billion to LIV Golf, and the PGA Tour stated in a recent court filing that it believes the competing league “has the luxury of operating at a loss for as long as it needs to accomplish its goals.”

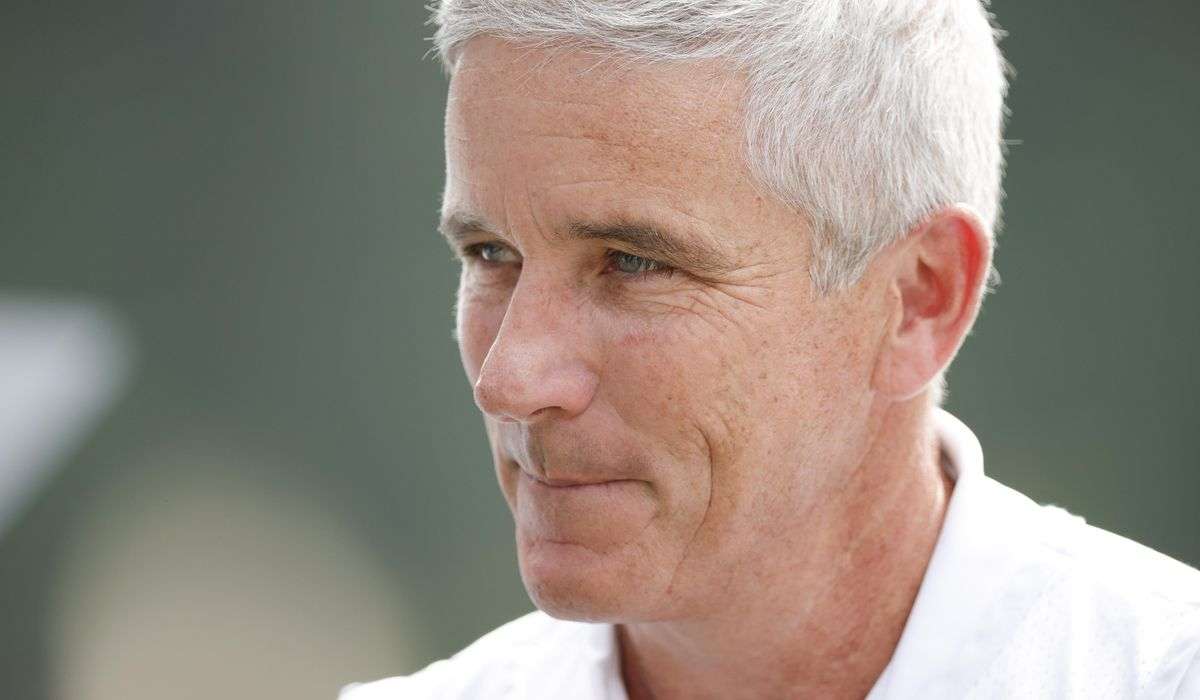

The PGA Tour is the runaway leader both domestically and internationally. Tour officials also have broadened their scope in recent years in an effort to make their product more accessible internationally. It has major broadcast deals that ensure tour events are both televised and live-streamed around the world. And earlier this year, the PGA Tour strengthened its partnership with the DP World Tour, increasing its stake in the European Tour Productions from 15 to 40 percent, expanding its own schedule with co-sanctioned events and helping beef up the DP World Tour’s tournament purses.

“It’s pretty obvious to say the current situation in golf has significantly accelerated that process,” Keith Pelley, chief executive of the DP World Tour, told reporters in June, shortly after LIV staged its first event. “I’m not going to sit here and pretend that is not the case.”

LIV, meanwhile, has aligned itself with the Asian Tour, investing $300 million and agreeing to co-host 11 events next season. Those events will be part of LIV’s International Series — not its league play. It is expected to feature some LIV golfers and showcase the LIV brand at events across Asia.

“Clearly, the U.S. is the biggest golf market,” Khosla said, “and you’ve got U.K. and Japan. But if you look at where golf courses are being constructed all over the world, 60-70 percent of new golf courses are in Asia.”

The PGA Tour remains active in many of these markets, and the two entities will continue trading blows both in the courtroom and the global marketplace. But LIV officials are bullish when they say events such as this weekend’s Thailand tournament offer only a taste of what’s to come.

“We put a product out in less than six months,” Khosla said. “I’m not sure when else that has happened in sports — at that level, at that pace.”