What is Chapter 11 bankruptcy?

What is Chapter 11 bankruptcy?

Put simply, it’s a way for troubled companies to save themselves by preserving profitable parts of their business while doing away with dead weight, which can include unprofitable stores and untenable debt. The company’s management remains in control of the business, but a bankruptcy court oversees the process as it negotiates with landlords, suppliers and other creditors.

“The goal in Chapter 11 is to carve out the productive part of the company and get rid of the parts that are losing money,” said James Angel, a professor of finance at Georgetown University’s McDonough School of Business. “They may sell off certain parts of the business, close down facilities and void contracts with the approval of the court.”

This is different from a Chapter 7 filing, which results in a liquidation, meaning everything is sold off and stores are shut down for good.

For many retailers, a Chapter 11 filing is the only viable way to pull out of a decades-long lease at a shopping mall or strip center. For example, J. Crew — which filed for bankruptcy on May 4 citing more than $1 billion in debt — has sought to “reject” 67 of its nearly 500 lease agreements.

“For retailers that overextended themselves and opened up too many stores too quickly, like J. Crew, this is a rare opportunity to cut back,” said Megan Murray, an attorney at Underwood Murray, a Tampa firm that specializes in bankruptcy law. “When used correctly, Chapter 11 can bring new life to a struggling company.”

Why are so many companies filing for bankruptcy right now?

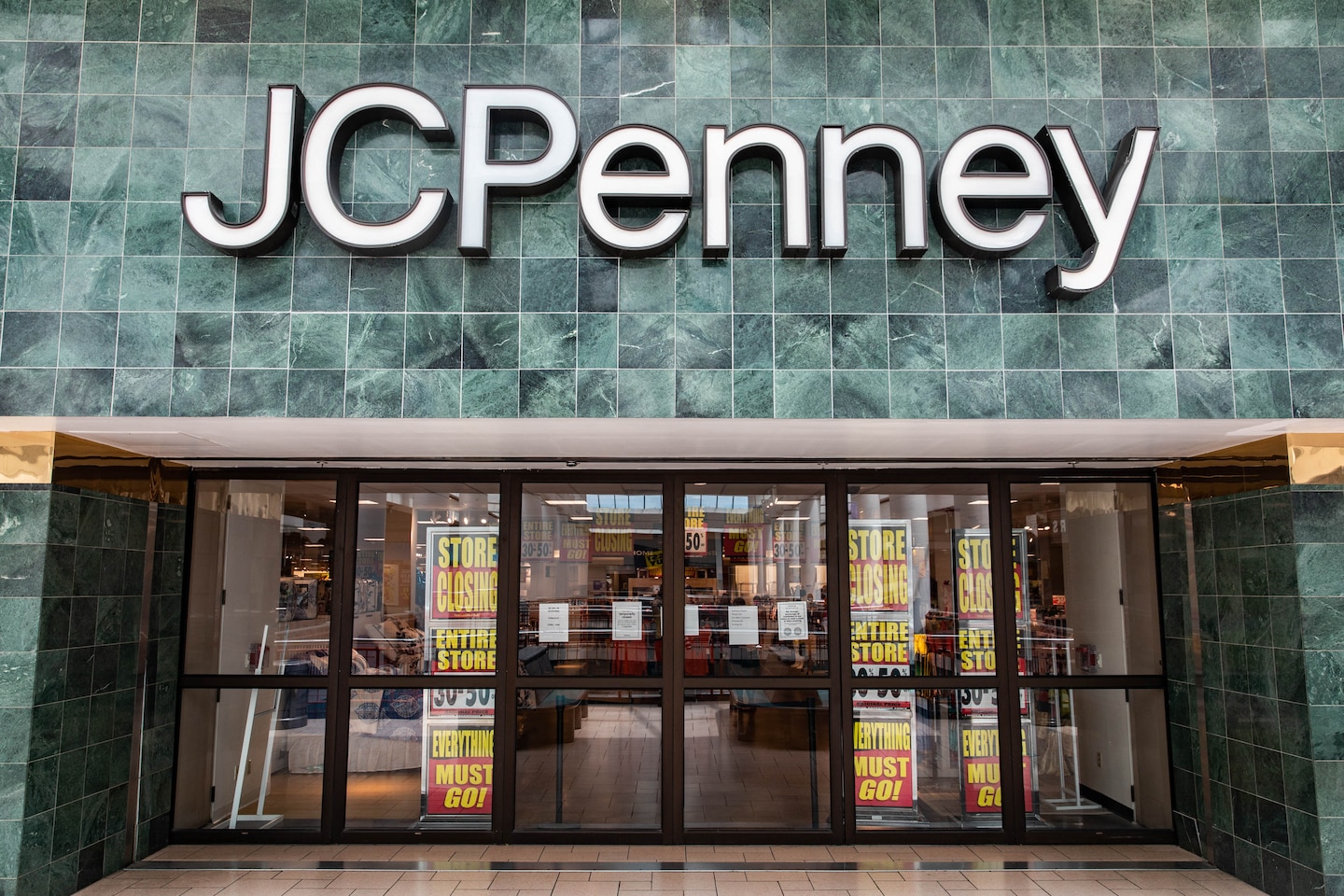

Many retailers — particularly mall-based chains and department stores — have been struggling for years. Then the pandemic brought business to a standstill, forcing them to close thousands of stores and leaving them with huge expenses, such as rent, and very little revenue.

There are two routes to a Chapter 11 filing: A company must either have more liabilities than assets (known as the “balance sheet test”) or be unable to pay its debt as it comes due (the “income statement test”). Bankruptcy attorneys say both scenarios have become increasingly common in recent months as retailers — and consumers — weather the effects of the coronavirus outbreak.

“For companies that were barely hanging on, the pandemic was the straw that broke the camel’s back,” said Lawrence Katz, a bankruptcy attorney at Hirschler Law in Tysons, Va. “Many had debt problems, they were struggling to find the right market — and then all of a sudden the pandemic hits, stores close and they realize the only way out of this now is to file for Chapter 11.”

Can a company recover from Chapter 11 bankruptcy?

Yes. In most cases, Murray says, companies emerge from Chapter 11 bankruptcy as stronger businesses, though it’s unclear whether that trend will hold during the pandemic.

“A vast majority of companies reorganize, but we may start to see more close their doors because income streams have been so badly hurt,” she said.

Pier 1 Imports, for example, announced in May that it would close all 540 of its home furnishings stores and shut down the business after it failed to find a buyer during the pandemic. The 58-year-old company originally filed for Chapter 11 bankruptcy in February.

Does this mean my favorite store is going away?

Probably not, experts say, though you may have to drive to a different location or shop online instead of at the mall.

Retailers typically use Chapter 11 as an opportunity to drop unprofitable stores or pare down locations that are too close together. GNC Holdings, which filed for bankruptcy in June, is shutting down more than 1,000 stores, while Brooks Brothers and Sur La Table, which both filed for bankruptcy in July, are closing about 50 stores apiece.

In all, retailers are expected to permanently shutter as many as 25,000 stores this year, most of them in malls, according to Coresight Research. That compares with about 10,000 closures last year.

“Retailers are moving fast to shut down unprofitable stores, the ones in bad locations, the ones that don’t make money,” Angel said. “During Chapter 11, the company can void contracts with the approval of the court — even if they’re stuck in a 30-year lease in a particular location, the bankruptcy court can say, ‘Bye-bye, lease,’ and it’s gone.”

Even when a company liquidates all of its stores, some parts of the business — its name or website, for example, or other intellectual property — may continue on depending on who snaps it up. Gymboree, for example, shut down all of its operations after filing for bankruptcy in 2017 and again in 2019, but parts of its business have found new life: Gap bought its Janie & Jack stores, while Children’s Place purchased the Gymboree name and relaunched its website.