Debt limit deal gives Washington a blank check

The bipartisan deal to raise the nation’s borrowing limit, hailed by both parties, barely moves the needle on pandemic-era government spending nor fixes the causes of runaway growth in the federal budget.

Republicans and Democrats agreed before beginning their negotiations not to touch so-called mandatory spending — Social Security, Medicare and Medicaid. Those politically popular entitlement programs account for nearly two-thirds of annual federal spending.

Interest payments on the national debt are another built-in cost, totaling $663 billion in the current fiscal year. That’s roughly another 10% of the federal budget.

So even before negotiators sat down at the table, they were limiting their discussions to programs that account for less than 15% of the federal budget — non-defense discretionary spending.

The runaway train of federal spending didn’t stop in January when the government hit its debt ceiling of $31.4 trillion. Although the government was not authorized by law to keep borrowing, and Treasury was taking “extraordinary measures” to prevent default, Washington kept on racking up more debt.

The national debt had reached $31.8 trillion before President Biden signed the bill on Saturday that authorizes more unlimited borrowing through 2024.

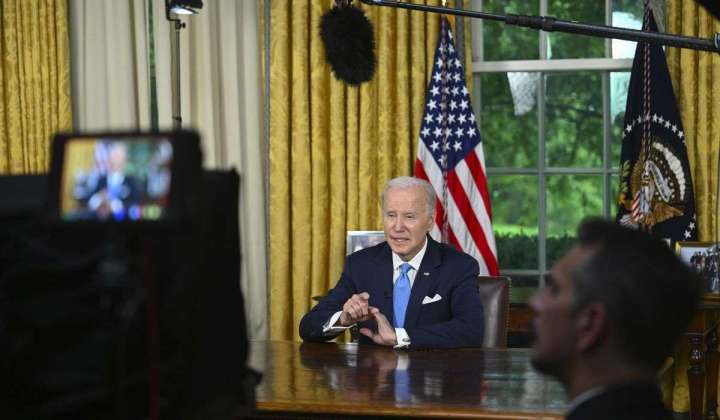

SEE ALSO: Biden hails debt bill as bipartisan achievement in prime-time address

“The debt is going up year after year because of entitlements,” said Republican strategist John Feehery. “This debt limit deal is focused only on discretionary spending. If you want to cut Social Security, be my guest. But that’s not what this deal is about.”

Social Security is the largest single expense of the federal government, currently about $1.2 trillion per year. The cost has increased as more baby boomers retire.

Recent high inflation has added to that cost. Social Security’s 66 million beneficiaries this year received an 8.7% monthly cost-of-living adjustment to help them keep up with price increases that topped 9% last summer. It was the biggest increase in Social Security benefits in 40 years.

For decades, lawmakers and presidents in both parties have ducked any serious talk about the three generally accepted solutions for shoring up the Social Security trust fund — raising taxes, slowing the growth of benefits and raising the retirement age which is now 67 for people born after 1960.

But entitlements are not the only driver of the nation’s rising debt. Overall government spending increased a whopping 40% in the past four years, from $4.45 trillion in 2019 to $6.21 trillion in 2023, according to the Congressional Budget Office.

Both the Trump and Biden administrations and Congress boosted spending massively in response to the COVID-19 pandemic. Spending on food stamps rose 102%; veterans programs, 50%; welfare costs, 50%; health tax credits, 45%; school food programs, 42%; unemployment compensation, 32%.

Opponents of the new debt limit deal say the agreement essentially has enshrined pandemic-era emergency spending levels as the new normal.

“This deal keeps that record high spending intact and makes it the baseline for all spending,” tweeted Rep. Nancy Mace, South Carolina Republican.

The Congressional Budget Office said the new law will cut deficits by $1.53 trillion over the next decade, almost all of it due to caps on discretionary spending. But there is a lot of wiggle room in the deal to allow for higher spending in the years ahead.

The agreement includes pay-go requirements for offsetting spending increases with cuts elsewhere. But it also gives the Biden White House sole authority to waive that requirement whenever it sees fit, with no court challenges allowed.

Republican opponents of the law say that renders the spending restraints meaningless.

Unlike other debt-limit increases, the deal struck by President Biden and House Speaker Kevin McCarthy sets no ceiling on borrowing through early 2025. As long as the White House gets approval from Congress, it can spend at an even higher rate than in the past four years.

“Is it in our best interest as a nation to allow Joe Biden, someone we cannot trust on spending, to have an open checkbook, no limit on the credit card until the end of his term? My answer is no,” said Sen. Tim Scott, South Carolina Republican, at an event hosted by Axios. “So the fact that the current deal allows for him to continue to spend however much he does with no limit is something that I can’t support.”

Fiscal watchdog groups came down on both sides of the deal.

Heritage Action, a conservative grassroots organization, had urged lawmakers to vote against it, saying it “fails to achieve many necessary reforms needed to fix a broken Washington, and President Biden is chiefly at fault.”

“Instead of capping overall spending to FY22 levels, the agreement only locks in a minuscule $12 billion in net savings in discretionary spending with a potential for increased spending in the out years of the agreement,” said Executive Director Jessica Anderson. “Most importantly, by suspending the debt ceiling until January 2025, this deal relinquishes the necessary pressure of the debt limit and its constraints on executive action. While there are notions of constraints in an administrative PAYGO requirement, many of these provisions can simply be ignored in practice.”

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said the measure “will likely be the largest deficit reduction law in almost a dozen years.”

“It will help the Federal Reserve fight inflation and begin to make progress in addressing our mounting national debt,” she said. “The legislation will reestablish some discipline in the appropriations process, impose constraints on costly executive actions, reduce unnecessary spending and, importantly, raise the debt limit and avoid default. It cuts some spending, imposes caps, and moves in the direction of limiting our out-of-control borrowing.”

She said much more needs to be done.

“To truly fix the debt, policymakers will need to put everything on the table, including revenue, defense, and mandatory spending, and they will need to work together to rescue our trust funds from looming insolvency,” she said. “But while it is politically easy to pass unpaid-for tax cuts and spending increases, enacting savings is much more difficult, and lawmakers who put together this deal demonstrated real leadership in finding compromises to achieve deficit reduction.”

She urged lawmakers to create a fiscal commission “that puts all parts of the budget on the table, including revenues, while reducing deficits and addressing impending Social Security and Medicare insolvency.”